Woodford Patient Capital: Bargain or falling knife?

We examine prospects for Neil Woodford's badly leaking investment venture as investors get the jitters.

22nd July 2019 10:01

by David Prosser from interactive investor

We examine prospects for Neil Woodford's badly leaking investment venture as investors get the jitters.

The bottom-fishers smell an opportunity. Woodford Patient Capital (LSE:WPCT) was the most-bought investment trust on interactive investor's web platform during June, as bargain-hunters sought to cash in on its plummeting rating. But will the opportunists make a killing – and should you join them? Or will Patient Capital's new shareholders rue the day they ignored that old stockmarket adage about never trying to catch a falling knife?

It's a debate Neil Woodford never expected the market to be having, but Patient Capital has been a serial underperformer since its launch in April 2015, a year after the star fund manager left Invesco Perpetual to go it alone and set up Woodford Investment Management. By early July, its shares languished at just 55p, 45% down on the issue price.

Waiting game

A clue that Patient Capital could come good is in the fund's name. Woodford has always stressed the need for investors to take a long-term view of a portfolio that is two-thirds invested in unquoted companies, many of them early-stage technology and biotechnology businesses. But that argument has been knocked for six in recent weeks by the crisis engulfing LF Woodford Equity Income, Woodford's flagship fund.

The announcement in June that the open-ended Equity Income fund was closing to withdrawals amid a spate of redemption orders it was struggling to cope with had a huge impact on Patient Capital. Its share price fell by 28% over the following month as the market noted that many of the problematic shares in Equity Income's portfolio – both quoted and unquoted – are also held by its investment trust counterpart.

This overlap is longstanding, but the funds' close relationship became closer still when Patient Capital acquired five unlisted companies from Equity Income in March, with the latter taking a 9.9% stake in the former in return.

Equity Income's travails continue. The gating of the fund was extended for at least a further 28 days in early July and looks set to continue until the end of the year. Still, some investors feel the reaction at Patient Capital has been overdone. After all, it remains open for daily trading, its structure ensuring investors can deal freely.

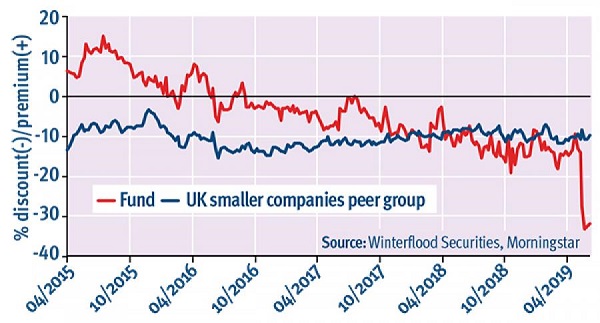

First, the bulls' case. This begins with Patient Capital's current valuation: clearly, the 31% discount at which its shares trade relative to the value of its portfolio offers an opportunity to acquire exposure to these assets on the cheap. If you believe Neil Woodford has not become a bad stockpicker overnight, following several decades of outstanding performance, that opportunity is not to be sniffed at.

Moreover, some analysts believe the Patient Capital portfolio is moving closer to coming good. At stockbroker Stifel, analyst Iain Scouller points to "the increasing maturity of the unquoted portfolio", 80% of which was acquired in 2015 and 2016. The trust's latest results, published in April, suggested several companies were not far away from a stock market listing, potentially at premium valuations. Other value-enhancing realisations might also be possible.

In fact, the timetable for such sales may be accelerated by the crisis at Equity Income. Its need to raise cash may now prompt more rapid disposals of companies in which Patient Capital also has stakes.

Woodford Patient Capital: performance since launch

Attractive assets

That's not necessarily bad news, argues Scouller, because competition among buyers of such assets is currently fierce. "While there is a risk of a fire sale, there is considerable cash waiting to be deployed by private equity funds for growth capital investments," he says. "Assuming individual companies or portfolios of investments are sold to private equity managers at current or higher valuations, this should be helpful for sentiment towards Patient Capital and its NAV return."

