Covid crash: which markets have done best and worst?

While no market has escaped the pandemic unscathed, as ever, some have performed much better than others…

7th May 2020 09:37

by Tom Bailey from interactive investor

While no market has escaped the pandemic unscathed, as ever, some have performed much better than others.

The coronavirus pandemic has caused extensive economic and financial damage, with markets around the world seeing some of fastest drops in history. As Tom Rosser, investment research analyst at The Share Centre, notes: “We’ve seen more than eight years of gains on the FTSE 100 erased in a month, the fastest bear market plummet in history on Wall Street, and global stocks having their best and worst sessions in a decade on consecutive days.”

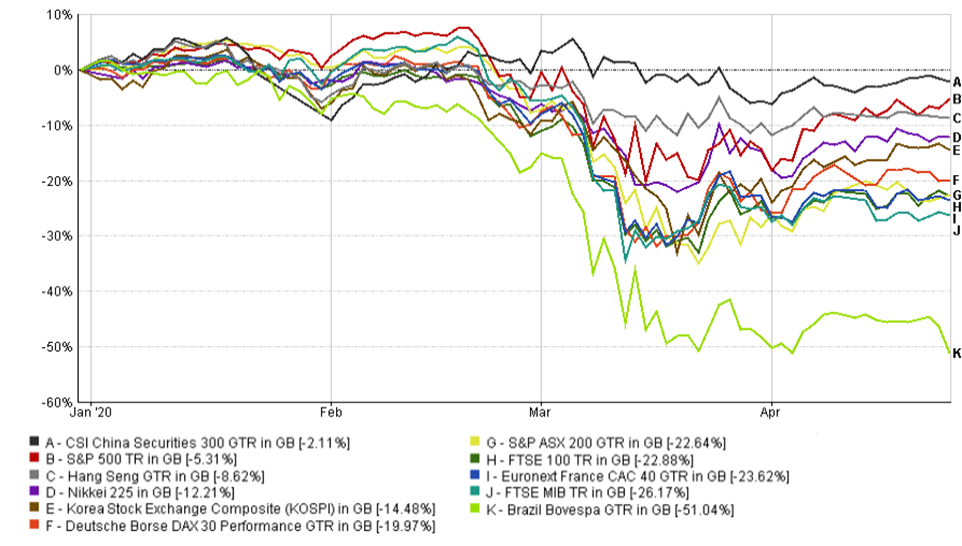

But while no market has escaped the pandemic unscathed, as ever, some have performed much better than others. Rosser notes: “The graph below shows there is no real winner year-to-date, but there are losers who have suffered less than others.”

Source: FactSet

Perhaps surprisingly to some, the best-performing index has been China. Dated from 20 January (when the world first became aware of the virus), the CSI 300 index has lost just 2.6%. In the midst of a global pandemic that has forced almost every economy around the world to run somewhere between 10% and 30% below capacity, that is not bad.

According to Rosser, this performance “is partly attributable to China being hit first and the drastic action the government took to combat the virus. The nation’s central bank has also stepped in, putting measures in place to encourage lending to small and medium-sized companies affected by the virus.”

Next on the list of best performance is the US S&P 500. The index has seen plenty of turmoil, falling some 34% from its peak at one point. However, ever since that point, the market has been in steady recovery mode and is now down just 5.3%. This strong performance is in part due to the relative strength of large US growth stocks such as Netflix, Amazon and Microsoft. At the same time, markets have enjoyed massive support from the US Federal Reserve.

The third-best market has been Hong Kong’s Hang Seng. Rosser puts this down to the city-state’s swift and successful response to coronavirus. He notes: “Hong Kong was one of the first places to report infections outside of mainland China. It quickly locked down, learning its lessons from the Sars outbreak in 2003, and with only four deaths to its name, it can largely be held up as a global success story.”

The worst-performing markets

Falling over 50%, Brazil’s Ibovespa index is the world’s worst-performing major equity index when measured in sterling. This is largely attributable to two things. First, a sharp decline in the value of Brazil’s local currency: year to date, the Brazilian real has fallen by over 23% compared to the pound. Second, Brazil’s index has a heavy weighting to oil, the price of which collapsed as the world went into lockdown.

Next on the list is Italy’s FTSE MIB index, which is down 26.3%. The nation has been among the worst hit by the pandemic. Rosser notes: “With Covid-19 posing a more serious threat to the elderly, Italy having a dense population, and northern Italy being a business hub with close trade and education connections to China, the adverse effects on the market are entirely understandable.”

France’s CAC 40 was the third-worst performer, with a loss of 23.6%. Rosser puts this down to the index lacking in sector diversity due to its low number of constituents. “It has likely been dragged lower due to the high weightings of major consumer-facing brands such as LVMH, L’Oreal, Hermes and Kering in the index. France is said to have enacted lockdown quite late and lacked the logistical capacity to promote mass testing effectively,” he notes.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.