Coronavirus cures: This stock is the current front-runner

Our Stockwatch analyst names companies hunting a cure for coronavirus and finds one that’s in the lead.

4th February 2020 12:45

by Edmond Jackson from interactive investor

Our Stockwatch analyst names companies hunting a cure for coronavirus and finds one that’s in the lead.

Ex-city economist George Magnus, a China specialist now at Oxford University, talks of Chinese GDP being hit from about 7% to 5% this year, although it seems premature to quantify this.

The Chinese economy is said by another specialist to be 70% in lockdown and, although the effect of SARS (another coronavirus, which started in Guangdong province) was impossible to quantify, what’s different this time is that China is now vastly more integrated into the global economy.

As I mentioned in last Friday’s piece on Apple Inc, an issue to watch out for is logistics’ disruption, where manufacturers are sourcing so much from China. This looks the chief reason Apple shares have eased nearly 5% since their Thursday close of $324.

The right call

I should also take this opportunity to mention how International Business Machines (NYSE:IBM) has jumped around 7% to $146 in the last two trading days. This is after late-Thursday news that CEO of Red Hat (a cloud technology business acquired by IBM for £26 billion equivalent last July) is to become head up IBM from April – exactly as I speculated in a 24 January piece, my idea being that this would be logical, what with IBM prioritising “hybrid cloud” services.

The move will also bolster sentiment given the incumbent of eight years has become tarred with “over-promising but under-delivering” despite – to her credit – lately incorporating cloud into IBM strategy. Comparison is promptly being made with another tech legend, with analysts asking if “Arvind Krishna can do for IBM as Satya Nadella has done for Microsoft,” which is a stretch given Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) were prime instigators of cloud.

Yet IBM’s valuation is less risky than Microsoft’s, on an historic price/earnings (PE) of 14x versus 30x and offering a meaningful 4.5% yield, hence my favouring IBM despite tech-stocks being richly valued.

A big risk I see for markets currently is disruption from the coronavirus puncturing over-inflated values for tech stocks, letting some air out, much like what happened in April 2000.

Global race is on for vaccines and treatments

Given no specific medicine is currently available to tackle this coronavirus, the talk is of it taking several months before proposed vaccines/treatments can pass regulatory approval simply for early-stage testing on humans.

Yet there is a loophole in Chinese law able to both accelerate progress and speculation in stocks which could benefit. Chinese regulation allows conditional approval for drugs where clinical data shows progress treating life-threatening diseases and there are no existing therapies.

- These are the US stocks hit hardest by coronavirus

- Time to embrace or avoid this ‘must-have’ stock?

- Want to buy and sell international shares? It’s easy to do. Here’s how

So, among the big companies, Johnson & Johnson (NYSE:JNJ) and GlaxoSmithKline (LSE:GSK) have both declared they are racing to find cures and procure them as swiftly as possible. Yet there must be literally hundreds of labs on the case now, in a global race for breakthrough. Britain’s Secretary of State for Health has declared proudly that he’s giving £20 million to Public Health England to find a cure. You quite wonder what has happened to global co-operation than localised chest-beating, but such is the way.

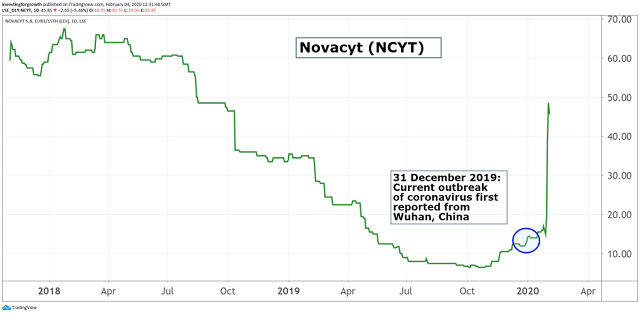

AIM-listed Novacyt has just leapt 223%

France-based clinical diagnostics company Novacyt (LSE:NCYT), listed on AIM and the Euronext Growth market (ALNOV), has seen its stock jump from 15p on 29 January to 48.5p on hopes for a novel coronavirus test.

It was flagged some way down a 28 January “full year trading and operational update,” though appeared not to gain attention; so, quite whether a dedicated “launch” RNS last Friday 31st was opportunistic PR is unclear.

Source: TradingView Past performance is not a guide to future performance

Novacyt’s unique selling point is professed ability to differentiate the 2019 strain of coronavirus, where other tests “may react to other related species giving rise to a false diagnosis.”

Its “Primerdesign” test is also stable at ambient temperatures, thereby eliminating the need for cold-chain transport in tropical climates. A result can be generated in less than two hours, meaning all samples can be screened quickly, hence mitigating spread of the virus. Mind this has all happened in just three weeks of the coronavirus being declared, and there is no mention of marketing, and doubtless other labs will pitch their own claims.

Yet the opportunity for this and other companies is very real given a chief risk is coronavirus symptoms not appearing for up to 14 days, during which time an infected person can pass it on. A worse-case scenario, therefore, is February unfolding with exponentially more cases if those few diagnosed/quarantined outside of China prove to be just the tip of an iceberg of infection now being spread through the travel system.

Novacyt’s capitalisation is just shy of £20 million, but liquidity is not simply a function of size. Yesterday, 7 million shares were traded on an indicative 3-4p spread of stock, the trade details showed it possible to get well inside (at least for buyers). Secondly, if Novacyt can hit the spot with its marketing, then it stands a better chance of boosting intrinsic value than the multi-billion-dollar US drugs companies you are otherwise currently considering.

