Avoiding stockmarket carnage: Why timing the market can work

2nd January 2019 09:42

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Traditional investment wisdom says trying to time the market is a fool's errand but, as Saltydog analyst Douglas Chadwick explains, observant investors can maximise their profits that way.

In a recent publication I received from a high-profile broker, the opening article was entitled: 'You have to be in it to win it'. The conclusion was that if you missed out on the 10 best days in the market over the last 20 years, it would have cost you 3.5% per year, or 166% overall in lost returns.

Now, there is nothing wrong with this arithmetic, nor with the statement that by 2017 your £10,000 would have grown to £34,000. However, the article failed to mention that in 2002 and 2008 you would still only have had your initial investment of £10,000, and that the £34,000 is a result of the long bull run from 2009.

If we look today, however, the £34,000 has fallen back to £27,000, and who knows where it might end? The argument that you should always stay fully invested just does not cut the mustard.

Buy and hold flawed

How much more money would you have made if you had managed to exit the market when it was falling and gone back in after it had started to rise? The answer is considerably more than £34,000, and you would have slept better at night. Moreover, over this extended period you would no doubt have been moving among the rising Investment Association sectors, rather than just sitting in a sector chosen 20 years ago.

If you are actively managing your portfolio and are on top of the sector performances, then why would you stay fully invested under all market conditions? Cash is surely an important investment sector as well.

Another statement in the piece was that it was important to have a spread of different investments, and of course that makes a lot of sense. But it went on:

"Occasionally sell a little of what's done well and add to the stuff that's done poorly."

Now, this is baffling in so many ways. Run your winners and sell your losers is the normally accepted wisdom. Adding to your poorly performing funds is a new approach to me. Why would you want to do that?

I can imagine that many brokers and fund houses might like private investors using Oeics and unit trusts to stay invested and not be moving in and out of the market. It must be much more difficult and more expensive for them to keep their books and those fund numbers balanced.

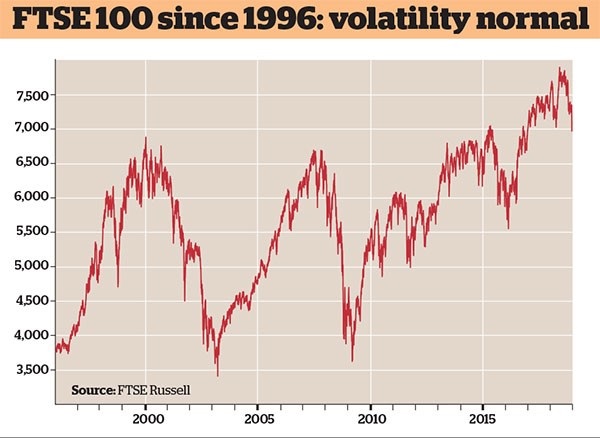

Here's a graph showing the performance of the FTSE 100 index over the last 20-plus years, which demonstrates that the current market volatility is not unusual; in fact it could be described as the norm. There were also two occasions when the index almost halved in value: during the bursting of the dotcom bubble in 2000-03 and the 2008-09 financial crisis.

Past performance is not a guide to future performance

Avoid the carnage

Both these falls were not precipitous, but took place over many months. This should have given those investors who were observant time to exit left and avoid the carnage. In fact, six of the 10 best days referred to in the article actually took place during 2008; nonetheless, you would have been better off just being out of the market for the whole year.

If the above is a reflection of 'real investing life', and is likely to repeat again and again, then what is not to like? If you have sheltered your money as the storm passes over, then the following calm should allow you to re-invest and produce that pot of gold. Of course, if you keep to the 'buy and hold' philosophy, then your portfolio is going to be holed below the waterline and it is start-again time.

As Jesse Livermore memorably pointed out:

"There is nothing new in Wall Street. There can't be, because speculation is as old as the hills. Whatever happened in the stockmarket today has happened before and will happen again."

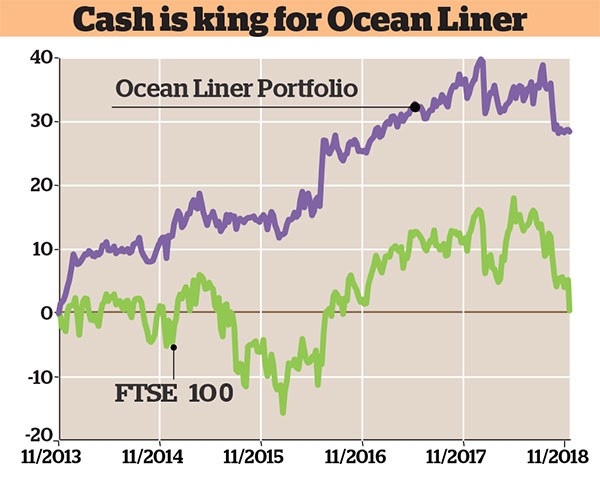

Our demonstration portfolios started going safe in September, when we doubled the amount of cash we were holding. We increased it further during October and November; the Ocean Liner portfolio now holds 66% cash. That has protected us from the worst of the recent falls, and saved us some sleepless nights.

Source: interactive investor past performance is not a guide to future performance

Douglas Chadwick is a founder director of Saltydog Investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.