Another factor in Patient Capital's favour is its fee structure. With Woodford Investment Management solely dependent on performance-related fees – for which the hurdles have not yet been met – the manager is currently running the trust for nothing. The row over whether fees on Equity Income should be waived continues, but at least investors in Patient Capital are getting a free ride.

In addition, the bulls point to the advantages of Patient Capital's investment trust structure. It's not just that closed-ended funds are much better suited to holding illiquid assets such as unlisted stocks. Their governance is also important: the trust has an independent board of directors that has a fiduciary responsibility to shareholders. If Woodford can't turn Patient Capital around, the board can fire him and hire someone who can.

In this context, the strengthening of Patient Capital's board in recent weeks is encouraging, particularly given previous concerns about its independence; at one stage, three of its five directors were also directors of portfolio companies. Chair Susan Searle has now stepped down from one of those companies, Mercia Technologies, to concentrate on Patient Capital. And the fund has taken on a new director, asset management industry veteran Stephen Cohen, who will chair its audit, risk and valuation committee.

Some investors will feel any flexing of the board's muscles is a case of shutting the stable door after the horse has bolted. The directors' initial reaction to the Equity Income crisis was limited to a brief statement that the "operational performance" of Patient Capital's portfolio companies was unaffected and to a promise to consult shareholders. But it has stepped up since then: the directors have since promised to reduce the current level of gearing, 17%, to zero within 12 months. That could pave the way for share buybacks that bring down that whacking discount, to investors' benefit.

Deep scepticism

Does all that sound too good to be true? Plenty of analysts remain unconvinced. In the bears' corner, Charles Cade at stockbroker Numis Securities warns:

"Patient Capital is in a difficult situation and we do not expect its shares to rerate for some time, in the absence of materially positive portfolio or corporate developments!"

There are a number of reasons to be gloomy. One big problem is that 9.9% Equity Income stake, which the market expects to be sold as the open-ended fund raises money to meet redemptions. In the meantime, that’s a large overhang holding back Patient Capital's share price.

Worse, the 23% of the shares held through Hargreaves Lansdown could represent a similar obstacle. The broker’s dropping of Woodford’s open-ended funds from its recommended funds list may prompt its clients to desert his investment trust too.

Another headache is the potential for valuations of Patient Capital’s unquoted companies to deteriorate rather than improve. Even without the threat posed by the sell-off of Equity Income’s overlapping holdings, there is pressure on the fund’s net asset value. In June Patient Capital’s board announced a 4% write-down, following an independent valuation of its unlisted stocks. In July Patient Capital shares fell by 3% in a single day on the back of disappointing news from just one of its holdings, Benevolent AI, underlining the trust’s hyper-sensitivity to setbacks in the portfolio.

As for the argument that the trust’s board will intervene on shareholders’ behalf, there is no magic wand it can wave. Lower gearing is an attractive idea in principle but may be difficult to achieve without raising money from significant realisations, particularly as Patient Capital’s board has warned that some portfolio companies may require further financial support.

Woodford Patient Capital: discount history since launch

Some prospects but no guarantees

Similarly, while sacking Woodford Investment Management is an option – and with a large portfolio of assets to manage, competition from would-be replacements should be fierce – there is no guarantee of a turnaround under new management of what is a highly specialised mandate.

Instead, the board may even conclude that its best option is an orderly wind-up of Patient Capital, warns Numis. This would no doubt take place over an extended period to protect shareholders’ interests, but it would hardly be conducive to any substantive share price recovery.

These potential headwinds mean the argument between the bulls and the bears is finely balanced. In the more negative camp, Cade argues:

"Continuing with business as usual for Patient Capital will be difficult, given performance and the shrinking of assets at Woodford Investment Management."

Even the more optimistic Stifel has downgraded its previous buy recommendation on Patient Capital shares to hold, in light of the Equity Income crisis.

Nevertheless, there are those who believe Patient Capital is worth a punt at its current valuation. "Famous last words, but I suspect most of the bad news is in the price," says Mick Gilligan, head of fund research at Killik & Co. "I still think there is good long-term return potential from this portfolio, though I would be careful about the size of a position for anyone buying or topping up." In practice, he suggests, a limit of no more than 1-2.5% of your portfolio.

The bottom-fishers have been warned.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.