Call for pension rule to be changed to prevent unfair penalty for furloughed workers

There are fears that those over the age of 55 may be caught out by a pension rule when accessing their …

1st June 2020 12:54

by Kyle Caldwell from interactive investor

There are fears that those over the age of 55 may be caught out by a pension rule when accessing their retirement savings during the Covid-19 pandemic.

Wealth manager Quilter has penned a letter to chancellor Rishi Sunak that calls on the government to relax a pension rule that will have consequences for some furloughed workers that have dipped into their pensions during the coronavirus crisis.

Quilter is concerned those in this position will be negatively impacted by the money purchase annual allowance (MPAA). The MPAA, which is set at £4,000 per year, is the amount savers can pay into a pension each tax year (and benefit from tax relief) once they have started taking a pension.

- Coronavirus: how to manage your personal finances if money is tight

- Voluntary redundancy: should I stay or should I go?

- What does coronavirus mean for your retirement plans?

The MPAA is a heavily reduced limit on the amount that can be put into a pension while benefiting from tax relief. It is triggered when an individual takes their first taxable cash out of a ‘pot of money pension’ as opposed to a salary-related pension. The pension rule is designed to limit pension recycling, whereby pension withdrawals are paid back into a pension and tax relief is received for a second time.

But, there are some circumstances when the allowance is not triggered, such as if an individual only takes tax-free cash (25% of the pension pot) and leaves the rest untouched in a flexible drawdown account. Or, alternatively, takes the tax-free cash and buys a lifetime annuity.

- Pension Clinic: beware the £4,000 pension contribution trap

In addition, the MPPA is not triggered for small pension pots that are valued at less than £10,000.

Nonetheless, Quilter is concerned those aged over 55 may be caught out by the MPPA when accessing their pension to cover a loss of earnings during the Covid-19 pandemic.

In order to prevent them suffering a tax penalty when they return to work, Quilter is calling on the government to waive MPAA triggers for the 2020/2021 tax year so that people taking money from their pension during the crisis retain their normal annual allowance. It is also calling on the government to restore the MPAA to £10,000 (it was cut to £4,000 in April 2017) a year to ease annual allowance concerns for the majority of workers.

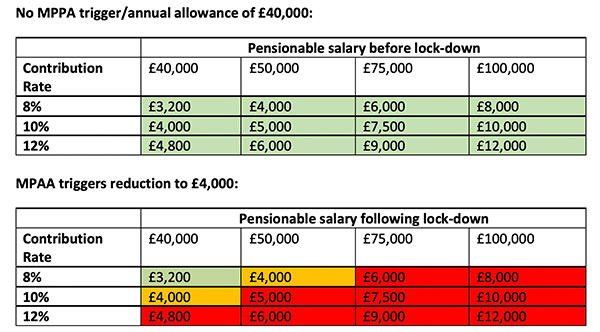

Quilter’s analysis of contribution rates shows that workers with earnings of around £40,000-£50,000 and above can expect to be impacted in the future if they make a pension withdrawal. Those in this position that breach the £4,000 annual allowance will pay tax on the excess, which is equivalent to the amount of tax relief you would have benefited from.

Jon Greer, head of retirement policy at Quilter, says: “With millions of people being furloughed or made redundant, a huge number of people could be unfairly penalised. Those that use their pension to top up their income now will see their annual allowance cut by 90% for the rest of their career once they return to work.

“The Covid-19 pandemic is damaging career prospects today, but we must limit the long-term impact on our prosperity. We are calling for the relaxation of the MPAA so that nobody is prevented from saving for a prosperous retirement due to this crisis.”

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.