The beginning of a recovery or a dead cat bounce?

12th November 2018 12:28

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After a timely shift into cash, Saltydog analyst Douglas Chadwick discusses his strong urge to get back into the markets and whether now is the right time.

Over the last couple of weeks, we've seen an improvement in the performance of stock markets around the world.

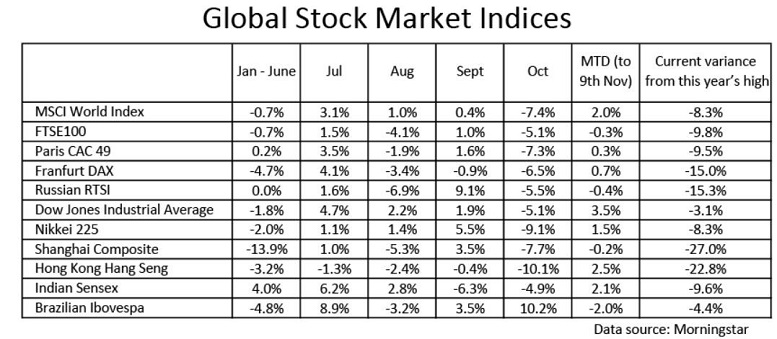

So far in November the MSCI world index has gained over 2%, starting to reverse the 7.4% loss that we saw in October. The US Dow Jones Industrial Average has done particularly well, up 3.5%, and the Hong Kong Hang Seng and Indian Sensex are both up over 2%.

Is this a temporary recovery before the recent downward trend continues (a dead cat bounce), or a more significant shift in a positive direction?

Here's a table showing the performance of a number of key stockmarket indices since the beginning of the year.

In the first six months of the year, most of the indices went down. The most noticeable exception was the Indian Sensex which went up by 4%.

During July, August and September the MSCI World index went up, but some countries did much better than others. The Dow Jones and Brazilian Ibovespa went up by 9% and the Nikkei 225 went up by 8.1%. In contrast the FTSE 100 went down by 1.7% and the Hang Seng lost 4%.

Then in October we saw significant losses all around the world with only the Brazilian Ibovespa bucking the trend.

Even though we have had a slight pickup in November, most of the indices are down since the beginning of the year and they are all below highs recorded earlier this year. Overall, the Dow Jones seems to have suffered the least and is only 3.1% below the high that it recorded in October. At the opposite end of the spectrum is the Shanghai Composite, which is 27% lower than it was on the 24th January.

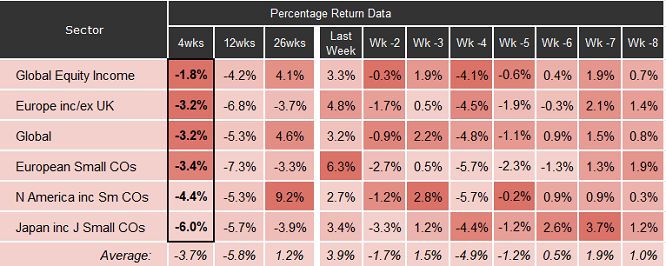

In last week's Saltydog sector reports, the same pattern could also be seen. In our 'Full Steam Ahead – Developed' Group all of the sectors made good progress last week, going up between 2.7% and 6.3%, but they are all still showing cumulative losses over four and 12 weeks.

Data Source: Morningstar. Past performance is not a guide to future performance.

We increased the cash holding in our portfolios during September and it's still over 70%.

Although we have a strong urge to get back into the markets, the recent performance data isn't strong enough to convince us that the time is right and nothing can match the feel-good factor of having your portfolio heavy in cash, when the times are slippery with Mr Trump, Mr Xi and Mr Putin purporting to be friends, and Mrs May struggling to get agreement on a Brexit deal.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.