Brexit: Protecting your portfolio from a strong pound

Here are two ways investors can offset a possible negative impact of sterling strength on many funds.

4th March 2019 11:50

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Here are two ways investors can offset a possible negative impact of sterling strength on many funds.

It's all about the dollar

Or, to be more accurate, it's all about the pound and its relationship with the dollar and other major currencies.

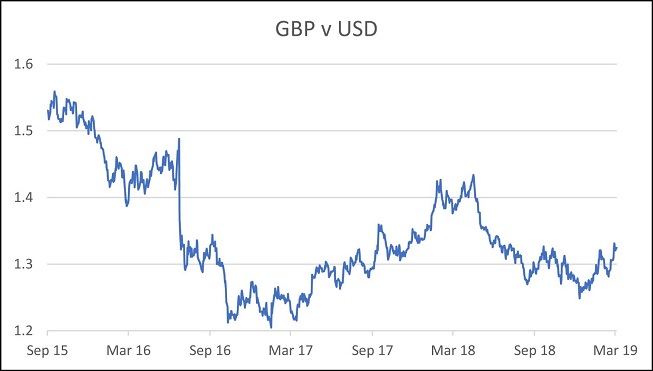

Before the EU referendum the pound was trading at around $1.45, having been as high as $1.70 in the middle of 2014. On the evening of the vote it briefly went above $1.50, when it looked like the remainers had it in the bag, but soon dropped once the outcome was clear. At one stage it almost fell to $1.20.

Source: interactive investor Past performance is not a guide to future performance

Since then it's been on a bit of a rollercoaster.

The perceived wisdom is that a 'soft' Brexit (or no Brexit) will make the pound strengthen, a 'hard' Brexit (or a 'no deal' Brexit) will see it fall. This has accounted for much of the ebb and flow over the last two and a half years.

Last week we saw sterling rise from $1.30 to $1.33 but then drop slightly at the end of the week. It's still roughly at the midpoint between the pre-referendum high and the post-referendum low.

It seems that the market is now ruling out a 'no deal', which accounts for the latest movement, but it still leaves the question of how much further it could go. If the pound were to go back to $1.45, then that's a gain of 9%. Funds holding assets valued in dollars would see a corresponding reduction in value.

The funds that would be hit the hardest are those with all of their assets and earnings abroad. However it would also affect funds investing in UK companies with significant overseas earnings. That's why the FTSE 100 tends to go down when sterling strengthens.

At Saltydog Investor we don't believe in telling our members what to do. We provide data and analysis to help them make informed decisions. Our demonstration portfolios show what we’re doing with our own money.

Over the coming weeks there's a threat that if the pound strengthens it will have a negative effect on many funds. We're guarding against this by holding relatively high levels of cash and having a mixture of UK and overseas investments. We're considering reducing our exposure to the markets even further later this week.

Another option would be to invest in one of the 'currency' ETFs, like the ETFS Short USD Long GBP (LSE:USGB), which would benefit directly if the pound did strengthen against the dollar. There are even leveraged versions, like the ETFS 3x Short USD Long GBP (LSE:PUS3), for the really adventurous.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.