Bitcoin: Case builds for safe-haven status

When trouble arrives, bitcoin thrives. Our award-winning crypto writer explains the link to gold.

4th February 2020 14:16

by Gary McFarlane from interactive investor

When trouble arrives, bitcoin thrives. Our award-winning crypto writer explains the link to gold.

Whenever there is trouble in the world – such as the killing of an Iranian general by the US and now the coronavirus epidemic – bitcoin is a beneficiary.

True or not, that statement would seem to reflect the thinking and behaviour of increasing numbers of market participants, as bitcoin makes its best start to the year since 2012 and seeks to build a reputation as a safe-haven asset, despite its price volatility.

However, other factors may also be behind the strong price showing for bitcoin. The impact of the approaching halving of block rewards is certainly influencing buyers. And so too is the strengthening interest from institutional investors, evidenced in the successful launch of bitcoin options trading on the Chicago Mercantile Exchange and, perhaps more importantly, the institutional funds that US crypto investment firm Grayscale has been attracting.

And when the Financial Times runs stories headlined ‘Big investors come back for another bite of bitcoin’, as it did today (4 February), it is probably reasonable to assume something is stirring again in the institutional world. Bitcoin’s returns are making them sit up again and take notice.

The FT story quotes Chris Zuehlke, global head at Cumberland, the crypto arm of Chicago-based trading giant DRW, saying it’s “only a matter of time before traditional banks get involved, perhaps as brokers between customers and liquidity providers like us”.

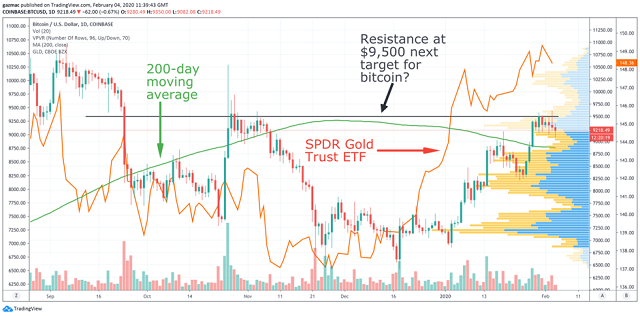

Bitcoin advanced 30% in January and, in the past week or so, had regained momentum to challenge resistance at $9,500, although the bullish enthusiasm was weakening on 4 February as equity markets stage a recovery after the shock to sentiment from the deepening coronavirus crisis.

The top cryptocurrency is priced at $9,218 at the time of writing.

Black Swans give bitcoin a lift

The price take-off that began when the prospect of a Middle East conflagration seemed a real possibility came to a halt on 10 January as those worries receded. The price briefly went as low as $7,755 before it reclaimed the $8,000s a few days later.

The bitcoin price reached $9,133 on 19 January, but had failed to hold in the $9,000s until the next Black Swan event hit the markets with the unwelcome progress of the coronavirus epidemic in China, which a growing body of top virologists now expect to become a pandemic.

Since 25 January, the bitcoin price has been climbing, from around $8,200 at that time to break above key resistance levels at $9,500 on Thursday 30 January.

As we suggested in our previous report, resistance at that level has proven robust. The price fell back to hover around the $9,300 level on Monday 3 February, although it briefly touched $9,620 when trading opened on the Chinese stock markets for the first time since the lunar new year holiday.

Whether or not your hold store with the digital gold theory, which has it that bitcoin is 21st century gold, the recent positive correlation seen in the prices of both is indisputable.

In the chart below, the correlation of the SPDR Gold Trust ETF price with bitcoin since October 2019 is striking.

Bitcoin options – good and bad

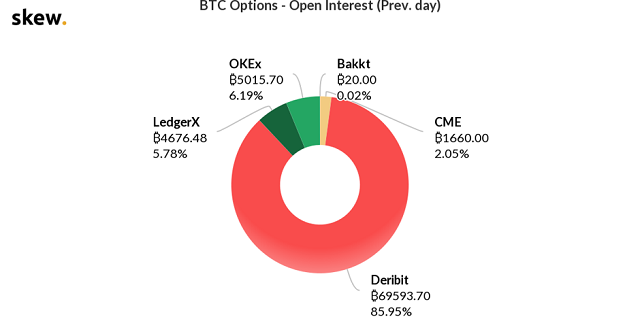

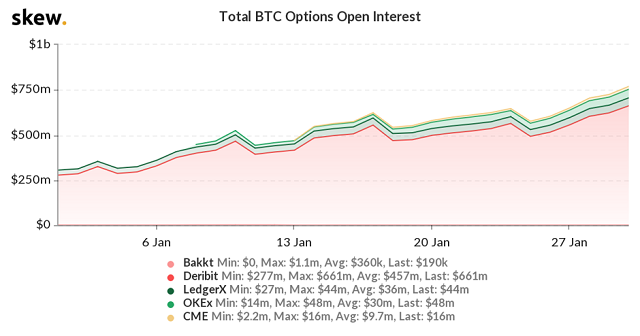

The Chicago Mercantile Exchange, the largest derivatives market in the world, launched its bitcoin options product on 13 January, and its success has been cited by some as indicative of the growing interest in gaining exposure to bitcoin among institutional investors.

Although the market has grown rapidly since launch, it is from a very small base, with average daily volume of $9.7 million.

But if this is to be seen as supporting the claim of burgeoning institutional interest, it stands in stark contrast to the performance of the Bakkt bitcoin options market, where activity has dried up over the past 12 days according to crypto analytics website SKEW (see charts below).

Bitcoin to $100,000 on ETF approval?

A Bitwise/ETF Trends survey of US financial advisers on their attitudes to cryptoassets provides some useful insights.

Only 16% said their preferred vehicle for holding crypto would be directly in a crypto wallet, while a large majority – 65% – are waiting for an exchange traded fund to be approved by the US Securities and Exchange Commission (SEC), with 9% preferring open-ended funds.

Advisers in the survey are bullish on bitcoin, with 64% expecting the price to rise over the next five years, and 37% expecting the price to be between $10,000 and $24,000.

The survey was based on 415 advisers, of whom 76% said they had received questions from their clients about cryptocurrencies in 2019.

Those advisers expecting to allocate to crypto on behalf of clients more than doubled from 6% to 13%.

Tony Sagami at Weiss Ratings says the survey strongly supports the view that ETF approval by the SEC would be a massive price driver, leading him to claim: “$100,000 per Bitcoin is not out of the question. In fact, that may be too conservative.”

The SEC has shown no indication that it will approve a bitcoin ETF anytime soon.

Grayscale scoops up institutional buyers

Perhaps a better guide as to whether institutional interest is on the up comes from the US-based Grayscale Investment’s annual Digital Asset Investment Report.

Inflows to the crypto investment firm in 2019 came in at $607.7 million, a sum greater than the cumulative investment for the prior six years ($565.8 million).

Not all of the 2019 total was in bitcoin via investment in its Grayscale Bitcoin Trust. 22% of investment went into other cryptoasset – mostly digital application platform Ethereum.

The report provided a breakdown of the type of investor, with institutional accounting for 71% of those investing in 2019. The remainder were 19% accredited investors, 7% retirement accounts and 3% family offices.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.