XP Power shares: They're electrifying!

20th April 2018 16:43

by Richard Beddard from interactive investor

sold more power converters by value in 2017 than it did the previous year across every segment of its business, and business is still booming. At the year end, the company reported a book to bill ratio of 1.11, which means orders had increased substantially more than revenue. Subsequently, the company's confirmed it's turning those orders into sales.

XP's meat and drink is AC/DC power converters, the kind that convert alternating mains current into more stable direct current, but it's expanding the product range to include converters that change the power and voltage of direct current.

XP powers machines used in factories and hospitals, and machine manufacturers have experienced buoyant demand for the last two years. An acquisition three quarters of the way through the year also played a bit-part in the growth story. XP bolted Comdel, an American manufacturer of Radio Frequency power supplies, onto its business in September. High power converters like Comdel's are used in semiconductor equipment to generate plasma, but they also have applications in XP's other markets.

The main driver in a decade of growth at XP, though, has been the remorseless development of new power converters that can be slotted into its customer's equipment with relative ease. During the year the company launched 27 new power converter product families, 19 of which were "Green XP Power", the company's ultra high efficiency adapters.

XP expects a new manufacturing facility in Ho Chi Minh City, its second facility in Vietnam, to go onstream later this year, it's recruited a new finance director, and at its Annual General Meeting earlier this month shareholders voted to change the articles of association to allow it to borrow more. The executives have also received a walloping pay rise.

Phew! What a year. To assess the impact of all that change on the company's suitability for investment I shall run it through my Decision Engine's scorecard. Each section is scored out of two, to give a total out of ten:

How does the business make money?

What's special about the business? How does it perform through thick and thin? Is it profitable? [2/2]

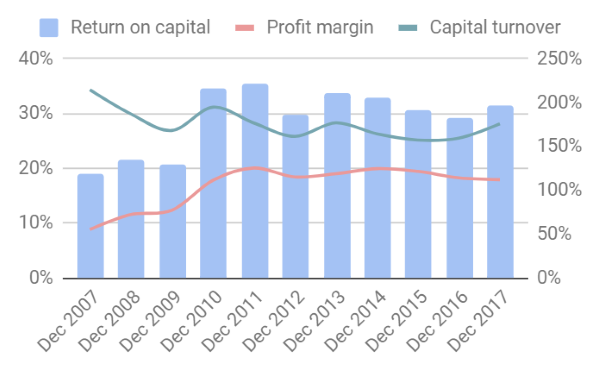

Unsurprisingly, XP Power's operations are still highly profitable:

Source: interactive investor

XP's elevated return on capital stems from a decision to change the way it makes money about a decade ago. Then a distributor, it married its salesforce to new capabilities in design and manufacturing.

Since the salesmen knew what the customers wanted, which is reliability and efficiency in a small footprint, XP's products were better. Since its factories were new, they were produced efficiently. Since it already had a large and technically adept salesforce located near its customers, principally in Europe and North America, it could turn samples around quickly and support customers as they designed its products into theirs.

Today, XP is the market leader, it says it has an 11% market share in America, where it has 18 direct sales offices, 11% market share in Europe, where it has nine, and a 2% market share in Asia, where it has five sales offices. That puts it in a kind of goldilocks zone: still small enough to grow by selling a wider variety of converters to its blue-chip customers, but with the broadest range of products and largest and most technically proficient salesforce in the industry.

A failed converter could halt a production line, or a medical procedure, so customers pay a premium for reliability. XP's "Green XP Power" converters are so efficient they produce five times less waste heat, compared to a typical converter. XP says a Green converter usually pays for itself within one year, through lower electricity costs, but they also run so cool they do not need a mechanical fan, the most unreliable part of a power converter.

Unfashionable though it is, I think vertical integration: innovative products, efficient manufacturing, and attentive sales and support, have enabled XP Power to sell more products at higher profit margins to its customers.

How will it make more money?

Describe the strategy. Will it make the company more competitive?

Is it adaptable? [2/2]

XP is broadening the product range, so it can sell more adapters to existing blue-chip customers, and focusing on requirements that are difficult to engineer like efficiency, reliability and high power, because there are fewer competitors and profit margins are higher. In 2017, it customised one of its off-the-shelf designs to operate below -40 degrees centigrade and up to 70 degrees centigrade for satellite broadband base stations "located at the far corners of the planet".

That strategy continues as XP builds a third factory and plans 30 new product families in 2018, but to extend the range beyond AC/DC power supplies it has turned to acquisitions. New finance director Gavin Griggs was recruited because of his experience in acquisitive businesses, and the company will be able to spend more on acquisitions once it can borrow more.

