Diversify risk with this well-run oil major

Attacks in the Middle East highlight industry complacency. Here's a great alternative to BP and Shell.

18th September 2019 10:04

by Rodney Hobson from interactive investor

Attacks in the Middle East highlight industry complacency. Here's a great alternative to BP and Shell.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Controversy over climate change has put a cloud over petroleum companies but the attack on oil refineries in major crude producer Saudi Arabia has underpinned the price of oil and made shares in the sector more attractive. One producer worth a look is French group Total SA (EURONEXT:FP).

It produces and markets fuels, natural gas and low-carbon electricity with 100,000 employees in more than 130 countries. The focus is on investments with a low breakeven point, so they will be profitable even if the demand for petroleum slips. This is important, as each dollar change in the price of crude flows through to the bottom line.

The group took advantage of the low part of the oil price cycle to acquire high-quality resources at attractive prices, with 7 billion barrels of oil and gas added to its reserves between 2015 and 2018. At the same time, it has shown an ability to cut costs.

In exploration and production, the aim is to grow output 5% per year on average, with production costs of $5.5 a barrel among the lowest of the majors.

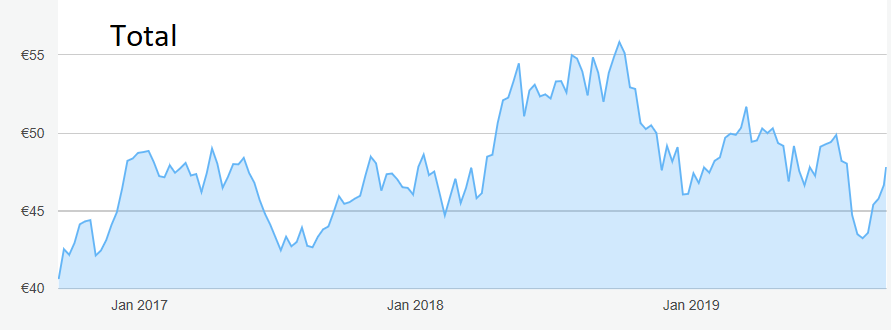

Source: interactive investor Past performance is not guide to future performance

Total has also been expanding operations in natural gas, the one fossil fuel whose use is growing 5% a year and is predicted to grow over the next 20 years.

In July 2018 it paid $1.5 billion, plus up to $550 million depending on any improvement in the oil markets, to acquire the upstream LNG assets of Engie, another French company, to become the second largest publicly-traded player in the LNG business with a worldwide market share of 10%.

Conscious of the environmentally unfriendly image of fossil fuels, Total has been building a presence in low-carbon electricity. This is not just because demand is growing: the board is very conscious of the need to project a clean energy persona. The group produces, and markets to end users, electricity from gas, solar and wind. It has about 5 million customers with a target of 7 million by 2022.

The drone attacks on state oil company Saudi Aramco's Abqaiq crude processing plant and a plant in the Khurais field caused the suspension of 5.7 million barrels of crude oil production per day. That's more than half Saudi's total output and more than 5% of global oil supply. The spike in oil prices may be short-lived, though. Crude has already fallen back on reports that Saudi Arabia’s oil output may return close to normal within two to three weeks.

Over the past 12 months Brent crude has been as high as $80 and as low as $53 but, barring a serious global slowdown, it looks likely to hold at around $60. That price is high enough for Total’s low-cost operations.

Profits fell in the second quarter on lower natural gas prices, but they did meet analysts' expectations and the outlook is positive.

The dividend is paid quarterly and has remained steady or risen every year for 37 years. This year's total will be €2.64, up 3.1% on last year and more than three times the level at the turn of the millennium, rising to an expected €2.72 next year.

Good visibility of cash flow from eight start-up projects over the past two years and selective acquisitions underpins the payout. It is also funding $1.5 billion of share buybacks and £15-17 billion of capital investment a year. Gearing is being held below 20% to protect Total's grade A credit rating.

Hobson's choice:Keith Bowman rightly pointed out the attractions of Total as an investment on this site two months ago when the shares were €48. They have slipped a little in the meantime but are nearly back to that level and the opportunity may not last much longer. Buy up to €50 and enjoy a yield of over 5%.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.