Is active portfolio management really worth the effort?

With markets volatile, the Saltydog analyst reveals how his portfolio has performed versus the market.

20th May 2019 12:47

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

With markets volatile, the Saltydog analyst reveals how his portfolio has performed versus the market.

Buy and hold loses out to active management and cash

Over the last nine months, we've seen stock markets around the world fall, recover, and now it looks as though they're not quite sure where to go next.

During this time we have made several changes to our demonstration portfolios – initially increasing the cash levels, and then reinvesting as markets recovered. Was it worth all the effort, or would we have been better off just holding our nerve?

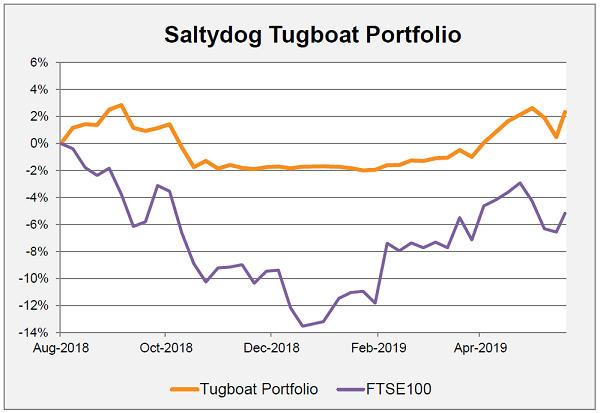

On this occasion it appears that there was a gain, and our most cautious portfolio, the Tugboat, has beaten the FTSE 100.

Data source: Morningstar. Past performance is not a guide to future performance

Admittedly, the index doesn't include reinvested income, but even when that is taken into account the FTSE 100 total return is still showing a loss and the Tugboat is up by more than 2%.

What we find even more satisfying is that we achieved what we set out to do. We avoided the majority of the fall.

As trend investors we'll always get affected by the beginning of any market correction, while we react and head for safety. We'll also miss out on the beginning of any recovery as we wait for it to gain momentum. However, we’re happy to avoid the dip in the middle; there’s no way of knowing how big it's going to be.

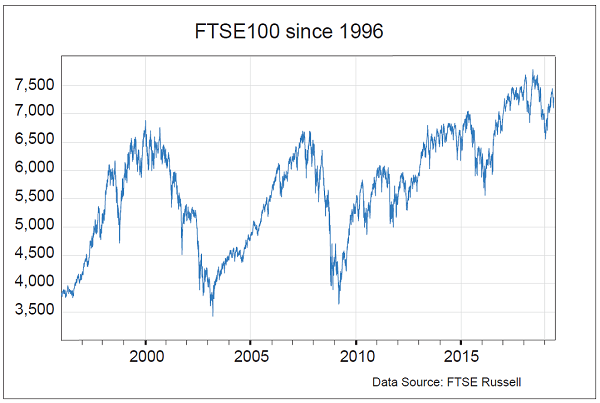

It's easy to forget, but huge market crashes happen with alarming frequency.

There was the bursting of the dotcom bubble in 2000-03, and then in 2008/9 it was the financial crisis. Both times stock market investments could have been cut in half.

Data source: FTSE Russell. Past performance is not a guide to future performance

Since then we've seen smaller, but not insignificant falls. In 2011 there was the eurozone debt crisis and in 2015 it was a panic over China's growth. More recently, we've had concerns over Brexit, the end of low interest rates and quantitative easing, and the trade war between the US and China. They are like rogue waves at sea, they are just going to happen.

We have recently experienced another minor roller; history would suggest that at some point there will be another damaging investment tsunami. That’s when active management could save our portfolios from sinking without trace.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.