Buying safety and yield on the cheap

A brilliant German company is investing heavily in the UK. Our overseas stock expert likes what he sees.

5th June 2019 10:00

by Rodney Hobson from interactive investor

A brilliant German company is investing heavily in the UK. Our overseas stock expert likes what he sees.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

As economic growth slows in Europe and fears grow over the possible impact of US President Donald Trump's trade wars, investors need to be particularly careful in choosing Continental stocks. Defensive plays look particularly attractive at this stage.

One such is Munich-based financial services company Allianz (XETRA:ALV), which has just pulled off two deals in the UK. It has agreed to buy most of Legal & General (LSE:LGEN) general insurance business covering building, household contents and pet insurance, for £242 million; and it is taking full control of its joint venture with Liverpool Victoria Friendly Society for £365 million.

Allianz will combine the two into one UK operation.

Both acquisitions should be completed by the end of this year, leaving Allianz as the second-largest player in UK general insurance. That's an interesting statement of intent coming from a German company while Brexit remains in abeyance.

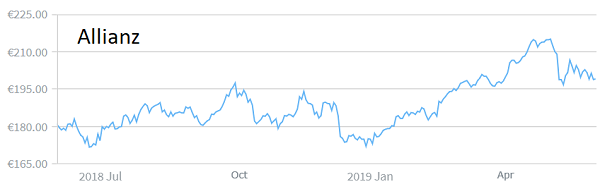

Source: interactive investor Past performance is not guide to future performance

However, reorganisations always come at a cost and the benefits that will undoubtedly follow in due course will not be in time to boost this year's figures.

The acquisitions are part of a continuing expansion programme at Allianz that has been going on for nearly 30 years, and which has made the group one of the global leaders in the insurance sector with nearly 150,000 employees around the world.

Its core businesses are insurance and asset management, with a portfolio that includes a wide range of insurance products across property, casualty, life and health for companies and individuals. It also offers some traditional banking services.

Life and health insurance represent over 54% of total turnover, non-life insurance 39% and asset management just over 5%.

Part of the expansion has come through judicious partnerships, such as one signed in 2014 with Ford (NYSE:F) for the provision of motor insurance. Another partner, for travel insurance, is French rail company SNCF. More recently, Allianz signed an agreement to insure drivers with taxi company Uber (NYSE:UBER). Allianz often collaborates at major sporting events.

Recent results have been highly encouraging, with a strong ending to 2018 spilling over into 2019.

Profit and revenue both grew in this year's first quarter despite higher costs on the asset management side. Operating profit rose 7.2% to just short of €3 billion on total revenue up 9.2% to €40.3 billion, while the return on capital improved from 13.2% to 13.7%.

Chief executive officer Oliver Bate said that, despite economic and political volatility, the results put Allianz on target to achieve its full-year target of operating profit of €11-12 billion. In 2018, the company reported €11.51 billion in operating profit and it will be surprising if that figure is not beaten this time.

Annualising the first quarter profit figure puts Allianz at the top of the projected range. Operating profit in what was a successful final quarter of 2018 was €2.8 billion. At that stage the dividend was raised 13% to €9 a share and the company announced a €1.5 billion share buyback programme.

Bate says Allianz is building its brand on the twin standards of quality and customer service.

Allianz shares reached a peak of €215 at the start of May but have come off the boil, opening up a buying opportunity. They slipped back to a tad below €200 though the downside looks strictly limited to €171, which has provided a floor twice in the past 12 months. However, I believe it is highly unlikely that they will slip as far as €195.

The price/earnings (PE) ratio is a very undemanding 11.3 times and the dividend yield is 4.5%, pretty good for a company of this quality.

Hobson's choice: The shares have started to recover from the recent dip, but I rate Allianz a 'buy' up to €210.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.