Bitcoin: Institutional interest and price forecasts

Our award-winning crypto writer cuts through the noise to report what’s really exciting crypto traders.

9th December 2019 14:09

by Gary McFarlane from interactive investor

Our award-winning crypto writer cuts through the noise to report what’s really exciting crypto traders.

Bitcoin has failed to reclaim $8,000 after recent falls, with successive attempts to straddle that key level repeatedly rebuffed.

Currently priced at $7,494, according to cryptocompare, bitcoin has run into headwinds at $7,800, but has managed to hold support in the $7,300-7,400 region. However, it traded as low as $7,068 on the Bitstamp exchange on 4 December. A breach of those lows going into the weekend didn’t happen. If it had, that would have likely signalled extreme bearish trouble ahead, but the bulls are not out the woods yet.

If the watchword is instead consolidation, there are also straws in the wind that might encourage bitcoin bulls, although a prediction by one model of a $100,000 price next year should probably be taken with a large dollop of salt.

Bitcoin CME Futures gap

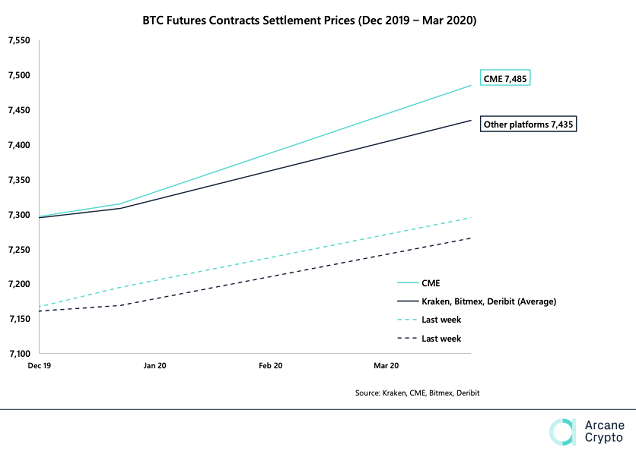

Market participants have been looking for clues as to where bitcoin is headed with reference to the bitcoin CME futures market.

The regulated futures market often trades at either a premium or discount to the spot price and the difference between the two has led to much talk of buyers (or sellers) using it as a cue to “fill the gap”.

M. Zack Norman, a trader and contributor at the Seeking Alpha website notes that historically the CME gap always eventually gets filled, and this is accentuated at weekends because of the juxtaposition of the mainstream trading days/hours of regulated bitcoin futures and the 24/7 nature of the bitcoin markets.

Although analysts talk frequently of Asian, European and US trading sessions, this is really a reflection of the legacy of the trading days/times of traditional asset classes and, as far as crypto is concerned, relates more to human sleeping times (when there is therefore less trading activity) than it does to whether or not a position can be opened or closed in the market.

With that in mind, Norman observes (as shown in the chart below) that:

“The recent market correction occurred near the weekends, as futures closed while Bitcoin corrected to a six-month low of $6,500. Taking a closer look at the inverse heads and shoulders patterns, there were three futures gaps that had been filled.”

The latest report from Arcane Research provides some more colour. It finds that the March 2020 bitcoin CME futures contract premium seen between 29 November and 2 December increased 30%, while at the same time the bitcoin spot price fell 6%. In other words, traders are expecting the price to rise in the first quarter of 2020.

Bakkt bitcoin futures volume and open interest soars on institutional interest

In a further bullish sign, open interest (sum of contracts that have not expired) in the Bakkt physically settled bitcoin futures market has rocketed, standing at 889 BTC the week before last for a 798% increase on the previous week. Volumes are up 220% on a fortnight ago.

A daily Bakkt BTC futures volume record was set on 27 November at 4,973 BTC.

It is also worth bearing in mind that Bakkt futures start trading on ICE Singapore today (9 December). That could be a bearish event given the original launch of Bakkt futures coincided with the sharp downturn in price in October. Alternatively, with institutional interest seemingly growing, it may increase long positions at what could be an enticing entry point.

With implied volatility predicted to rise from a mid-December 55% to 70% in June next year, traders are expecting big movements in the price – to either the upside or downside.

By way of comparison, gold prices have an implied volatility of 11.5% for June 2020.

The predicted surge in implied volatility is related to the halving in block rewards that takes place in May.

Bulls are also banking on the return of the Santa rally phenomenon which sees buying interest pick up around festive periods.

