A bit of Hollywood about this week’s stock

Our meticulous companies analyst scrutinises a fun business that just keeps growing.

7th February 2020 15:52

by Richard Beddard from interactive investor

Our meticulous companies analyst scrutinises a fun business that just keeps growing.

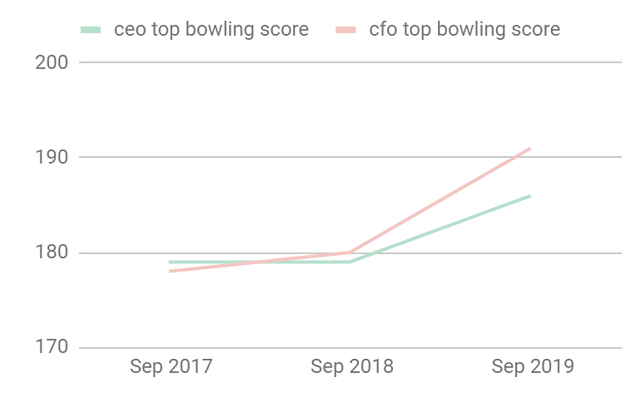

The nation’s biggest chain of ten-pin bowling centres, Hollywood Bowl (LSE:BOWL), is such a well-oiled machine even its bosses report incremental improvements in their games year after year:

Source: Hollywood Bowl annual reports

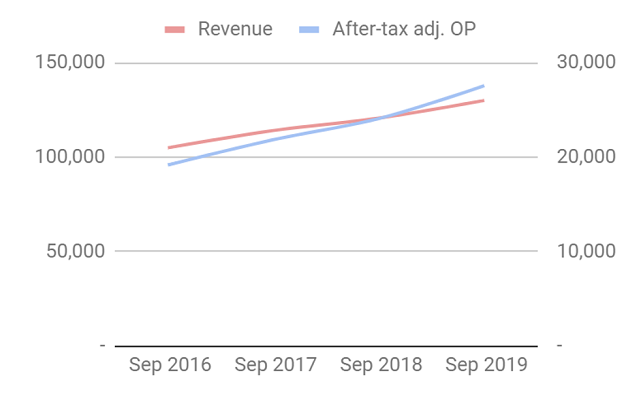

While it’s good to see they roll their sleeves up, from a shareholder’s perspective a similar shaped curve on a different chart tells an even more heartwarming story:

In the year to September 2019, Hollywood Bowl lifted revenue 8% and adjusted profit 14%, its fourth consecutive year of growth since the company floated. It was spun out of Mitchells and Butler, an operator of pubs and restaurants, in 2010 and was subsequently augmented by the acquisition of AMF and Bowlplex.

The company’s two-pronged strategy requires the refurbishment of its estate of 60 ten-pin bowling centres periodically as it evolves the format to attract more customers and get them spending more on ten-pin bowling, which brings in about half of revenue, and food, drink, and amusements, which brings in the other half. The other prong is new centres, it typically opens two a year.

Behind the strategy is a formula for co-locating the centres with other leisure attractions including a cinema and restaurants to generate high levels of footfall. Plus, a “sector leading” technology platform uses dynamic pricing to adjust the price of a game to demand and integrates scoring and marketing to lure customers back to beat their best scores, and a program for motivating and developing the managers and assistant managers that run the centres.

Reading the annual report gives the impression of a clockwork-like operating model, that is improving. The company introduces new menus and amusements, introduces new bowling technology, tweaks the Hollywood theme, and it is making more radical investments by trialling a new leisure format: Puttstars, which is indoor mini-golf (let’s just call it crazy golf).

Three of Hollywood Bowl’s four scheduled openings in 2020 are Puttstars. Leeds gets one, Rochdale gets one, and lucky York gets a Puttstars and a Hollywood Bowl. Lest you think the ten-pin bowling format is running out of steam, the company has two new Hollywood Bowls in the pipeline for 2021, 2022, and 2023. It’s not promising more Puttstars until it has evaluated the first three.

A Puttstars hole. Source: Puttstars

There are only two aspects of Hollywood Bowl that unsettle me. Though ten-pin bowling and mini-golf are relatively cheap outings for the families Hollywood Bowl targets, the company’s short history as a listed firm does not give me the reassurance I need that profitability will hold up in a recession. The directors are highly paid too.

This is how I score Hollywood Bowl:

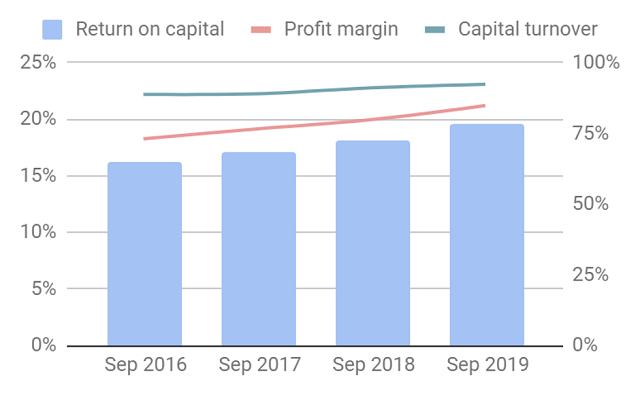

Does Hollywood Bowl make good money?

