60/40 portfolios: there may be trouble ahead

Portfolios that are 60% stocks and 40% bonds have outperformed more diversified allocations over the pas…

5th March 2020 09:23

Portfolios that are 60% stocks and 40% bonds have outperformed more diversified allocations over the past 10 years, but investors should temper their expectations for a repeat, says Rick Friedman.

A passively allocated 60% stocks/40% bond portfolio has well served investors seeking to compound wealth with reasonable levels of risk.

A global 60/40 portfoliodelivered 7.3% after-inflation returns from the lows during the global financial crisis through 2019. A US-biased balanced portfolio did even better, chalking up annualised real returns of 9.5% – more than double the long-term average of 4.4% going back to 1900.

While the passive-balanced portfolio has delivered extraordinary recent returns and can be easily and cheaply implemented, investors should be wary looking forward. Two key problems lie ahead.

Problem 1: Low yields from stocks and bonds

First, stock and bond valuations are both extended, suggesting that they will deliver less than they have historically. The maths with bonds is straightforward. 10-year US Treasuries yielded just under 2% at the end of 2019 and even less today. It is more or less impossible for a bond index yielding roughly 2% to deliver the 5% nominal returns that investors have become accustomed to over any period of time approaching or exceeding the index’s duration. Of course, anything (including even lower rates) can happen in the short run.

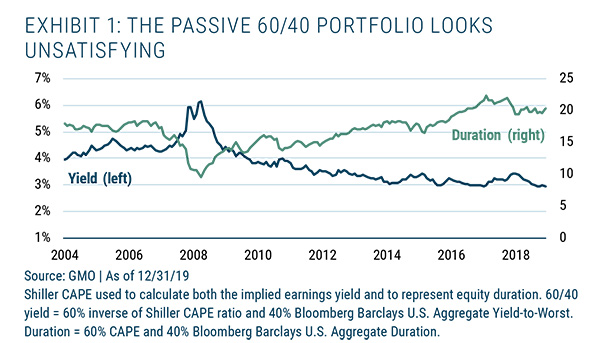

Similarly, the underlying earnings yield of the stock market has fallen as valuations have risen. The blue line in Exhibit 1 traces the aggregate yield of a 60/40 portfolio by combining the normalised earnings yield for stocks (S&P 500) and the yield-to-worst for the Bloomberg Barclays US Aggregate Bond Index. Unless expensive valuations rise higher and low rates fall lower, the passive 60/40 portfolio will likely deliver disappointing returns. The low starting yield of a 60/40 portfolio represents the first problem we see ahead.

Problem 2: High duration of stocks and bonds

At the same time, the underlying yield is at its low point, the duration (green line) of the portfolio is near its apex. Duration measures the sensitivity of the portfolio to a change in that underlying yield. Today, the sensitivity of a 60/40 portfolio to a change in yield is nearly as high as it has ever been. Both stocks and bonds are levered to future changes in discount and interest rates. Even a small amount of mean reversion upward in the aggregate yield of the 60/40 portfolio will be painful because there is less underlying yield to cushion any capital losses and those capital losses should be expected to be larger than normal for any change in yield given the high duration.

While investors have become conditioned to believe that a 60/40 portfolio delivers consistently strong returns, history shows that this has not always been the case and the twin problems weighing on such a construction today suggest that robust returns are unlikely going forward.

Due to elevated valuations (low yields) and extended durations of both stocks and bonds, it is possible that in a future downturn investors will not receive the diversification that they expect from their bond portfolio. Stocks and bonds have risen together and could certainly fall in unison as well.

Liquid alternatives

To address these dual threats, we have rotated into risk-controlled, highly liquid alternative strategies across our multi-asset portfolios. These strategies take risks in ways that provide very low durations, offering an important form of portfolio diversification.

For example, compare merger arbitrage to long equity holdings. With equites, you are buying a stream of cash flows stretching decades into the future. The main risks are that a depression will meaningfully impair those cash flows or that discount rates will rise and lower the present value of those long-dated cash flows.

With a merger position, you are still invested in equities, but the key risk you are underwriting is the odds of that deal blowing up. Typically, transactions close or break within 12 months, leading to a significantly shorter duration profile than traditional equities.

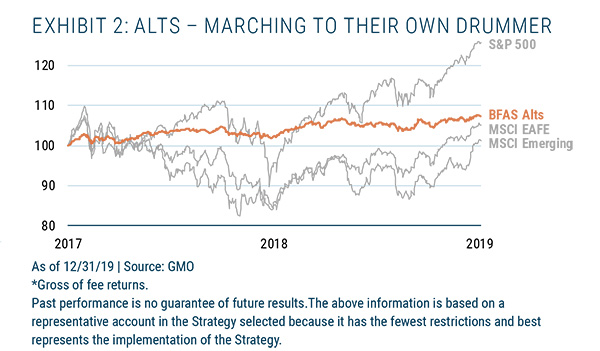

Liquid Alternatives can provide diversifying and uncorrelated returns. While Alternatives should not be expected to keep up with robust equity markets, they can help shield large drawdowns given their lower equity beta exposure. GMO’s suite of Alternatives within our Benchmark-Free Allocation Strategy has delivered generally in line with our expectations through the volatility of the last couple of years as Exhibit 2 indicates. Liquid alternatives improve the robustness of our multi-asset portfolios by helping to protect against the problems that today’s low yields and high durations present.

Rick Friedman is a member of GMO’s Asset Allocation team.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.