Can De La Rue really be saved after latest crash?

It’s ironic that a banknote printer is running out of cash and its future is in serious doubt.

26th November 2019 13:43

by Graeme Evans from interactive investor

It’s ironic that a banknote printer is running out of cash and its future is in serious doubt.

The worst fears of De La Rue (LSE:DLAR) investors were realised today when the banknote printer not only scrapped its dividend but raised question marks about its survival.

That's an extraordinary set of circumstances for a company with a rich industrial heritage and decent dividend record, having paid 25p a share since 2015 and almost twice that in 2014.

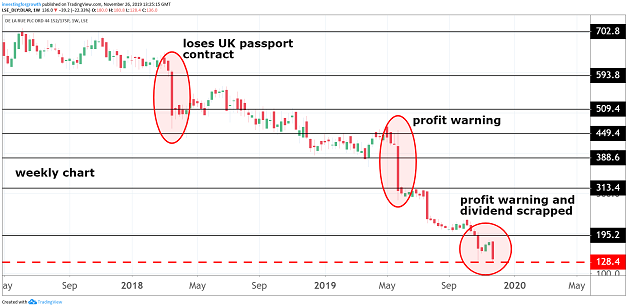

Shares plunged as much as 27% to 128.4p - valuing the company at less than £134 million - as today's interim results showed a loss per share of 1.5p following two profit warnings this year.

This, remember, is still the world's largest designer and commercial printer of banknotes and passports, while it also provides product identifiers and "track and trace" software.

Clive Vacher, the turnaround specialist who was appointed chief executive in October following a period of significant management upheaval at De La Rue, has it all to do as he works on a restructuring plan between now and the end of March.

It's true that De La Rue has recovered from disappointments in the past — most recently in 2014 — but this seems much bigger than anything that has gone before.

Source: TradingView Past performance is not a guide to future performance

At the end of September, the group's net debt had jumped from £107.5 million to £170.7 million with the debt to earnings ratio of 2.72 times also much bigger than previously forecast.

The group is confident it can stay within its three times banking covenant ratio, but admits that certain plausible downside trading risks would create a “significant doubt” over its ability to continue as a going concern.

That warning is likely to chill investors who might otherwise have been tempted to take a speculative bet on an established company whose shares changed hands at above 1,500p a decade ago and 700p as a recently two years ago.

Hopes of a trading-led revival are not helped by external pressures on De La Rue's biggest division of currency. As the move towards a cashless society gathers pace, weaker demand from governments and central banks has resulted in over-capacity across the industry.

Lower margins and a weaker pipeline of orders meant currency recorded a loss of £12.5 million in today's results. De La Rue hopes to offset this by more closely aligning bank note capacity with longer-term demand, with an existing group-wide three-year cost reduction programme already slated to deliver in excess of £20 million of cost savings by 2021/22.

However, it is clear that management will only be able to partially mitigate the growing competition in banknote printing and conclusion of De La Rue's UK passport contract in 2020.

As part of the restructuring, the currency business — which accounted for more than 60% of revenues in the half year — has just been merged with identity solutions to create a new division. The other business providing security features for product authentication and brand protection is more successful after growing revenues 70% to £33 million.

Vacher is hopeful that cost reduction efforts and improved currency volumes can deliver a better second half performance, with adjusted operating profits for the full year of between £20 million and £25 million. This compares with £60.1 million last time.

He added:

“With strong emphasis on cost control and cash management, coupled with a focus on innovation and reversing the revenue decline, we will become a leaner, more efficient company and drive shareholder value."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.