So far so good. In 2019, the company earned a slightly above-par 20% return on capital and achieved a 21% return on sales.

Source: Calculations by the author from data in annual reports

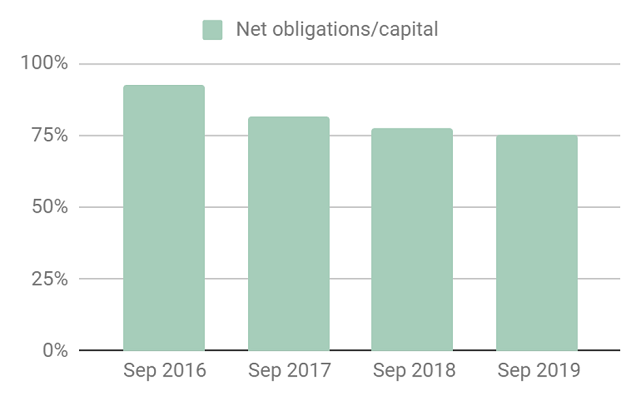

High profit margins should cushion the impact of recession, but I am slightly leery about Hollywood Bowl’s dependence on outside finance, which at the year-end was very roughly split between bank borrowings (25%) and lease obligations (75%) even though it can easily afford the interest and rent currently.

Source: Calculations by the author from data in annual reports

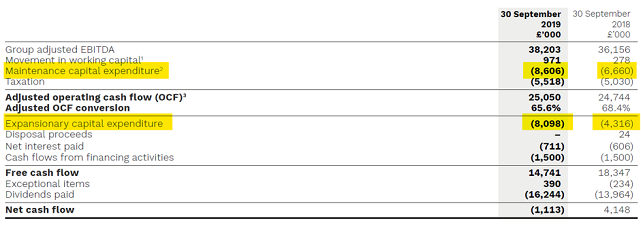

Cash conversion was poorer than usual in 2019, but the reconciliation below shows the biggest factors in Hollywood Bowl’s increased spending were investment to spruce up existing centres (a £2 million increase in maintenance capital expenditure) and to develop new ones (a nearly £4 million increase in expansionary capital expenditure).

Source: Hollywood Bowl annual report 2019

The company’s refurbishment and new centre programmes have driven recent growth, so these are probably good investments although the increase in expansionary capital expenditure has probably been spent on the unproven Puttstars concept. Hollywood Bowl’s average cash conversion over the last four years is a confidence building 93%.

Score: 1/2

What could prevent it from growing profitably?

The company is rolling out two new centres a year, but the country’s appetite for ten-pin bowling will be finite, which begs the question: what happens then?

Competition. The next biggest operator is Tenpin (Ten Entertainment Group (LSE:TEG)), which is also listed.

Score: 2/2

How will it overcome these challenges?

The Hollywood Bowl roll-out is set to continue for at least another four years, and if the Puttstars trial is a success, the company will be in the enviable position of having more choice when it comes to deciding which new projects to invest in.

Ten pin bowling centres do not co-locate with other ten pin bowling centres, so direct competition is limited. In competing for the best new locations, Hollywood Bowl’s reputation as the biggest operator and a reliable tenant is an advantage. The company identifies the loss of centre managers as the most likely and impactful risk it faces, hence its focus on retaining them (see below).

Score: 2/2

Will we all benefit?

The company impresses in its communication with shareholders and regularly pays special dividends.

It says its employees are the most important factor in delivering a good customer service and training, development and internal succession are priorities. In 2019, 55 management positions, 48% of the total, were filled internally. Centre managers are allowed to operate their centres “as their own businesses” and can earn large bonuses if they do well.

Many entry-level employees are paid the national living or national minimum wage though. Reviews on Glassdoor, the recruitment site, highlight generous employee discounts (which have got more generous in 2019) and the opportunity to progress, but they also moan about pay. The company says all employees have the opportunity to earn service and profit related bonuses and claims “industry leading” team member retention rates. All employees can participate in the company’s save-as-you-earn sharesave scheme.

Chief executive Stephen Burns, the highest paid executive, received over £1 million in remuneration in 2019. His pay reflects the good performance of the business, which means he received most of his bonus and all of his performance related nil-paid options vesting in 2019, but even so I think the disparity between executive pay and other employees should be lower.

Score: 2/2

Are the shares cheap?

No. A share price of 299p values the enterprise at 20 times adjusted profit. 2019 was Hollywood Bowl’s most profitable yet though. If it had earned a return on capital of 18%, the average over the last four years, it would have earned slightly less and the enterprise multiple would have been slightly higher (22 times adjusted profit).

Score: -0.4/2

With a score of 6.6 out of 10, Hollywood Bowl is ranked 14th of the 30 shares I follow most closely. The shares are probably fairly valued.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.