Will bull run for gold and Centamin shares continue?

The price of gold is currently at record highs amid geopolitical uncertainty, interest rate speculation and heavy buying by world central banks. Independent analyst Alistair Strang unveils his new target price.

10th April 2024 07:40

by Alistair Strang from Trends and Targets

Obviously, with the price of gold currently behaving as if it’s on steroids, we’ve been receiving a bunch of emails asking about various gold mining shares. Amusingly, with gold currently around $2,350, our report on gold in November last year issued a future target of $2,357, although we did wonder whether it would be "something promised but never actually attained".

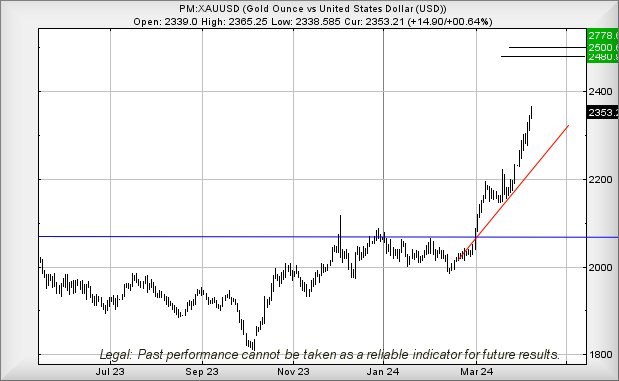

However, movements on the price of gold since the start of March have proven our cautious nature was a load of tosh, and once the price of the metal successfully closed above the glass ceiling (Blue on the chart), it was only to be a matter of time until it sprouted faster than a dandelion on a sunny day.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Gold is now showing some useful potentials, needing below $2,080 to spoil the party. Instead, it now appears likely above $2,357 provides the potential of a lift to an initial $2,480 with secondary, if bettered, at $2,500 and some potential hesitation, if only to satisfy all the doomsayers who will claim it can’t surpass this level. In normal circumstances we’d agree, except for two things.

Firstly, a bunch of folk will almost certainly open Short positions at $2,500, and there are few things the market finds funnier than collecting a bunch of stop losses.

Secondly, perhaps more importantly, the Big Picture now claims a future $2,778 is possible for gold, a price level where unless “they” start gapping it up, the metal should almost certainly experience some collywobbles.

Source: Trends and Targets. Past performance is not a guide to future performance.

Centamin (LSE:CEY), the gold producer active in Egypt and further down around the Ivory Coast, show extraction results which would shame the “best” commercial producers on Discovery’s Gold Rush TV show. They extracted nearly 1/2 million ounces from their Sukari pit.

Our immediate outlook for Centamin suggests above 125p should prove capable of boosting the share price to a less than impressive 127.6p. Our secondary, above such a level, calculates at a future 144p, along with a demand the share price close above such a level to hopefully make a Big Picture future 177p a reality.

The share price certainly has fairly strong prospects and we cannot help but wonder when the runaway price of gold may spread into high revenue expectations for miners.

If things intend to go wrong for Centamin, the share price needs to drop below 106p to spark trouble, allowing reversal to an initial 100p with secondary, if broken, at a probable bottom of 91p.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.