Best and worst FTSE 100 shares in the second quarter of 2020

Investors did their best to peer through the lockdown and the pandemic and assess what sort of economic …

2nd July 2020 16:35

by Tom Bailey from interactive investor

Investors did their best to peer through the lockdown and the pandemic and assess what sort of economic recovery would follow.

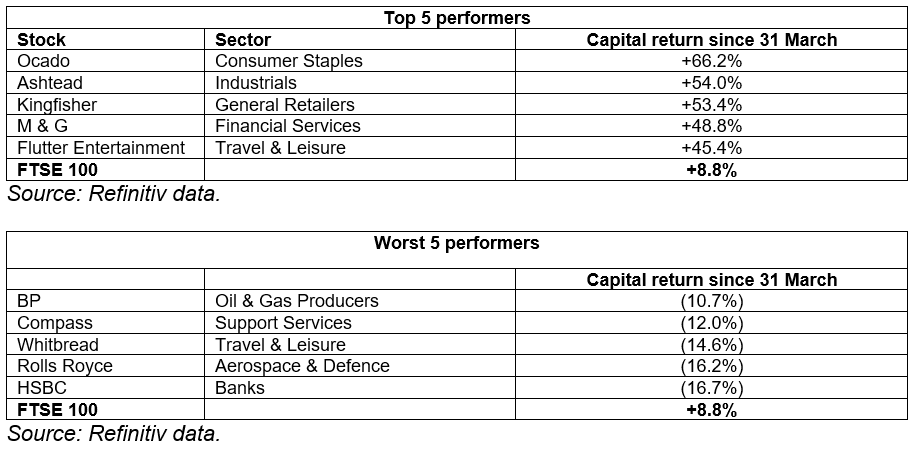

The second quarter of the year was much more positive than the first for the FTSE 100, with the index returning 8.8% measured over the three-month period. While the blue-chip index failed to regain all the ground lost since the outbreak of the Covid-19 pandemic, as Russ Mould, investment director of AJ Bell notes: “At least it represented a welcome shift in momentum.”

Mould continues: “Investors did their best to peer through the lockdown and the pandemic and assess what sort of economic recovery would follow – V-, W-, U-, L-, tick-, bathtub-shaped or something else.”

The winner over the period was Ocado, which returned investors 66.2%. The online grocer and logistics software company has long been a favourite of the FTSE 100 index, regularly topping best performance list. However, as Mould notes, the company did particularly well recently “thanks to its ability to deliver life’s essentials online at a time when the UK population was in lockdown.”

Second on in the table was equipment rental giant Ashtead, with returns of 54%. According to Mould this was driven by what had been growing optimism about the US economy, from which the company derives 90% of its profit. He notes: “Hopes for a speedy rebound in economic activity Stateside, thanks to more than $6 billion of fiscal and monetary stimulus from Congress and the Federal Reserve gave the shares a huge lift.” However, with states such as Arizona, Texas and Florida seeing significant in cases and the re-imposition of lockdown measures, the company’s fortunes may soon reverse.

Retailer Kingfisher saw its share price increase by 53.4%. Mould notes: “It will have welcomed initial queues outside its B&Q stores in the UK and Castorama and Brico Depot shops in France.”

Flutter Entertainment, the holding company created from the merger of Paddy Power and Betfair, also saw strong gains, returning 45.4%. Largely this was thanks to the return of activities for punters to bet on, notably professional football in the UK, Germany, Spain and Italy.

Losers

The worst performer was HSBC, losing investors over 16%. Partly the issues HSBC have faced have been common to all banks. Lower interest rates and flatter yield curves have further reduced bank margins on new loans. At the same time, the UK government insisted that the banks suspend paying dividends to be able to lend more and withstand losses. Mould, however, notes that the bank has also “found itself in a political pickle.” HSBC, he says, has “publicly supported China’s imposition of new security laws in Hong Kong to appease the authorities in its most profitable markets only to face a backlash from politicians and the public in the West.”

Rolls Royce also saw its share price decline by over 16%. The company is the supplier for both Boeing and Airbus. With aircraft fleet grounded and the prospects of the airline industry broadly weak, the company’s share price has struggled.

Oil company BP was also a notable loser, with its share price down 10.7%. While the company retained its dividend, in contrast to FTSE 100 competitor Royal Dutch Shell, investors still took a dim view of its prospects. As Mould notes: “Investors focused instead on how oil prices collapsed after the viral outbreak led to a plunge in demand and then the fairly tepid recovery, which failed to hold the $40-a-barrel mark.

“Investors also continue to ponder how BP can hold the $7 billion-a-year dividend while investing in its current assets, reinventing itself for zero-carbon future and servicing the interest bills on its growing debt mountain at a time when low oil prices are pressuring cash flow.”

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.