- Four AIM strugglers with recovery potential

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

My concern is the firm’s otherwise weak financial record, making this stock very high risk – a potential “pump and dump” which already discounts plenty for its coronavirus test. The financial table below conveys a perennial loss-maker that has also increased its debt lately, and, although consensus forecasts show an expected move to €2.2 million net profit (£1.9 million) for 2019 on revenue of €21 million, then €3 million of profit on €28 million revenue this year, that is not supported by recent updates.

First-half 2019 results showed only marginal profitability at the EBITDA level - €0.2 million versus a €0.1 million loss in the first half of 2018 - while the interim operating loss was only reduced by €0.1 million to €0.7 million.

The full-year trading and operational update on 28 January cited continuing operations revenue for 2019 of €13.1 million (38% down on forecast) which is slightly down year-on-year, depending how the disposal of a lab business is viewed. Working capital constraints hindered Novacyt from the second quarter, and long manufacturing lead times made it hard to achieve meaningful recovery in the last few weeks of 2019.

More positively, the 2020 order book is cited as being “significantly higher” like-for-like, benefiting also from a €1.3 million rollover of orders to the first half of this year (it was not possible to fulfil recently due to working capital and supply chain issues).

Frankly, I don’t see enough substance to warrant a “buy” stance at current prices, especially when so much (in the valuation) rests on this coronavirus test – yet to be marketed, and where a more positive scenario sees the virus contained. Novacyt fell over 20% to 38.5p in early trading today, then recovered to about 47p. I’d avoid action for now but it’s one to watch.

| Novacyt S.A. - financial summary | ||||||

|---|---|---|---|---|---|---|

| year ended 31 Dec | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| Turnover (€ million) | 1.2 | 4.5 | 8.9 | 11.1 | 12.7 | 13.7 |

| Operating profit (€m) | -1.0 | -3.7 | -13.2 | -4.5 | -2.1 | -1.4 |

| Net profit (€m) | -1.0 | -3.9 | -13.9 | -5.7 | -5.4 | -4.7 |

| Reported earnings/share (€) | -0.3 | -0.9 | -2.1 | -0.5 | -0.2 | -0.1 |

| Normalised earnings/share (€) | -0.3 | -0.9 | -1.1 | -0.5 | -0.1 | -0.1 |

| Operating cashflow/share (€) | -0.3 | -0.5 | -0.8 | -0.2 | -0.2 | 0.0 |

| Capex/share (€) | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.0 |

| Free cashflow/share (€) | -0.5 | -0.6 | -0.9 | -0.3 | -0.3 | 0.0 |

| Balance sheet cash (€m) | 1.0 | 2.3 | 1.7 | 2.9 | 4.4 | 1.1 |

| Working capital (€m) | 1.1 | -0.7 | 1.3 | -1.5 | 3.1 | -2.1 |

| Net fixed assets (€m) | 0.2 | 0.6 | 0.9 | 1.3 | 1.8 | 3.7 |

| Net debt (€m) | -0.8 | -1.3 | 1.7 | 4.3 | -0.5 | 4.2 |

| Net assets (€m) | 2.3 | 20.3 | 10.5 | 17.8 | 24.9 | 20.1 |

| Net asset value/share (€) | 0.8 | 3.2 | 1.5 | 1.0 | 0.7 | 0.5 |

| Source: historic Company REFS and published accounts |

This giant has possibly the most promising therapy

Gilead Sciences (NASDAQ:GILD), capitalised at $84 billion (£65 billion), looks best positioned of all globally, at least for now. Its stock has risen from around $63 to $66 since last Friday after news emerged locally in China that “Remdesivir”, the company’s new antiviral drug targeting infections such as Ebola and SARS, will be tested in the Chinese city of Wuhan among 270 patients suffering pneumonia caused by coronavirus.

This development leapfrogs Remdesivir into pole position for combating 2019-nCoV. Moreover, a US medical journal has noted the first person diagnosed as infected in the US saw his pneumonia improve after being treated with Remdesivir. So, there is a speculative case for Gilead based on fast-track approval by the Chinese authorities.

Source: TradingView Past performance is not a guide to future performance

Obviously, we don’t know what China or any other labs in the Far East might be poised to declare, but the decision to hold human trials suggests Remdesivir is being prioritised.

China’s health regulator has also recommended that AbbVie Inc’s HIV medicine undergo human trials as an ad-hoc treatment; this being a circa $122 billion company with its stock priced at around $82. Its PE multiple is already a demanding 38x compared with 32x for Gilead, although AbbVie’s risk/reward profile involves a near 6% prospective dividend yield (quite an anomaly, if forecasts are realistic) versus 2.5% for Gilead, which seems more likely for a high PE stock.

The reason such US drug stocks aren’t leaping ahead is their sheer size already, plus uncertainty as to who could prove the ultimate beneficiary – Novavax (NASDAQ:NVAX), Inovio (NASDAQ:INO), Moderna (NASDAQ:MRNA) and Johnson & Johnson (NYSE:JNJ) are all, like Gilead, re-purposing existing drugs towards 2019-nCoV. Given the time-leads involved, however, Gilead does look to have a head start.

Event-driven speculation versus disciplined investing

Share price moves can be tantalising, but the proposition is buying into something that’s already moved on news and where the actual earnings proof (if it arises) may anyway fall short of hopes. These are “best to travel than arrive” stocks that are liable to frustrate.

Among scenarios playing out, aggressive international quarantine and treatment measures may contain viral spread, hence the favourable story supporting stocks would fade.

So I flag Gilead as a “buy” if a worse-case scenario does unfold, with the caveat being how upside is speculation given that it’s impossible even to ascribe odds to scenarios emerging for 2019-nCoV.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.