I think modest acquisitions are a logical extension to XP's strategy because customers already use the acquired products, sometimes to change the power or voltage in machines already powered by XP's AC/DC adapters. Since XP has more customers and a bigger sales force than the companies it's buying, it should be able sell more converters.

What could go wrong?

Describe the risks. How well does the strategy address them? Is it resilient to fluctuating economic forces and competition? [2/2]

The risks fall into three categories: Competition, the capital equipment cycle, and complexity.

XP routinely warns of emerging low-cost competition in Asia and the potential for competing new technologies. Reassuringly, its strategy might be the antidote. By manufacturing more demanding power adapters that must be customised or developed in collaboration with the customer, its focus is moving towards non-standard technologically advanced products that cannot be sourced direct from Asia.

The Green Power range is an important element of this strategy, and revenue from Green products grew 31% in 2017, slightly faster than the group as a whole, contributing 24% of the total. Nineteen of the 27 new product families launched in 2017 were Green XP.

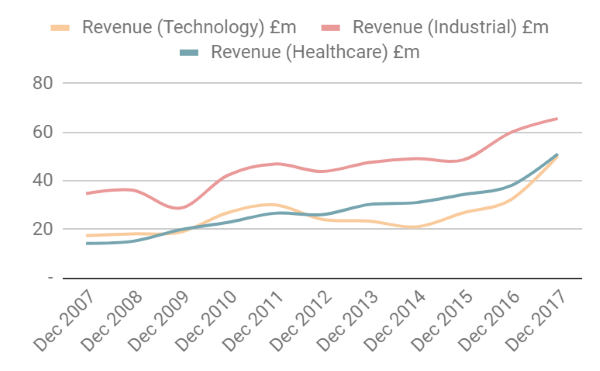

Equipment manufacturers invest when the business outlook is rosey, and they have money to spend. They cut investment when orders shrink and they must conserve cash. This capital equipment cycle can produce big swings in demand for suppliers, although the risk is reduced because XP supplies three distinct markets. Two of them, technology (primarily semiconductors) and industrial, have been cyclical. Healthcare, the grey-green line in the chart below, is more stable:

Source: interactive investor

These markets tend to zig and zag independently of each other, and elements of XP Power's business model further dampen the effect of reduced demand. Once designed into a piece of equipment, XP can rely on sales until the customer redesigns the machine, typically for seven years. While demand for the converters may fluctuate, customers are unlikely to swap out an XP product for a cheaper alternative to cut costs, because they would have to retest and certify the machine.

The semiconductor industry, XP's mostly cyclical market, may also be stabilising. In the past, individual technological innovations like smartphones, and before that the Internet, drove demand, but as semiconductors become ubiquitous, the impact of any one innovation may be reduced.

As the company grows though, it becomes more complex. In future, the business will not only be supplying more converters, it will be doing more customisation, a departure from the strategy that has made XP so successful: standardised product families that can be customised fairly easily. It's absorbing other companies, and it can now take on more debt. To my mind, there are more ways to break XP Power, though I doubt the directors will.

Will shareholders benefit in the long-term?

Does management look after staff, suppliers, customers and shareholders? Is it equitable? [2/2]

XP Power is customer focused. Longstanding chief executive Duncan Penny and founder and chairman James Peters have enriched shareholders. The annual report says all the right things about developing staff.

The only mote in this glossy view is a huge hike in executive pay. The company says it was triggered by the recruitment of finance director Gavin Griggs. To snare him the company offered to pay twice what his predecessor received, to help manage a business that is admittedly growing in complexity. As a result, pay ratcheted up across the board, with concomitant increases in bonuses and the long term incentive plan.

Peters and Penny have built a great company. I'd be surprised if the board were obsessed with lining their own pockets, but I'm sorry to see XP climbing aboard the high pay merry-go-round.

Are the shares inexpensive?

Does the share price undervalue the firm, considering its prospects? [-1/2]

The shares are not cheap. I down-rate the score of companies that have have an adjusted earnings yield of 5% or less, analogous to a debt-adjusted price earnings ratio of 20 or more.

Verdict

XP Power scores 7/10. In my opinion, it's probably a good long-term investment, but there are risks - particularly in the share price.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard owns shares in XP Power.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation, and is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Members of ii staff may hold shares in companies included in these portfolios, which could create a conflict of interests. Any member of staff intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. We will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, staff involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.