Important information: A SIPP is for those wanting to make their own investment decisions when saving for retirement. As investment values can go down as well as up, the amount you retire with could be worth less than you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

ii SIPP (Self Invested Personal Pension)

New customers start on our £5.99 a month Pension Essentials plan.

When the value of your account grows above £50,000 you will move onto our £12.99 a month Pension Builder plan.

- It's free to join us, and free to leave.

- You can contribute as little as £25 a month with our regular investing service. There are no trading fees when you contribute this way.

- If you want to buy or sell shares and funds, trades usually cost £3.99.

- There are no extra charges for taking money out of your pension.

- There are some other fees for things like foreign currency exchange and Stamp Duty on shares. View full rates and charges

Get up to £2,000 when you switch to our SIPP

Reap the rewards of switching up your retirement savings this summer. You could keep more money for your future with our low, flat-fee Personal Pension (SIPP) and enjoy a cashback boost for now.

Get your £100 to £2,000 cashback when you open a SIPP and deposit or transfer a minimum of £10,000. See more details on this offer.

Offer ends 31 July 2025. Subject to 12 month holding period. Terms and fees apply.

Check before you transfer

A SIPP is for those wanting to make their own investment decisions when saving for retirement. As investment values can go down as well as up, the amount you retire with could be worth less than you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028).

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Why should you invest with an ii SIPP?

- More opportunities - choose from one of the widest ranges of investments on the market.

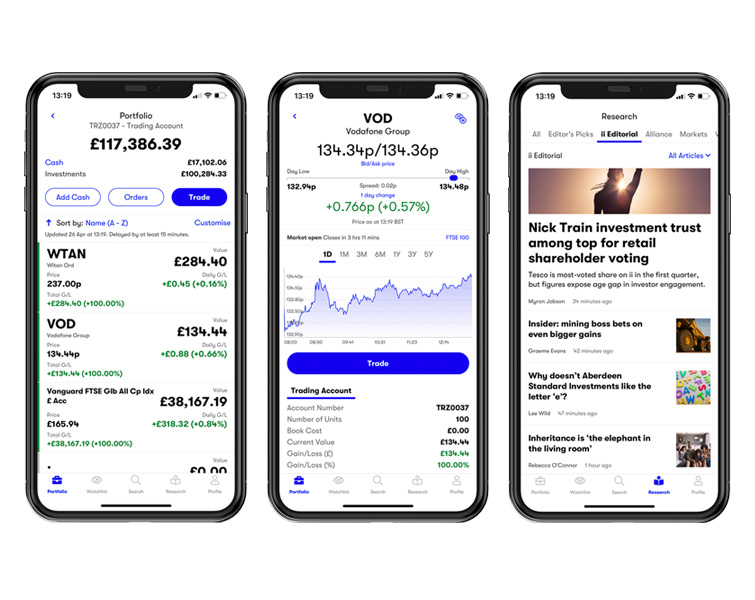

- You're in control - check on your investments any time, anywhere with our secure mobile app.

- Keep your cash - there is no percentage fee, so your costs stay the same as your portfolio grows.

- We've got your back - our UK-based team is rated 'excellent' on Trustpilot.

- Learn from the best -impartial information from our analysts, including selected funds, ready-made portfolios and our award-winning newsletters.

Things to consider before you transfer

Please check that you won’t lose any safeguarded benefits if you transfer. This could include guaranteed annuity rates or lower protected pension age than the Normal Minimum Pension Age (rising from 55 to 57 in 2028). Please also check any transfer-out fees.

Please note that if you plan to hold both drawdown and non-drawdown pots in your ii SIPP, you cannot allocate specific investments to each pot separately. This means that the value of each pot will change in line with the overall performance of all the investments held in your SIPP.