Bovis Homes steps up pursuit of Galliford-owned rival Linden

Bovis Homes is back in talks with Galliford Try about buying Linden Homes. Will it be second time lucky?

10th September 2019 12:18

by Graeme Evans from interactive investor

Bovis Homes is back in talks with Galliford Try about buying Linden Homes. Will it be second time lucky?

Bovis Homes (LSE:BVS) investors thinking that Brexit had put paid to a new swoop for Linden Homes may have under-estimated the determination of CEO Greg Fitzgerald.

Fitzgerald knows Linden as well as anybody, having overseen its purchase in 2007 during 10 years in charge of the housebuilding and construction company Galliford Try (LSE:GFRD) up until 2015.

He joined Bovis in 2017 and has done an impressive job in boosting the performance and reputation of the housebuilder, which today reported a 20% rise in half-year profits to a record £72.4 million. The interim dividend was lifted 8% to 20.5p a share, with Bovis one of a pack of housebuilders currently yielding in the region of 10%.

With a three-year turnaround almost complete and trading robust in spite of Brexit uncertainty, Fitzgerald and the Bovis board have turned their attention back to Linden Homes.

They failed with an approach in May, when Bovis proposed offering £950 million of shares and £100 million of debt in return for Galliford's Linden and Partnerships & Regeneration divisions.

Today's latest interest is built around an improved cash and shares proposal worth nearly £1.1 billion. Bovis said it would fund the £300 million cash element of any deal from an equity placing, additional debt and existing resources. Galliford shareholders will get 0.57406 Bovis shares for each share they own, with this portion of the proposal worth about £675 million.

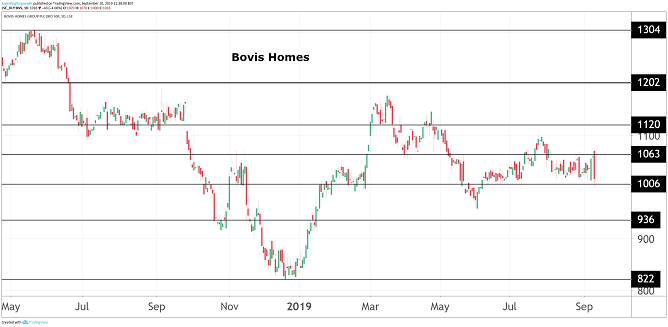

Source: TradingView Past performance is not a guide to future performance

While Bovis has stressed that talks with Galliford are still at a very early stage, Fitzgerald is clear about the strategic rationale driving the company's interest. This includes being able to compete more effectively in the UK housebuilding market and to accelerate Bovis Homes' move into the higher growth partnerships and regeneration markets.

It also provides Bovis with a complementary geographical footprint and stronger strategic land bank. Fitzgerald said: “Based on my familiarity with the businesses and the compelling strategic rationale, I think this is a massive opportunity.”

Any deal should accelerate Bovis towards its target for a return on capital employed of 25% by 2022, up from today's 19.8%. Bovis' newly-established Partnerships division, which is developing land alongside housing associations, is a key part of achieving the target as it brings a less cyclical and more resilient revenue and profit stream.

Aynsley Lammin, an analyst at Canaccord Genuity, said he continued to see the strategic logic of the proposed combination with the Galliford Try operations.

He added:

"It would immediately increase the scale of its housing business (Bovis & Linden Homes would deliver c.7,000 to 8,000 units) and is expected to deliver some synergies (as yet not quantified). It would also accelerate the group's entry into the attractive and fast-growing Partnerships and Regeneration business."

Canaccord left its price target for Bovis shares unchanged at 1,140p, based on a current valuation multiple of 1.3 times compared with a sector average of 1.5 times. The share price has risen 22% this year, but was down 4% today at 1,017p to reflect the placing impact and shares element of any deal.

Source: TradingView Past performance is not a guide to future performance

It also emerged that should a deal go through, a proposed £60 million capital return expected this year - part of £180 million since 2017 - would, subject to shareholder approval, be returned by way of a bonus issue at 1,059p.

The half-year results showed good progress in Bovis's turnaround plan, with completions up 4% to 1,647 and the operating margin up by 140 basis points to 16%. Despite wider market uncertainty around Brexit, Bovis said market fundamentals remain supportive with high employment levels, interest rates at historic lows, and good competition in mortgage lending.

About 96% of total sales for 2019 have now been secured, along with a further 10% of the private sales target for 2020. Bovis said: "While we are having to work hard in the current market, we are confident of delivering completions in-line with our expectations for the year and deliver another strong performance."

For Galliford Try, the cash element of the Bovis proposal should result in a better-capitalised standalone construction-focused group. It has benefited from a recent operational restructuring, having previously endured an arduous period of construction overruns and the saga of the Aberdeen road bypass scheme.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.