Buy, Hold, Sell: Why I'm buying ITV, but selling M&S

Paul Mumford, of Cavendish Opportunities, talks about the stocks he has been buying and selling.

12th July 2019 09:43

by Tom Bailey from interactive investor

Paul Mumford, of Cavendish Opportunities, talks about the stocks he has been buying and selling.

Paul Mumford is manager of Cavendish Opportunities, a fund that launched in the late 1980s. Historically, he has tended to focus the fund on the smaller - and mid-cap end of the market. Recently, however, he has begun to pivot back to larger companies, spying potential value opportunities there. He says:

"Some larger companies look so crashed-out that you can easily envisage returns if investors take a view on market changes."

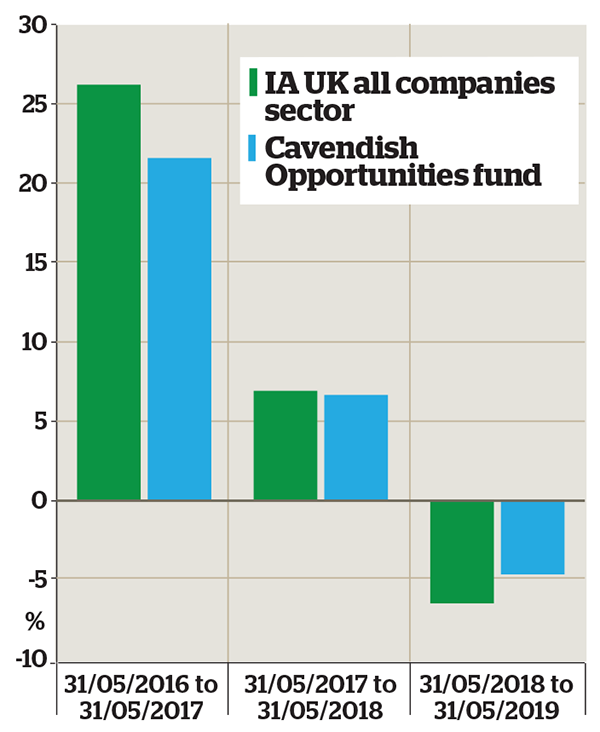

Mumford's fund has delivered 31.5% over five years, ahead of the smaller companies sector average of 29%. Mumford also runs an Aim-focused fund for Cavendish.

Buy: ITV

(ITV)

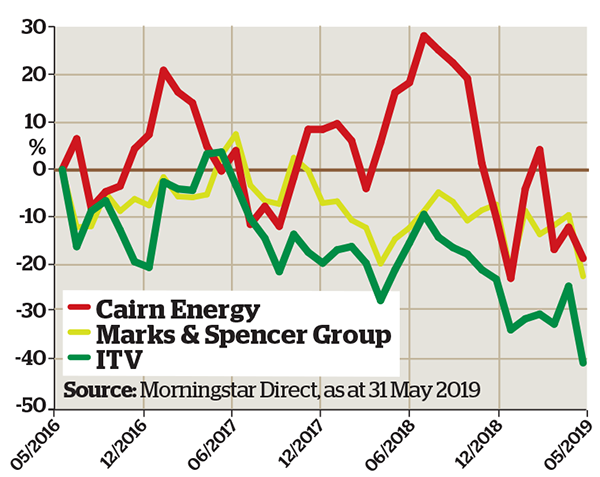

"This company is out of favour. Its trading outlook is not particularly bright," says Mumford. "ITV (LSE:ITV) bombed out in the first quarter of 2019, with advertising revenue down 7%." Second-quarter advertising is not looking too bright either, with the figures struggling to stack up against those from last year boosted by the World Cup.

So why is Mumford buying? He says he expects that after a rocky second quarter for ITV, its prospects will start to look up.

"This is a recovery stock with a lot of potential. It is in a unique market."

He adds: "These media companies don't need to rely purely on advertising revenue anymore. ITV has a good backlist of programmes it has created itself, and lots of other channels need content."

Mumford also likes ITV because he believes it is ripe for a buyout. "It could become a takeover target at some stage in future, due to the area it is in," he says. "At this level of share price, it would be a sitting duck."

However, he notes concerns that ITV might cut its dividend, as Vodafone (LSE:VOD) recently has. He says: "ITV has a reasonably high dividend yield. We are in a situation where larger companies are cutting their dividends in the aftermath of Vodafone announcing its cut. There is a feeling that [Vodafone's move is] an excuse for other companies to follow suit."

Ultimately, though, Mumford is hopeful about the long-term prospects for ITV, even if it is "a bit of a sleeper in the short term".

He actively bought the stock throughout May and is likely to end up with a weighting of 0.75% to the company.

Hold: Cairn Energy

(CNE)

This company, as its name suggests, is an energy business. Mumford says it has several promising projects in the pipeline, including active exploration programmes in Senegal, Norway and Mexico. "If it strikes lucky in any of these areas, it could be transformational," he says.

At the same time, the company has a strong balance sheet and cashflow. Moreover, despite the company's potential, its share price has not become overvalued: Mumford says its market cap is at an all-time low. "So why wouldn't I buy? I’m waiting for news."

Cairn Energy (LSE:CNE) is currently a hold, although Mumford expects it to turn into a buy soon, following the resolution of its dispute with the Indian authorities. He says:

"The company is involved in a court case in India, where the authorities have seized one of its interests. The case is going through independent arbitration at the moment."

Winning the case could see Cairn awarded compensation of as much as $1.4 billion (£1.1 billion). That would be a huge windfall. However, as the market widely expects Cairn to win the case, Mumford sees no reason to buy right now. He says: "Whatever the outcome, it is going to suit me. If it is bad for Cairn, I will buy its shares, which will be cheaper. If it is good for Cairn, prices may rise, but I could still add to my holding at a higher price."

In the meantime, he is sitting tight: "The share is a hold while we await developments in the court case. While that is being resolved, any money in the company is likely to be dead money – the share price will just move with the oil price."

A spot of bottom fishing

Sell: Marks & Spencer

(MKS)

Despite the excitement generated by Marks & Spencer's (LSE:MKS) recent deal with delivery service Ocado (LSE:OCDO), Mumford picks out the retailer's stock as one to sell. He says: "I don't actually own this stock, but if I did I would sell."

His reasoning is that it will be two or three years before M&S starts to see any serious money come in from its Ocado deal. "It's a very difficult [venture] to get going," he says. At the same time, he thinks M&S's clothing business remains weak. He points out that, despite the company's many attempts to reinvent that side of the business, it just hasn’t been able to do so.

He adds:

"In my view, for the next two or three years [any investment] is going to be dead money. Moreover, taking a view on whether the internet food offering takes off is quite a risk. It may work well. But why buy today?"

Source: FE Analytics, as at 31 May 2019

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.