BP shares yield 10.6% after dividend retained

Despite a plunge in profits, the oil major has cheered income seekers, reports our head of markets.

28th April 2020 11:11

by Richard Hunter from interactive investor

Despite a plunge in profits, the oil major has cheered income seekers, reports our head of markets.

BP (LSE:BP.) has defied the dividend doubters and raised a cheer from income-seeking investors. Unfortunately, however, the calamitous drop in the oil price has very much left its mark on these numbers for the first quarter of 2020.

Demand and supply for oil are strikingly out of kilter. On the one hand, aircraft standing idle, vastly reduced travel generally and manufacturing shutdowns have all contributed to serious demand destruction.

Moves by the oil exporting countries has thus far failed to resolve the issue of oversupply, to the extent that even storage of physical oil is becoming more difficult as storage space is increasingly taken. For a behemoth such as BP, this has meant that its vast operation has needed to be streamlined, and at speed.

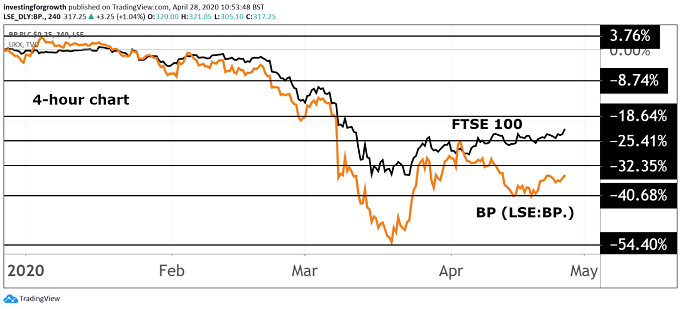

Source: TradingView Past performance is not a guide to future performance

Even before the medium-term measures it has in mind, the impact is already visible. Underlying replacement cost profit has fallen to $800 million which, despite being above expectations, is down from a previous number of $2.4 billion.

Net debt has spiked by $6 billion to $51 billion, while gearing currently stands at 36%, significantly north of the company’s long-term target of between 20% - 30%.

Inventory holding losses have appeared as the oil price has plunged, contributing to a net loss for the quarter of $4.4 billion, in stark contrast to the previous £2.9 billion profit.

Furthermore, while the outlook BP is able to give is largely constrained by the ramifications of the outbreak, it nonetheless sees a weaker second quarter in terms of upstream production, with downstream demand also likely to remain under severe pressure.

As such, BP is bringing out the big guns. In particular, it is targeting the pillars of capital, costs, liquidity and the balance sheet.

By 2021, BP hopes to have completed $15 billion of divestments, shoring up the capital position, while also aiming to reduce cash costs by $2.5 billion.

Capital expenditure is also to be reduced by 25% this year (although interestingly $500 million of investment into low-carbon activities will go ahead), including the delay of some exploration activities.

In addition, the company has also engineered its liquidity position to the extent that it presently stands at $32 billion. In the meantime, operating cash flow for this period was $1.2 billion and divestments contributed a further $700 million to the coffers.

- Oil for beginners: why oil prices move up and down

- Investing in oil: prices, dividends, shale firms, and stock tips

- Chart of the week: is Shell’s share price rally on borrowed time?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

One particularly noticeable – and challenging - aim for 2021 is that BP is looking to reset its breakeven level allied to the oil price. In 2019, this stood at $56 per barrel. The company’s target is to reduce this to just $35 per barrel by 2021.

As such, BP will continue to cut its cloth and react to exogenous events as necessary. Its prodigious ability as a cash generator will play into this plan, and its decision to keep the dividend at 10.5 US cents (about 8.4p) – underpinning a current yield of 10.6% - is not just a sign of its confidence in prospects, but also a boon for income-seeking investors who had feared the worst, given the increasing dividend drought as other companies seek to shore up their near-term cash requirements.

The dividend is expected to be paid on 19 June to investors still owning the shares on 7 May. The exact figure for sterling dividends will be announced on 8 June.

Unfortunately, some of the increase in the current dividend yield is due to a falling share price. The 36% decline over the last three months is a painful result of both economic and oil-related concerns. Over the last year, BP shares have dropped 44%, as compared to a dip of 21% for the wider FTSE 100 index.

Even so, this is a company which has some history in dealing with major catastrophes, and the market consensus of the shares as a “buy” is a reflection that investors, even now, are prepared to come along for a tumultuous ride.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.