Drink up: a €100bn share still worth ordering

7th July 2021 09:54

by Rodney Hobson from interactive investor

An aggressive expansion campaign is over, and an experienced new boss with different priorities looks promising.

New chief executive, old debt problem. As the days of lockdown give way to catching up with lost drinking time, it is worth asking whether the share price recovery at brewing giant Anheuser-Busch InBev SA/NV (EURONEXT:ABI) has further to run.

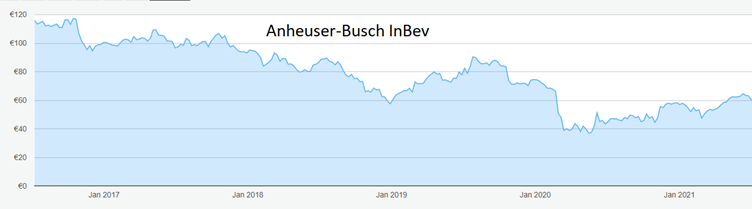

Certainly, a lot of good news has been factored into the share price since it bottomed at €37 in May 2020. A remarkable rise of over 60% has taken the value to around €60. The big worry is that Carlos Brito is handing over the reins at a high point, leaving the problems to his successor Michel Doukeris, formerly president of the North America zone.

Brito will be a spectacular act to follow. He has spent 32 years at AB InBev in its current and previous forms, helping to build what was once a small fish in the comparatively small Latin-American pond into a big shark in the world’s ocean. His expansion programme took advantage of the consolidation of the sector across the globe and made his company into one of the leaders.

Not all the routes he took were paths of unalloyed glory. The last deal, the $79 billion takeover of SAB Miller in 2016, left AB InBev with a massive debt pile that still stands at $83 billion.

Source: interactive investor. Past performance is not a guide to future performance

Doukeris, who has been chief global sales officer and has held roles in all the company’s key markets, has also been part of the transformation of the company, having been there for nearly as long as his predecessor, so he naturally stands by the SAB acquisition.

He is, however, unlikely to extend the aggressive tactics and this could – and certainly should – be the moment when AB InBev gives reducing debt priority. Interest rates are likely to edge higher, increasing the burden of servicing the debt. Smaller add-on deals, though, are likely to remain on the table.

The new chief executive has made his name building brands and boosting digital sales, skills that will bring in the cash to reduce debt.

AB InBev’s best known brands include Budweiser, Stella Artois and Corona. However, the future could depend on hard seltzers – alcoholic fizzy water infused with fruit – and ready to drink beverages such as canned wine and cocktails. These are the growing areas of the alcoholic drinks market, especially among younger customers, and AB InBev is one of the strongest players with its Beyond Beer portfolio. It has the lion’s share of the US market and is pushing into newer markets.

The two biggest deals in the acquisition years have been unfortunately timed. The acquisition of Anheuser-Busch came in 2008 as the financial crisis broke; the SAB Miller deal preceded the Covid-19 pandemic that closed so many outlets for the sale of alcohol.

- Two-speed recovery from the pandemic: the winners and losers

- Hot sector: should investors put down roots in plant-based foods?

- Take control of your retirement planning with our award-winning, low-cost Personal Pension

Just as AB InBev came through the first setback, so it is recovering from the second. Despite unfavourable currency changes, it reported a 7.8% rise in underlying profits in the first quarter of 2021 on revenue 17% higher compared with the same period last year. Total volumes were 13% higher. Earnings per share of 30 cents were a big improvement on the $1.13 loss in the previous first quarter.

This year, AB InBev is counting on low double-digit growth in sales and profits, which at least gets the firm back to 2019 levels after similar sized falls last year. Doukeris will be looking to improve the mix of brands and continue to control costs tightly. Much should become clearer when he delivers his first set of results, covering the second quarter, next month.

Hobson’s choice: In April and August last year I drew attention to the fact that AB InBev shares had been oversold in the pandemic. There was plenty of opportunity to get in well below €50. The case is less clear cut now, but it would not be wrong to consider getting in below the recent peak of €64.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.