This is why investors blow up – even when knowing the future

Nassim Taleb was right: even when investors were given tomorrow’s news in advance, most lost money – and many went bust.

23rd May 2025 09:03

by Stéphane Renevier from Finimize

- As part of a test, participants were given tomorrow’s news and some “real” money to trade in a simulation, but half still lost money – proving that even perfect information is useless without the skill to use it

- The real killer wasn’t bad predictions – it was bad position sizing. The lack of a position sizing strategy, overconfidence and reckless leverage wiped out a sixth of players

- Pros did better – not because they knew more, but because they bet selectively, sized wisely, and knew when to sit out. Yep, discipline beats foresight.

Nassim Taleb once warned: If you give investors the next day’s news 24 hours in advance, they’ll still go bust in less than a year.

And it turns out, he was probably right.

Wait, what?

Taleb – the statistician and former trader who made his name betting against conventional wisdom on Wall Street – was making a deeper point: that having information isn’t the same as knowing how to use it. His warning isn’t so much about the news – it’s about us. About the biases, overconfidence, and lack of discipline that could cause most of us to go bust even with perfect knowledge.

It sounds ridiculous, I know. If you knew what was coming, how could you not make money? That’s exactly what investment advisory firm Elm Partners decided to test with a real-money experiment designed to simulate the ultimate trading fantasy: what if you could see tomorrow’s newspaper – today?

They took the front page of 15 actual editions of The Wall Street Journal – stripped them of prices, but left them packed with major news – and handed them off to 118 finance students from top universities. Most covered big, market-moving events: a third featured employment reports, a third Fed announcements, and a third were randomly chosen from 2008 to 2022. The students would get the scoop 36 hours before the presses were due to roll and have the chance to trade the S&P 500 and 30-year Treasuries across the following market days. Each player got $50, could take long or short positions, and could crank up the leverage to 50x.

Since they had tomorrow’s news, all they had to do was figure out how markets would react. Easy money, right?

