BP shares struggle, but dividend still a priority

With the shares unexciting for a while now, our head of markets analyses latest quarterly results.

29th October 2019 09:46

by Richard Hunter from interactive investor

With the shares unexciting for a while now, our head of markets analyses latest quarterly results.

This was not BP's (LSE:BP.) finest quarter, but overall the oil major remains on track.

An average oil price of $62 a barrel for the third quarter compared with $75 the previous year, driven by weak demand and the political situations in the likes of Iran and Venezuela. While this puts an immediate strain on profit, the level is comfortably above the $55 per barrel number which BP uses as a yardstick to break even.

In addition, ongoing maintenance and Hurricane Barry affected Upstream operations in particular, where earnings were sharply lower. The historic Gulf of Mexico spill continues to cast a shadow, although a provision of $400 million for the quarter at least shows further light at the end of the tunnel.

Meanwhile, net debt, which has risen 21% to stand at $46.5 billion – although flat quarter on quarter – remains an uncomfortable metric which BP is looking to reduce to the middle of its forecast range, largely through asset disposals which are ongoing.

Although there is an overall reported loss, there was an underlying replacement cost profit which, while at $2.3 billion was lower compared to the previous year at $3.8 billion, nonetheless exceeds analysts' expectations of $1.7 billion.

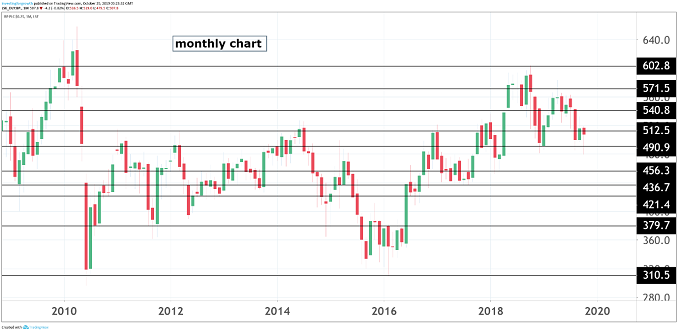

Source: TradingView Past performance is not a guide to future performance

Despite this lengthy checklist of issues to be addressed, there remains much to be said for the company both operationally and in investment terms. Operating cash flow remains prodigious, enabling the continuation of a share buyback programme and a dividend yield of 6.5%, underpinned by the company's historic pledge to keep this dividend as a major financial priority.

Although Downstream profit was down 10% year on year, the figure spiked 57% quarter on quarter and BP has given a sturdy outlook overall for prospects in the final quarter of the year.

The asset disposal programme, which is core to the reduction of net debt, is progressing apace, while the integration of BHP (LSE:BHP), which has already yielded synergies, looks primed to both deliver further cost savings and contribute to BP's overall strength.

The factors which have dragged on performance for the quarter have more broadly been in evidence for somewhat longer with regard to the share price. A 7% dip over the last six months and a 3% decline over the last year, the latter of which compares to a 4.3% hike for the wider FTSE 100 index, are ample evidence of the challenges confronting the company.

Even so, while the situation is complicated to manage, BP is making progress and remains a typical core portfolio constituent. The market consensus of the shares as a 'strong buy' underpins the fact that the BP strategy is viewed as a marathon and not a sprint.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.