Active Income Portfolio needs overseas exposure after Daimler reverse

22nd April 2013 10:53

by Nick Louth from interactive investor

German carmaker Daimler once again occupies our attention, with some of its recent strength shifting into reverse.

I warned last month that I would keep a close eye on the share in case the market's enthusiasm flagged, and so it has. The price had already run well ahead of the company's success in improving fundamentals and had outperformed the German Dax index.

Although the shares never quite touched the €48 (£41) limit order for profit-taking I set last time, I was perturbed by a sharp reversal from almost €46 last time back to €43 on 1 April, which ruptured the share's uptrend. That was enough for me to decide to sell half our stake immediately at €42.95 a share.

If April Fool's day was going to make a mug of me, the price would have then rebounded. It didn't. The shares have since slid to €40, making me wish I had sold them all.

So why the sharp change of fortune? The decline began after a somewhat bearish interview Daimler's finance director, Bodo Uebber, gave on 28 March, which suggested the long-forecast surge in Mercedes car sales in China wasn't happening and that European car and truck demand was weaker than expected. Sales figures released on 5 April confirmed this. The key worry for China-obsessed investors was that, despite global car sales rising 3.5% in the first quarter, car sales in China actually fell by a worse-than-expected 12% because of a sales reorganisation.

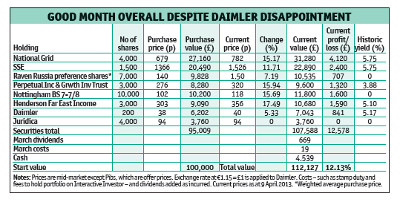

For us, the good news is that we are still 17% up on Daimler overall in a little more than six months. It would now be tempting to pile the proceeds into some of the portfolio's success stories, such as or , both of which are trading close to recent highs. We could also look at the two UK utilities, and , both of which are making good progress and have shaken off recent skittishness about their long-term prospects, although they already account for a hefty part of the portfolio. However, the portfolio needs overseas income.

The ideal home would be a good, strong European-focused investment trust, trading at a discount to net asset value, and with a strong record of benchmark beating and a yield of 5% or so. That's actually a tall order, but I'm in no hurry.

Meanwhile, I'm buying 4,000 shares in a rather curious investment trust called , which makes its money in the US by funding litigation. It probably has the highest potential yield of any investment I've seen, but more on that next time.

Looking at the portfolio as a whole, this has been a good month for dividends. Perpetual Income & Growth paid 2.55p a share, 3p and Daimler's previously mentioned dividend - a grand total in sterling of £669.