XP Power: one of my favourite companies

Our analyst likes this business which is reasonably priced and probably a good long-term investment.

22nd May 2020 15:50

by Richard Beddard from interactive investor

Companies analyst Richard Beddard likes this business which he believes is reasonably priced and probably a good long-term investment.

XP Power (LSE:XPP) is one of my favourite companies, because it explains itself so well. The annual report tells you things most annual reports do not.

Simple things, like what the company does, why it is so good at it, and what it needs to do to stay competitive.

It contains details like market share (11% in North America, 11% in Europe, and 2% in Asia). Strangely many companies treat such information as though it were a trade secret.

The company manufactures power converters for industrial electronics and medical equipment. In the main, the converters convert alternating mains current to stable direct current and RF power (stable alternating current oscillating at a very fast frequency).

All electronic equipment requires some kind of power converter, often more than one, but the converters we know best - the ones that plug into things like laptops - are not particularly special, so XP Power does not make them.

XP Power makes power supplies for robot battery pack charging stations. The robots are used in warehouses and stores to pick groceries. Source: XP Power annual report 2019.

The converters in machines that make semiconductors or monitor patients in hospitals on the other hand are critical. Failure could halt a production line, or an operation.

These converters are part of a machine’s design, and cannot be substituted for an off-the shelf product. Once an equipment manufacturer has chosen to use an XP Power converter, it should remain a customer for the machine’s lifetime.

Powering up

You may well ask how I know so much about power converters. It is an illusion. I’ve read a few XP Power annual reports over the years, and it is given me an education.

Not just about power converters, but about business strategy. XP Power’s strategy is to move up the value chain, a euphemism for tacking the business into more profitable waters. It means XP Power is always changing, which can be discombobulating.

Two decades ago, XP Power was a distributor. This enabled it to build up a large technical sales force that worked with customers to find the best converters.

It started to design converters that better met their needs, and then it started to manufacture hundreds of families of converters which it could easily customise. Today it claims the world’s biggest technical sales force, and the world’s broadest range of converters, which are competitive advantages in themselves.

It can take up to two years of collaboration to design a power converter, which is why a large technical sales force is so important, but for machine manufacturers converters are often something of an afterthought, and to fit them in to machines, small size and efficiency is an advantage, which is where the many families of converters come in.

Manufacturing, located increasingly in Vietnam but also China, gives XP Power control of quality and cost. In addition to reliability, more complex converters are in demand because the customers of XP Power’s customers are under pressure to use less energy, and electronics are proliferating.

The main threat is low-cost competition from Asia, which is eating away at XP Power’s soft underbelly. Low power/low complexity adapters are two-a-penny, so the next stage of XP Power’s evolution, enabled by three acquisitions in as many years, are high power/high voltage and RF Power converters.

This, along with XP Power’s efficient Green range of AC/DC adapters, is the cornerstone of its strategy to sell more converters to its biggest customers. These products communicate with the equipment they are installed in, requiring more collaboration, which plays to XP Power’s manufacturing and sales strengths.

As XP Power moves up the value chain, it is sloughing off parts of the business. It closed its low voltage design centre in the UK last year and plans to source more low voltage converters from third parties. It also moved recently acquired high voltage manufacturing from Nevada USA to Vietnam.