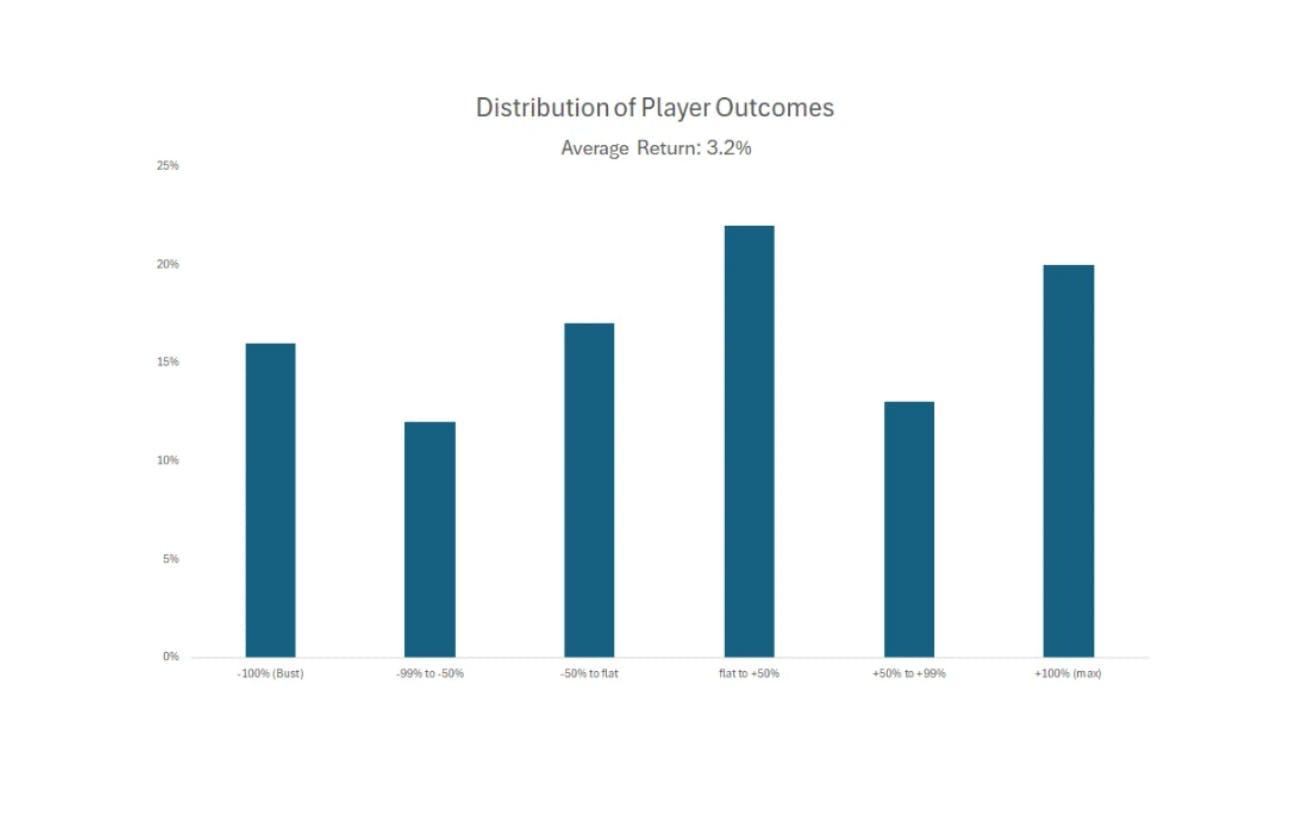

Welp, here’s how they fared:

- Half lost money

- One in six went bust

- And the average gain was just $1.62 on a $50 stake – barely enough for a vending machine snack.

Despite knowing tomorrow’s news, half lost money and a sixth went bust. Source: Elm Partners.

Before you laugh too hard at the students, try the challenge yourself here – it’s harder than it looks, and you’ll learn a ton in the process.

Why did they do so badly?

First off, they weren’t great at predicting how markets would react– even with tomorrow’s headlines in hand. Their hit rate was just 51.5%, barely better than a coin flip. They did slightly better on bonds (56%) than on stocks (48%), but that didn’t help their returns very much – since they bet more heavily on stocks anyway.

That might sound surprising, but remember: markets aren’t the economy – they merely anticipate it. See, the students weren’t trading the news itself; they were trading how markets would react to it. And markets only move when reality turns out to be better – or worse – than what’s already expected and priced in.

For example, a strong jobs report might sound bullish, but if investors already expected it – or if they worry that it might mean there’ll be interest rate hikes – stocks could fall. Add in things like recent price action, investor positioning, and sentiment, and the same set of headlines can trigger completely different market reactions.

But getting the direction wrong wasn’t the real killer for these students. After all, you don’t go bust by being right half the time. The trouble was in what they did with that information.

A full sixth of participants went bust, and the biggest reason was how they sized their bets.

So, look, a lot of them were overconfident in their read of the news – and they backed that up with wild leverage: 20x, even 50x. With that kind of exposure, one small slip can wipe you out. And slip they did, far more than their confidence suggested. If they’d used a sensible and constant 6x leverage for stocks and 8x for bonds, they’d have generated an average return of 10% – while massively shrinking the number of disastrous blow-ups.

Another mistake was that they didn’t scale their positions based on whether the odds were in their favor. The study found no pattern between how likely they were to be right and how much they bet. Some days, the headlines offered clear signals – not so much on others. Yet most sized their bets the same, no matter what.

OK, but could the pros have done any better?

Elm also brought in five seasoned macro traders – including a head of trading at a top US bank and veterans from some top-ten hedge funds – to take the same challenge. And, yep, they did much better. All five finished with gains: on average, they grew their initial stake by 130%, with a median return of 60%.

Sure, they were more accurate (63% hit rate), but the biggest difference was that they were more disciplined. They knew when to trade and when to sit tight. They did not bet at all on about a third of the trading opportunities, but they bet big on days when the odds were in their favor. What’s more, their trades reflected not just confidence, but caution – they kept their maximum leverage in check, aware that even with tomorrow’s news, overconfidence can still steer you wrong.

That mix of selectivity, humility, and sizing discipline is what set them apart.

So what are the main lessons for you?

1) Bonds may be easier to read than stocks. The pros (and even the students) did better on bonds. So if you're only investing in stocks, you could be missing easier wins elsewhere.

2) Context mattersat least as muchas the news itself. If you want to make money trading, you need to know what’s priced in, how markets are positioned, and how everyone else might interpret the news.

3) You need a process. The pros had a framework. The students didn’t. Without a clear investment process that includes not just what you buy, but also when and how much, even tomorrow’s news won’t help you.

4) You’re better off sizing your bets to match your edge. Don’t bet big when the odds are murky. Scale up when they’re clearer – but never so much that being wrong would take you out of the game.

5) Humility always beats confidence. Your behavioral biases will try to trick you. And you’ll be wrong more than you might expect. So build a strategy that survives that.

6) And, one more thing: read Taleb.The Black Swan is a good place to start.

Stéphane Renevier is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.