Chart that tells a story: the FTSE 100 offers investors ‘a once-in-a-decade opportunity’

Valuations on the index are at lows seen only at the nadir of cycles. That’s good news for investors.…

17th January 2019 11:46

by Tom Bailey from interactive investor

Valuations on the index are at lows seen only at the nadir of cycles. That’s good news for investors.

Investors are often at their happiest when prices are high. While their portfolio may be full of expensive and overvalued shares, those high prices translate into pleasing paper profits, for a while at least.

However, investors with anything other than a short term time horizon should take the opposite view.

Celebrating high prices, says legendary investor Warren Buffett, is akin to “a commuter who rejoices after the price of gas increases, simply because his tank contains a day’s supply.”

Similarly, financial author William Bernstein has noted: “A 25-year-old who is actively saving for retirement should get down on his knees and pray for a decades-long brutal bear market so that he can accumulate stocks cheaply.”

With this in mind, Tellworth Investment’s Seb Jory argues that the FTSE 100 currently offers investors ‘a once-in-a-decade opportunity.’

In a research paper published by Tellworth and BennBridge, Jory points out that that owing to the FTSE 100’s recent slide, valuations on the index are at a point only seen at the nadir of cycles.

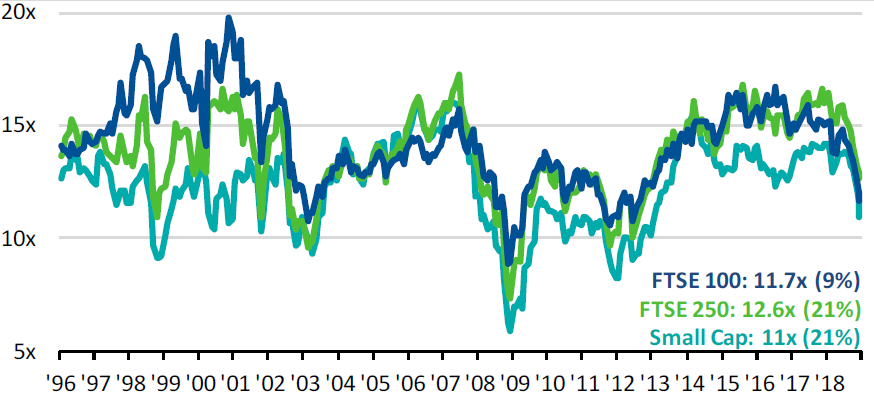

As the first chart below shows, the median price-to-earnings ratio on the FTSE 100 is in the cheapest 10% of readings since 1996. This, says Jory, makes the buying opportunity today a once in 10 year event.

Source: Datastream, Tellworth Investments. NB: Priced as of close 12/12/2018, inverse earnings yield aggregation method

He says: “Long-term investors and asset allocators should therefore be licking their lips. UK equities ostensibly present the sort of value opportunity that managers have been demanding for most of this cycle.”

The principal reason behind the FTSE 100’s depressed valuation, says Jory, is Brexit fear. He points out that as a result of Brexit, the UK market is on a 20% discount compared to global equities, the highest since the financial crisis.

However, despite the potential headwinds, Jory argues: “The market multiple [p/e] is so low that a significant positive future return is virtually guaranteed.”

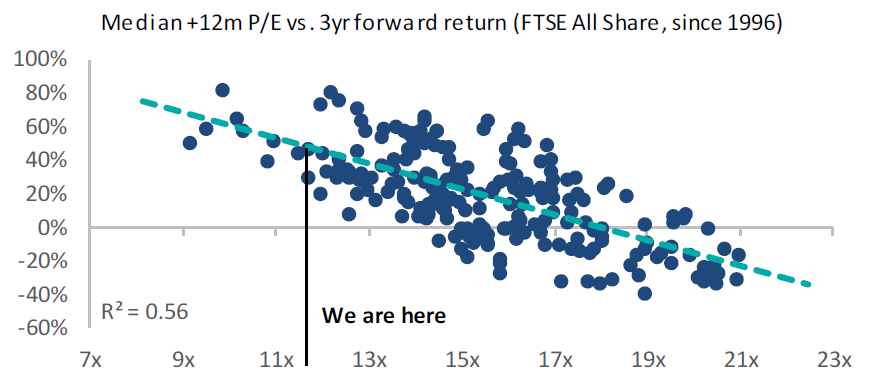

Using figures form the FTSE All Share since 1996 (below), Jory plots the starting valuations of the market (the horizontal line) and three-year forward returns (the vertical axis) of the index from each starting valuation.

Source: Datastream, Tellworth Investments. NB: ‘Biggest determinant’ because the R2 of this variable is over 50%

Historical figures suggests that based on the position of the index’s current valuation (marked on the table), investors can expect a potential 40% upside.

Jory argues that starting valuations are the biggest determinant of long-term returns.

He adds: “UK equities present as close to a win/win as we get in markets.

“The risk-reward on UK equity indices is very attractive currently, and particularly for global businesses and large caps.

“We think this is caused by the one-off complexity and ‘scare’ factor of Brexit, and this presents a fantastic opportunity for investors that can take this type of risk.Ignore it and there is, we think, serious opportunity cost.”

With markets taking a dive, should passive investors reconsider?

Other investors have been boosting exposure to unloved large-cap UK equities, including Paul O’Connor, head of the UK-based multi-asset team at Janus Henderson. O’Connor has been buying at the expense of US equities.

He explains: “I have been selling the market that is loved and buying the market that is loathed. Sentiment towards UK equities is negative, everyone can see that in the price of sterling, and there have been some huge share price moves in 2018.”

He adds that against a backdrop of “substantial Brexit risks” continuing to haunt markets, large-cap UK stocks are a safer way to play the UK, given that they are generally more internationally facing. O’Connor also points out that on the big companies have greater defensive characteristics compared to the mid and small cap firms found outside the FTSE 100 index.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.