Buy, Hold, Sell: "We have a very strong value perspective"

10th September 2018 13:14

by Tom Bailey from interactive investor

David Osfield, manager of the EdenTree Amity International fund, talks to Tom Bailey about the stocks he has recently been trading.

Every day it seems a mainstream fund announces a degree of environmental, social and governance (ESG) integration into its investment strategy, says David Osfield, manager of the EdenTree Amity International fund.

Amity, however, has had an ESG approach since its launch in 1999. He adds:

"This gives us a depth of experience, longevity and understanding. It is where the credibility comes from."

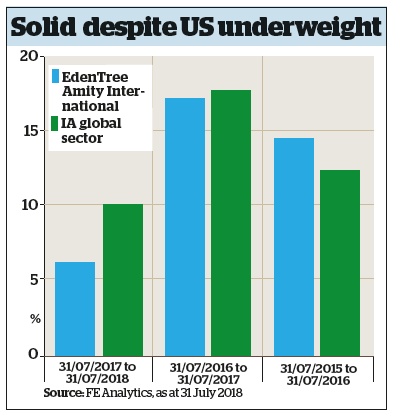

Amity is different in other ways. Unlike many ESG-focused funds, it has a "very strong value perspective", according to Osfield. "We don't want to be caught in growth traps, stuck in stocks that the market has already recognised as leaders in ESG.’ Moreover, the fund is tilted towards Asia Pacific and European equities, while being underweight in US shares. In part this is due to its value-orientated approach and in part to Osfield's extensive Asia Pacific equity experience. He believes Asia Pacific, particularly China, has a strong future in sustainable business development.

This focus has resulted in lagging performance over recent years: Amity International has a three-year alpha (the amount by which a fund has outperformed its benchmark) of -0.49%. However, argues Osfield, value has underperformed since the 2008 financal crisis. At the same time, the US has outperformed both Asia Pacific and Europe over the past year, again affecting the fund's relative performance.

Buy

NXP Semiconductors (NASDAQ: NXPI)

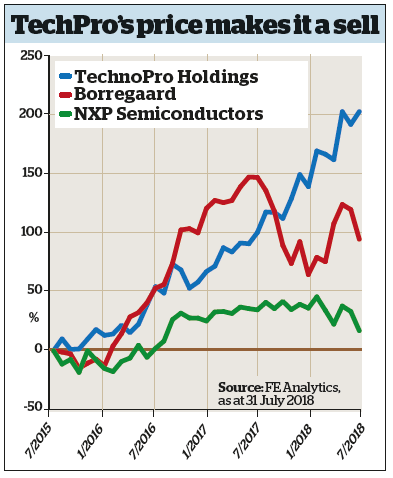

Amity is underweight in US stocks, but the fund has recently bought NXP Semiconductors, a semiconductor manufacturer. The fund first bought the share in August 2016, when it was trading at just above $80 (£62). It saw the share as having great value potential. Soon Qualcomm expressed its intention to acquire NXP, which pushed up the share price. The company also started to attract the interest of Paul Singer's hedge fund Elliot Management. By the first quarter of 2018, the price of NXP shares had reached around $125, leading Osfield to sell the share for a meaty profit.

"Then the trade war happened," says Osfield. Regulatory approval for the acquisition had been signed off by the US but not by China. With trade tensions mounting, the Chinese government did not give the acquisition the goahead, leading Qualcomm to terminate the deal and pushing NXP's share price down to $92.

This was an opportunity for Osfield to buy back into what was still, in his view, a strong company. "The market forgot how great this company is," he says. "It's right in the value wheelhouse. We are impressed with the management team and think it has a strong product. We expect sell-side analysts to realise that soon."

Past performance is not a guide to future performance

This was an opportunity for Osfield to buy back into what was still, in his view, a strong company. "The market forgot how great this company is," he says. "It's right in the value wheelhouse. We are impressed with the management team and think it has a strong product. We expect sell-side analysts to realise that soon."

Hold

Borregaard (BRG:NO)

"Borregaard plays into a lot of our sustainable themes," says Osfield. The company, based in Norway, makes specialised biomaterials and chemicals from sustainably sourced wood.

The focus on sustainability extends to the firm's output. One key product is the chemical lignin, which is in short supply. It has a variety of uses, one being in the manufacture of cement sacks. Lignin reduces the dust sacks give off while allowing the sacks to be used as part of the cement-making process – reducing waste and strengthening the compound.

"It's a fabulously run company doing something very different," says Osfield.

"Management doesn't look for quick wins but aims to develop the market for the long term."

It is not a buy because the firm faces several headwinds, the principal one being cost inflation. The price of wood is rising because of US tariffs on Canadian timber as well as fires that have affected timber supplies. "That is causing short-term cost inflation," says Osfield. A further problem at the company is some overcapacity. Shares in the firm were purchased in September 2016 at a price of 72kr (£6.74).

Sell

TechnoPro (TYO: 6028)

This business, sometimes described as an engineering collective, is a technology-focused staffing and services company active in Japan and China. The firm takes on engineering graduates as well as those in midcareer and gives them an opportunity to multi-skill, providing the firm with a flexible workforce that is contracted out to other firms.

The flexibility of the collective has helped it secure higher prices, which trickle down into engineers' incomes. This makes the collective very attractive to join, given Japan's historically low rate of wage inflation.

Past performance is not a guide to future performance

However, despite the positives, Osfield sold the stock in March 2018 for around ¥6,800 a share. "Valuation got quite full," he says. "We just said thanks very much, but its valuation is now too rich for us. We have a very strong sell discipline."

TechnoPro was first purchased in February 2015 shortly after its flotation, when the price was about ¥2,345.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.