Bargain hunters pile into Superdry

5th July 2018 12:47

by Graeme Evans from interactive investor

Bombed-out Superdry has attracted plenty of buying interest following full-year results which included a big special divided, reports Graeme Evans.

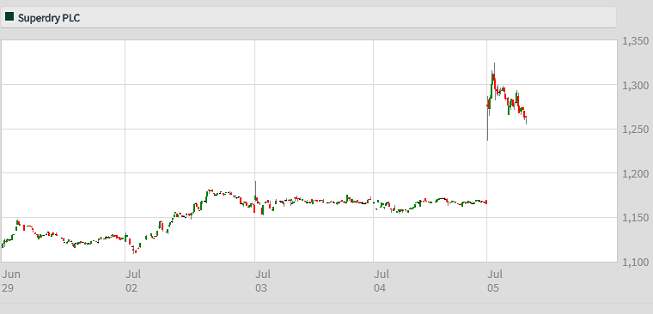

Write off Superdry at your peril was the message for investors today as shares in the lifestyle brand bounced back from recent turbulence in spectacular fashion.

Superdry's promise of a £20.5 million special dividend later this year triggered the 10% share price rise as management restored confidence in the company's prospects following May's weather-related Q4 profits warning.

The recovery serves a reminder to investors that the current trend to 'run for the hills' at the first sign of retail weakness may not always be the best strategy.

Superdry's January peak of 2000p is still a long way off, but at least one City firm believes that the company's global growth story merits a return to this level.

Source: interactive investor Past performance is not a guide to future performance

Peel Hunt's retail team of John Stevenson and Jonathan Pritchard also believe there’s no reason this year's 25p special dividend cannot be repeated.

They said:

"Superdry has cash balances of £80 million + and is increasingly cash generative going forward, suggesting the specials have potential to become more of a regular feature."

Superdry is currently trading at about a 10x price earnings (PE) multiple, but Peel Hunt think there's potential for a mid-teen rating given its global profile, double-digit EPS growth and strong cash generation.

Buoyed by a total dividend yield of 4.8% for 2018, Liberum is another supporter after increasing its target price today from 1350p to 1400p.

Underlying earnings per share rose 10.8% to 93.6p in today's 2018 results, while City expectations for double-digit earnings growth in the current year remain in place despite ongoing like-for-like sales weakness in its store estate.

Source: interactive investor Past performance is not a guide to future performance

The retail pressure has been offset by continued strong online and wholesale growth as Superdry pursues its strategy as a "Global Digital Brand." It is now guiding towards lower space growth of between 4-5% this year, compared with 8% previously, as it focuses on capital light sales channels.

Other City valuations drew comparisons with rival retail stocks, with Berenberg today noting that Superdry trades at a 33% discount to Ted Baker, despite having similar growth expectations, and at a 40% discount to H&M.

Whitman Howard analyst Tony Shiret said that Superdry was at the same sort of valuation level as Marks & Spencer Group and Kingfisher, even though investors in those companies have doubts about their respective strategies.

Shiret said: “Superdry has articulated its strategy which is a growth strategy rather than a restructuring based one.

"Investors are sceptical after recent mis-steps. But even if Superdry does move to a position where it decides to restructure its physical estate, this will be done against a backdrop of significant scalability of the rest of its model. A more premium valuation looks more logical."

He said retail remained important to Superdry in terms of projecting the brand in significant markets as part of an omni-channel offer.

Shiret adds:

"Leading mass global brands like Nike and Adidas need to present their offer in an aspirational physical setting to drive their premium attributes and we believe this is the same for Superdry."

The business, which dates back to 1985 when Julian Dunkerton co-founded Cult Clothing from a market stall in Cheltenham, now operates in 54 countries and has 5,000 staff. It has 246 owned stores with 412 franchised and licensed.

It has now achieved double-digit revenue and underlying profits growth for a third year in a row, driven by the strong performances in wholesale and e-commerce. This has helped net cash generated from operations to rise to £80.1 million from £62.3 million the year before.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.