Bitcoin stock-to-flow model predicts $100,000 price

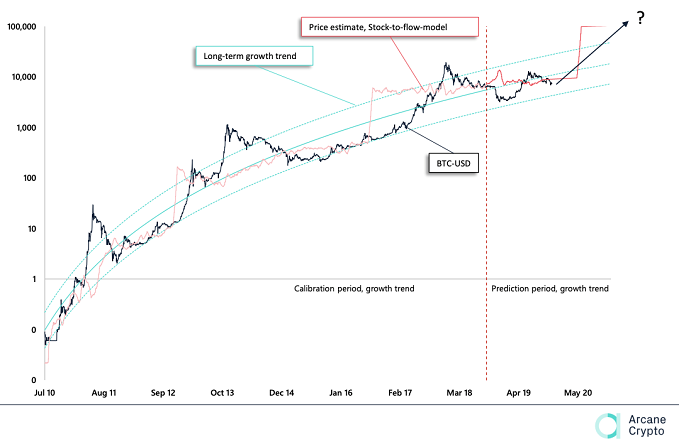

An increasingly popular way of getting to grips with bitcoin valuation is stock-to-flow modelling.

This is a method for assessing scarcity by comparing existing stockpiles of an asset to yearly production. Assuming this to be a valid modelling approach for bitcoin, it indicates prices will move markedly higher from here, with an inflection moment imminent.

The stock-to-flow model predicts a price of $100,000, which is in sharp contrast to the long-term trend band, identified in the chart above, that targets a much lower $13,000 around the halving time in May.

Cryptocompare’s Turner sees “2 to 3 times” price hike over next few years

In a podcast for interactive investor on 22 November, Karl Turner, head of business development at data site cryptocompare, was somewhat more cautious when it came to bitcoin price predictions. He said: “increasing interest and decreasing supply should equal price going up” but was only willing to suggest a 2-3 times appreciation on “where it is now” over the next two to three years.

For more on fake trading volumes, crypto regulation in the light of US Congressman Brad Sherman’s view that “bitcoin is worse than 9/11”, stablecoins and cryptocompare’s future data coverage plans in areas such as derivatives, which Turner says is “top of the list” for new features, plus comment on bitcoin lending, you can listen to the podcast here.

German banks to hold bitcoin

News from Germany has bullish implications for bitcoin going into next year.

A bill passed by the Bundestag as part of the implementation for the Fourth EU Money Laundering Directive, means that German banks will be able to directly hold cryptocurrencies such as bitcoin on behalf of their clients for the first time, according to a report by financial news outlet Handelsblatt.

A previous version of the bill had said that banks would need to use a third-party custodian to store crypto. German banks are not banned from holding bitcoin but, as with their UK counterparts, are loathe to do so because of the lack of regulatory clarity.

Handelsblatt quoted Sven Hildebrandt, head of the consulting firm DLC, as saying the bill was a bold move by German legislators:

“Germany is well on its way to becoming a crypto-heaven. The German legislator is playing a pioneering role in the regulation of crypto-truths.”

The bill has yet to be passed into law and, after it is, it doesn’t necessarily mean banks will rush to make use of its provisions regarding cryptoassets, but it should certainly make life easier for crypto companies previously shut out of the banking system.

China crypto crackdown overblown?

The supposed renewed crackdown by China on cryptocurrencies is cited as one of the factors that briefly pushed bitcoin down to a low for this year of $6,500.

However, the clampdown is not as all-encompassing as Western media has implied.

interactive investor spoke to Randolf Zhao, vice president operations at Beijing-based crypto derivatives exchange BaseFX, on the real state of play in China.

“It is pretty much an open secret that the Chinese government only banned cryptocurrencies and crypto trading regulation-wise, but gave implicit consent to local operations that are not involved in Ponzi schemes or other forms of illicit behaviour.”

Zhao added:

“Legitimate projects and exchanges voluntarily moved their registration offshore yet the majority of their teams remain in China, and as long as they don't play too wild, the local government sees no problem. I would say local governments are silently happy with the revenues and chances of employment we bring to the local economies.”

HSBC is planning to put $20 billion worth of securities bought in private markets onto a blockchain. Currently the records of such assets are costly to access for both bank and clients. According to a Reuters report, the global bank will use a Digital Vault platform to enable its customers to access records in real-time. The paper trails that still dominate such areas of finance will be standardised and digitised.

Ciaran Roddy , head of custody innovation at HSBC, said he expects more interest in private placements.

