Bodycote: Building a better business

A focus on Specialist Technologies may inoculate Bodycote against recession, writes Richard Beddard.

5th July 2019 15:35

by Richard Beddard from interactive investor

Bodycote is highly profitable most of the time, but a focus on Specialist Technologies and the Bodycote Margin Model may inoculate it against recession so it can be profitable all of the time.

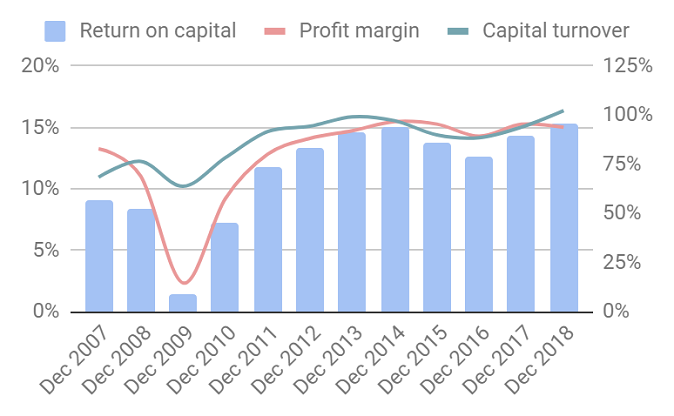

Judging by the year to December 2018, Bodycote (LSE:BOY) is in good health. The company lifted revenue and profit by 13% and 12% respectively, compared to the previous financial year. Before interest but after tax Bodycote earned a return on capital of 15% and similarly adjusted profit margins of 15% are impressive too. In cash terms the company is highly profitable, and at the year-end its debt level was modest.

As Bodycote opens and acquires metal treatment plants around the world, the challenge for long-term investors is to determine how stable these profits are, because Bodycote's past has been somewhat unstable and the company is trying to smooth the road ahead...

The size advantage

Founded almost a century ago by Arthur Bodycote, Bodycote has grown, in its own words, to be the clear market leader in heat treatment in Western Europe and North America. The treatments harden metal and makes it more resistant to corrosion. Almost all manufactured parts need to be treated, and many manufacturers outsource to Bodycote, which is reportedly five times bigger than its nearest competitor.

Size alone probably gives Bodycote an advantage, enabling it to supply multinational companies with consistent quality wherever they operate and allowing it to work on very large or inconvenient orders. Twenty-four per-cent of Bodycote's revenue is earned from "specialist technologies" using proprietary techniques that few companies, if any, can rival. This may explain Bodycote's high levels of profitability.

But the company does not have things all its own way. It serves two massive markets, described by two ungainly acronyms, ADE and AGI. ADE stands for Aerospace, Defence and Energy and AGI stands for Automotive and General Industrial. Both markets are growth markets, but even Bodycote's apparent dominance cannot protect it when large numbers of customers manufacture less.

That happened in 2015 when the oil price crashed and oil companies' thirst for new equipment was slaked, reducing demand from energy and industrial customers. It happened more impressively during the global recession triggered by the financial crisis in 2008.

The impact of downturns

Assessing the impact of downturns on a business depends on how we measure it. Bodycote's revenue in 2015 fell 7% and adjusted profit fell 9%. The adjusted figure ignores net cash costs of £11 million from the sale, closure and rationalisation of plants, and a £9 million write-off in the value of assets.

Including these charges, profit fell 34%, which is perhaps a better measure of the impact of a downturn because plant closures and write-offs are the inevitable result. In 2009, revenue fell 27% and adjusted profit fell 498%. In unadjusted terms, after deducting the cost of plant closures and write-offs, the company made a hefty loss.

When declines in revenue result in much larger declines in profit, a business is experiencing the effects of operational gearing. Profit is revenue less costs so for profit to decline at the same rate as revenue, the company would have to lower costs at the same rate too. Companies like Bodycote cannot do this because they have high fixed costs: principally rent, plant, and employees, which must be paid regardless of how hard the factories are working, or the factories must be closed - which as we have seen in Bodycote's results is expensive..

In pursuit of a profit "cushion"

Another way of measuring the impact of downturns is through profit margins, which compare profit to revenue. The more a company can match costs to revenue, the more profit and profit margins will hold up.

In 2016's annual report Bodycote said its performance when the oil price crashed was more resilient than in prior downturns because of three policies: The Bodycote Margin Model, improved flexibility in its cost base, and the increase in revenue from Specialist Technologies.

It did not provide much detail though. The BMM encourages managers to seek higher margin jobs, the company employs more people on temporary contracts, and Bodycote reports profit margins of 30% plus (before interest and tax) earned by its Specialist Technologies. In other words, by charging more, or making costs more variable, all three factors boost profit margins.

Higher profit margins make companies more stable. They act as a cushion because revenue can fall further in a downturn before profit turns to loss and the company is at risk of insolvency. And where high profit margins are derived from proprietary technology or simply the lack of alternative suppliers, it is more difficult for customers to switch to cheaper competitors, reducing the pressure on revenue in the first place.

This is how I score Bodycote, provisionally, because it is my first time, and there are a lot of moving parts:

Does Bodycote make good money?

Return on capital was sub-par from 2007 to 2010, but the company has made good returns since then.

Score: 1

Source: interactive investor Past performance is not a guide to future performance

What could prevent it from growing?

There will be years Bodycote doesn't grow much (2019 may be one of them) and a global economic recession could seriously but temporarily dent growth.

Score: 2

How will it overcome these challenges?

Thanks to its pursuit of scale, specialisation and high profit margins Bodycote should weather recessions more easily than in the past while weaker rivals flounder, leaving it in an even stronger competitive position.

Score: 2

Will we all benefit?

The company says it is continuously improving, and higher margins probably indicate customers approve. Chief executive Stephen Harris led the company out of the financial crisis, and into a period of stable growth. He is very highly paid though and staff reviews on recruitment site Glassdoor are mixed (but more positive than negative).

Score: 1

Are the shares cheap?

The share price is currently 842p, which values the enterprise at about 15 times adjusted profit (before interest but after tax). The shares are not obviously expensive.

Score: 0.7

Although Bodycote has staying power, its earning power has been volatile. Buying shares for the long-term at the current price requires a strong belief the company is significantly more stable than in the past.

A score of 6.7 suggests I am nearly there, but not quite.