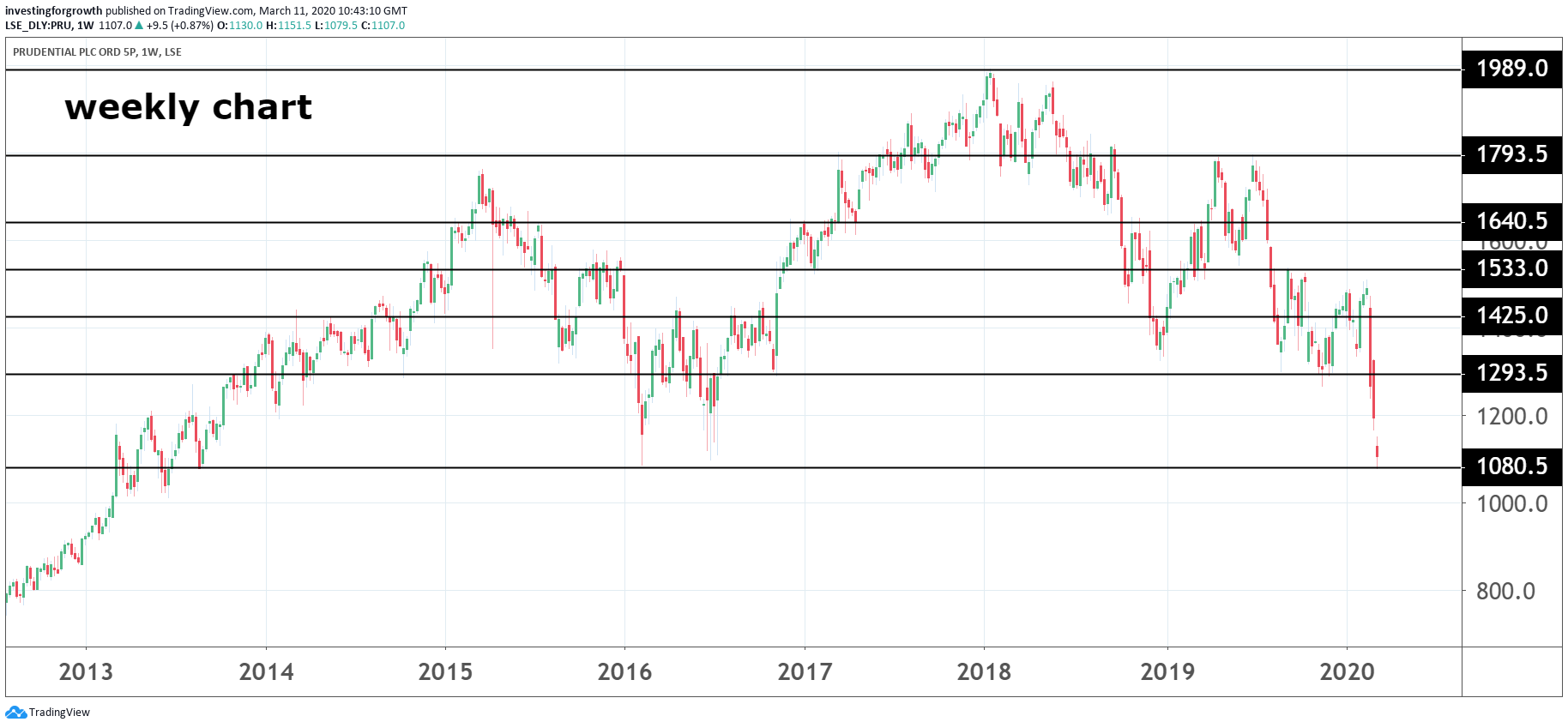

Do Prudential’s results mark a turning point for the shares?

At a price where they have bounced before, our head of markets examines prospects for Pru shares.

11th March 2020 10:47

by Richard Hunter from interactive investor

At levels where they have bounced before, our head of markets examines prospects for shares in the Pru.

Prudential (LSE:PRU) has delivered a defiant performance, particularly given the gruelling events over the last year with which it has had to contend.

Some of the numbers have inevitably suffered, such as the 28% decline in new business in the US and a general decline of 6% across the group. In addition, the pre-tax profit number dropped sharply, and the outbreak of the coronavirus has dampened sales momentum in Hong Kong and China, with the group predicting a consequential knock-on effect to new business profit.

Certainly, an extended period of market turbulence would do Prudential no favours in tightening the financial screw.

Source: TradingView Past performance is not a guide to future performance

Given the extraordinarily difficult set of circumstances in its key Asian region, Prudential has done well to weather the storm so far. On top of a Chinese economy which had been showing some signs of coming off the boil, partly due to the ongoing trade spat with the US, so followed the Hong Kong protests, the outbreak of the coronavirus and the subsequent global market turmoil.

As a result, annual premium sales in the region were affected, most notably Hong Kong which declined 11%, yet China significantly bucked the trend with an increase of 53%. The group is also looking to consolidate its digital offering where, for example, the “Pulse by Prudential” app in the region has already seen over a million downloads.

From an investment perspective, the strength of the balance sheet is unquestionable, with a solvency surplus of 309% and the dividend yield of 4.6% is also attractive in an interest rate environment which is retracting even further from the recent historical lows.

The Asian unit contributed adjusted operating profit which spiked 14%, with the overall group number adding 20%. Elsewhere, the planned minority IPO of its Jackson unit in the US, where the company may be better served by external future investment, could both raise significant capital for Prudential while also providing further focus on its core business.

Meanwhile, the spin-off of the M&G business seems to have been completed in a seamless fashion, thus avoiding any unnecessary management distraction.

- How will BoE’s strong medicine go down with savers and investors?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The long-term strategy is still playing into Prudential’s hands, where increasing demand for health, protection and savings across the Asian region continues to flourish given the backdrop of an emerging middle class.

Indeed, the reaction to the numbers could mark something of a turning point as investors appreciate this strong performance in a challenging environment.

The shares, which have plunged 28% over the last year, as compared to a 16% fall for the wider FTSE 100 index, may now attract some value buying interest. The general market view of the company is already anticipating enticing prospects, with the market consensus coming in at a “strong buy”.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.