Brexit overshadows Barratt Developments' record profit

A star performer in 2019, politicians are to blame for a muted reaction to these great numbers.

4th September 2019 10:03

by Richard Hunter from interactive investor

A star performer in 2019, politicians are to blame for a muted reaction to these great numbers.

The housebuilders have been suffering from the perception that the housing market is in dire straits, but recent mortgage numbers, as well as these outstanding annual results from Barratt Developments (LSE:BDEV), suggest otherwise.

The tailwinds for the sector have long been in place, with historically low interest rates, ample mortgage availability and the general housing shortage all playing a part. Barratt, meanwhile, is determined not to repeat its previous errors leading up to and including the financial crisis and the company is now looking in rude health.

Indeed, solid financial foundations remain very much in evidence while the key metrics are building on that framework. Net cash, while slightly down on the previous year, is still at £766 million, enabling the payment of a generous dividend, raised by 6% year-on-year, resulting in a current yield of 4.4% and a projected yield of over 7%.

Meanwhile, the company retains the right to switch between share buybacks and increased dividend payments, dependent on market conditions.

Elsewhere within the numbers, there are strong signs of progress – pre-tax profit increased by 9% to a figure bang in line with previous guidance, basic earnings per share have risen 10%, operating margin is a healthy 19% and the return of capital figure of 30% is impressive indeed. At the same time, the outlook is favourable - after Barratt managed its highest number of completions since the financial crisis, total forward sales are also strong.

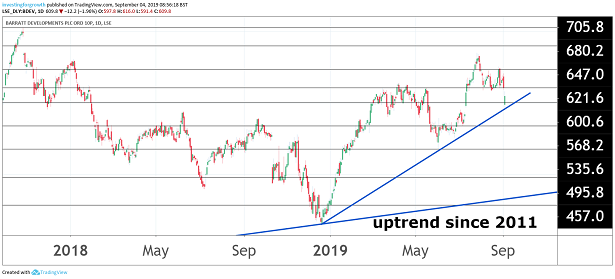

Source: TradingView Past performance is not a guide to future performance

Of course, there are elements outside of the company's control – most notably the ongoing Brexit bluster – which will likely result in some short-term UK economic pain, whatever the eventual outcome.

Similar to the UK economy itself, the shares of the company have been resilient and have made some progress, although it can only be a matter of conjecture as to how much stronger this could have been. Much further out, the cyclical nature of the sector would of course be hit by lower consumer confidence or higher interest rates, while the removal of the Help to Buy scheme is on the distant horizon.

- The Week Ahead: Barratt, Dunelm, Dixons, Halfords

- How our £10,000 equity income portfolio for 2019 is doing

Even so, Barratt remains a preferred play within the sector which, based on this evidence, is deserved. The shares have had a reasonable run of late, having risen 10% over the last three months and 14% over the last year, the latter of which compares to a decline of 2.5% for the wider FTSE 100 index over the period.

While the immediate reaction to the results owes as much to cautionary concern over the future rather than the actual numbers, the market consensus of the shares as a 'buy' is testament to the company’s positioning ahead of the rocky road ahead.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.