10 funds that really stand out

Saltydog analyst explains his simple but highly effective strategy and one potentially exclusive fund.

18th May 2020 12:14

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst explains his simple but highly effective strategy and one potentially exclusive fund.

On the whole, we like to focus on the relatively short term – weeks and months. We believe that as the global economic and geopolitical landscape changes, different investment sectors will come in and out of fashion.

As a sector starts to perform well, we will invest in it and then hold it until another sector comes to the fore. It is a bit like going to a horse race and being able to continually switch your bet to the leading horse as the race progresses. You are in the best possible position throughout and you will win at the end.

This style of investing is known as trend following or momentum investing. Although it has its critics, it is generally accepted that it works, and it is widely used by professional investors as well as legendary historic figures of the past.

The theory of momentum trading, like all the best ideas, is simple - the greater the amount of money that is being invested into a fund, or asset class, the quicker its value will rise. This in turn will attract further investment, pushing the price even higher. Obviously, the opposite also applies. As a fund or asset class loses investors, the upward momentum ceases and it will reverse, gaining impetus in the opposite direction. Time to move on.

In our weekly analysis, we look at the relative performance of the sectors, and then go on to highlight a few funds, based on their performance over the last four and 26 weeks.

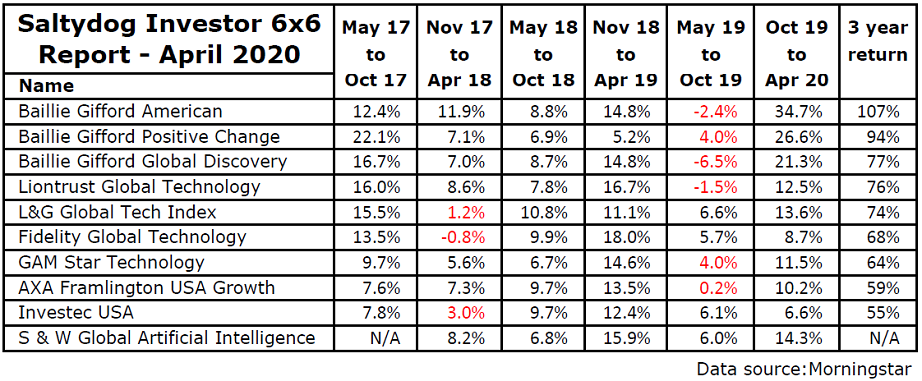

Every three months we review the funds on a slightly longer-term basis in our 6 x 6 report.

We are looking for funds that have performed at a consistently high level in each six-month period over the last three years. Our latest report covers the three years from the beginning of May 2017, through to the end of April 2020. The target is to achieve a return of at least 5% every six months, in each of the six periods.

No funds have succeeded in this feat, but there are 10 that have come close. The following funds have gained 5% in five out of the six periods.

The leading fund Baillie Gifford American, has been in and out of our demonstration portfolios many times over the years, and was one of the first funds that we went back into after the recent crash.

The fund at the bottom of the table, Smith & Williamson Global Artificial Intelligence, was only launched in June 2017 and so was not around for all of the first six-month period. It is the only fund that has gone up by over 5% in all of the subsequent half-year blocks and, when we review the data in six months, it could be at the top of the list with an exclusive six out of six.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.