Confidence in management

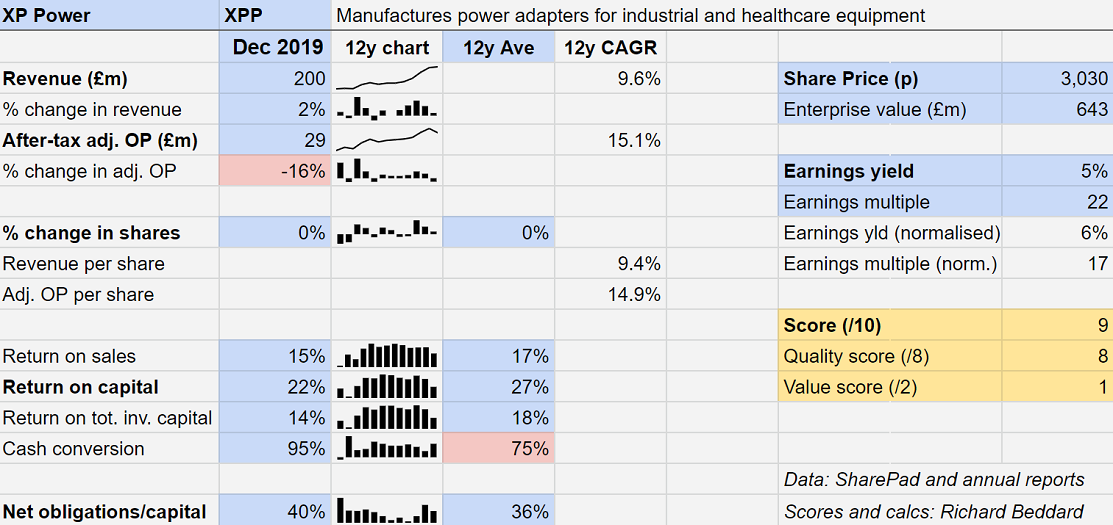

Sticking with a company as its strategy shifts requires confidence, especially when, as in 2019, XP Power’s performance dips and, as in 2020, when like most businesses it will experience the economic repercussions of the Covid-19 pandemic. My confidence does not just come from the quality of XP Power’s annual report, and its track record of profitability and growth, which is impressive:

I am also confident because the architects of XP Power’s previous metamorphoses are still running the company. Chairman James Peters founded it and owns a substantial shareholding. Duncan Penny, chief executive since 2003 joined as finance director in 2000.

In the year to December 2019, revenue increased marginally, but adjusted profit declined 16% as the company contended with a 21% reduction in sales to semiconductor equipment manufacturers, US tariffs on imports from China where XP Power manufactures some power converters, and a delay in shipments due to hiccups in a new software system.

The company has not updated the market on trading since 4 April, but then it was going well. Its two Vietnamese factories were operating normally and its Chinese factory had reopened after a Covid-19 shutdown.

It was experiencing exceptional demand in healthcare, and signs of recovery in semiconductor equipment, and it was receiving far more orders than it was billing, an indication that demand has increased. Since XP Power makes converters for patient monitoring equipment, ventilators, diagnostic and laboratory equipment, one can imagine where some of it was going. However, industrial markets will suffer if the economy does.

Scoring XP Power

I like XP Power. It sticks to growing markets where reliability and support are as important as cost, it works closely with customers, who, judging by XP Power’s profit margins are happy to pay for a reliable product and help to design it into their products.

A prolonged recession would hurt XP Power’s industrial customers, but the company has a history of investing through difficult times, and emerging with greater market share.

Does the business make good money? [2]

+ High returns on capital and sales

+ Decent cash conversion

What could stop it growing profitably? [2]

+ Modest borrowings

+ Big competitors like TDK-Lambda seem to be less dynamic

? Low-cost competitors are price competitive for less complex products

? Industrial/semiconductor markets are cyclical

How does its strategy address the risks? [2]

+ XP Power is moving its product portfolio up the value chain

+ It has the largest technical sales-force, and biggest range of customisable converters

+ Controls quality and costs by manufacturing high value products

+ Markets have different cycles, healthcare is growing more reliably

Will we all benefit? [2]

+ Directors are experienced and committed shareholders

? They are also very well paid, but perhaps not extravagantly so

+ The company lists employees first among competitive advantages, and publishes a cultural survey score (75/100)

+ It also explains itself very well

Are the shares cheap? [1]

A share price of £30.30 values the enterprise at about 22 times adjusted profit in 2019, but 2019 was a tough year and, although 2020 probably will be too, I think the shares are reasonably priced. XP Power is probably a good long-term investment.

Richard owns shares in XP Power

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.