The initial plans only cover a fraction of the estimated $7.7 trillion if private placements that will be slushing around the world economy by 2022, according to the bank’s estimates, representing a 60% increase from five years previously. The cost savings are not expected to kick in immediately and until more assets are migrated to it.

“With some of the yields that are on offer, we are definitely seeing an increase in demand,” said Roddy.

Saxo Bank outrageous predictions for 2020 – Asian digital reserve currency

In its annual 10 outrageous predictions, Saxo Bank predicts the launch of an Asian digital reserve currency, backed by the Asian Infrastructure Investment Bank.

With stablecoins all the rage in crypto and beyond, and the issue of de-dollarisation moving up the agenda, the prediction, while perhaps not realistic, does hint at a future direction of travel.

Saxo Bank says the dollar “is outliving its usefulness for the region” and threats to “weaponise the dollar” are pushing Asian countries in this direction. The Asian Drawing Rights vehicle will be “driven by blockchain” and backed by “regional central bank reserves”.

“The redenomination of a sizable chunk of global trade away from the US dollar leaves the US ever shorter of the inflows needed to fund its twin deficits. The USD weakens 20% versus the ADR within months and 30% against gold, taking spot gold well beyond USD 2000 per ounce in 2020,” predicts Saxo.

Flurry of crypto exchange traded product launches

Switzerland has already established a reputation as a centre of crypto excellence and development, with the latest crypto financial product launches adding to that lustre.

The Swiss senior stock exchange - SIX - sees two new crypto ETPs joining its roster of cryptoasset products.

ETF provider WisdomTree, with $61 billion of assets under management, has launched a physically backed Bitcoin ETP, with a total expense ratio of 0.95%.

Alexis Marinof, head of Europe, WisdomTree, said of the launch:

“We have been monitoring cryptocurrencies for some time and are excited to bring investors secure access to this developing asset class. We have seen enough to believe that digital assets, like Bitcoin, are not a passing trend and can play a role in portfolios.”

Swiss-based Amun, which already has nine ETPs on the SIX exchange, has teamed up with digital asset bank Sygnum to launch an index-tracking ETP.

Cryptoassets tracked by the Amun Sygnum Platform Winners Index include, bitcoin, Ethereum, EOS, Binance Coin, Cardano and NEO.

Hany Rashwan, co-founder and chief executive, Amun, commented: “Our mandate is clear; to pioneer and deliver innovative and convenient digital asset indices via ETPs. This partnership with Sygnum further demonstrates our commitment to supporting the digital asset industry in these dynamic and exciting times. We are thrilled to be working with the first digital asset bank and our collaboration with Sygnum in delivering this unique risk managed vehicle in a regulated framework.”

Another stablecoin – Perth Mint Gold Token (PMGT)

Digitised gold tokens are all the rage, with CoinShares’ DGLD token one of the most recent launches.

Another quality contender in the space is Perth Mint Gold Token, which is described as the first gold crypto token backed by government guaranteed gold.

PMGT issuer InfiniGold has struck a deal with The Perth Mint, the world’s largest refiner of newly minted gold, whose product is guaranteed by the Government of West Australia.

“The digitisation of gold via a public ledger is a natural progression for the global commodity markets. It will promote gold as a mainstream asset, enhance its accessibility, and offer greater liquidity, transparency and auditability of the real assets backing this type of digital token,” said Richard Hayes, chief executive of The Perth Mint.

The PGMT token is based on the ERC20 Ethereum token standard which could present regulatory issues in the US where FinCEN – the Financial Crimes Enforcement Network – requires an asset to be able to show a “chain of custody”.

On that general issue, Danny Masters, chairman of CoinShares, told interactive investor in a recent podcast: “We have the best partners in the business… The dilemma that we solve for in DGLD is on the one hand most of our competitors will be on an open network like ERC20 [an Ethereum blockchain token standard – DGLD uses a private ‘sidechain’ to the bitcoin network], which require a money service business licence and come under the remit of FinCEN in the US [the US Treasury’s Financial Crimes Enforcement Network], so all transactions have to show a chain of custody and you can’t do that with ERC20, while for us distribution comes from blockchain.com.”

InfiniGold’s legal team said they “can’t comment at this time” on what attitude FinCEN might adopt for the oversight over the token.

PMGT runs on the GoldPass platform and will enable owners to sell back their PMGT to The Perth Mint if they so wish. Token owners can take delivery of their gold by simply selling the GoldPass certificate in exchange for “a range of the Mint’s products”.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.