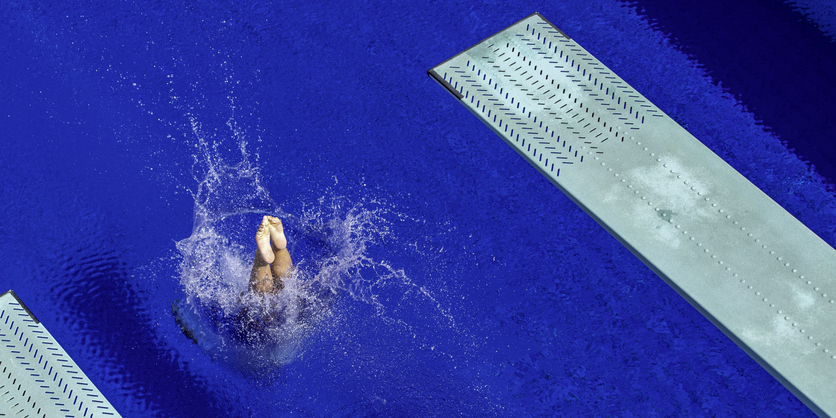

Why Ted Baker just nose-dived 38%

The accident-prone fashion chain continues its spectacular decline with a classic third profit warning.

3rd October 2019 12:37

by Graeme Evans from interactive investor

The accident-prone fashion chain continues its spectacular decline with a classic third profit warning.

Once reassuringly expensive, Ted Baker (LSE:TED) shares are back where they were a decade ago after stunning investors with the most spectacular of its three profit warnings in 2019.

The lifestyle brand revealed an unexpected underlying loss for the six months to August 10 of £2.7 million, when analysts had widely been expecting a profit figure in excess of £10 million. The equivalent surplus a year ago was £25 million.

Retail sales fell 2.5% in constant currency terms to £214.5 million, while the gross margin took a hammering with a 400-basis point decline to 54.3%. To make matters worse the second half is already under pressure after unseasonably warm weather in September, fuelling fears that underlying profits for 2019/20 could be as much as 30% below the City's consensus.

Shares tumbled 38% to 575p, leading to a 73% decline on the peak of 2,130p at the start of the year. They had been changing hands for over 3,650p as recently as 2015, when Ted Baker was embarking on a store opening spree across markets in Europe and North America.

Source: TradingView Past performance is not a guide to future performance

Whereas the company had been trading with a forecast price/earnings (PE) multiple of over 30 times in its heyday, this figure is now 9.7 times based on last night's close. The UK general retail sector trades with a multiple closer to 12 times, highlighting how far the stock has fallen.

In a further blow to investors, the interim dividend has been slashed by 56% to 7.8p. This comes after a 6% reduction in full-year dividend in March to 40.7p.

And to think 2019 had started well from a trading perspective, with January's post-Christmas update containing no indication of the woes to come.

Having confirmed the departure of founder and chief executive Ray Kelvin in early March, less than a month after hitting investors with a profits warning, it warned again in June. Inevitably, the company has pointed the figure towards heightened levels of consumer uncertainty, and "unprecedented and sustained levels of promotional activity".

While that's fair comment, the concern among investors will be that the brand is losing its strength with fickle consumers, some of whom may have been drawn to cheaper alternatives in the current uncertain climate.

Previously reported challenges with the spring/summer collection in womenswear won't have helped the cause, nor has the company's exposure to sales in the structurally challenged department store sector. Ted Baker's e-commerce sales were also down 1.3% to £52.3 million at a time when industry sales are increasingly shifting online.

New chief executive Lindsay Page, who joined the company as finance director in 1997, said the company would remain focused on cost controls and driving further efficiencies.

He insisted the brand remained strong and that it had delivered a number of strategic developments in recent months, including the reorganisation of its Asia operations. Autumn/Winter collections have also been well received, while new trading initiatives include monthly product drops and speed to market enhancements.

Ted Baker has 560 stores and concessions worldwide, including 199 in the UK and 136 in North America.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.