easyJet shares could spring a big surprise

1st December 2022 07:01

by Alistair Strang from Trends and Targets

A key player in one of the industries worst affected by the Covid pandemic, the budget airline is still in recovery mode, but independent analyst Alistair Strang thinks something could be about to happen.

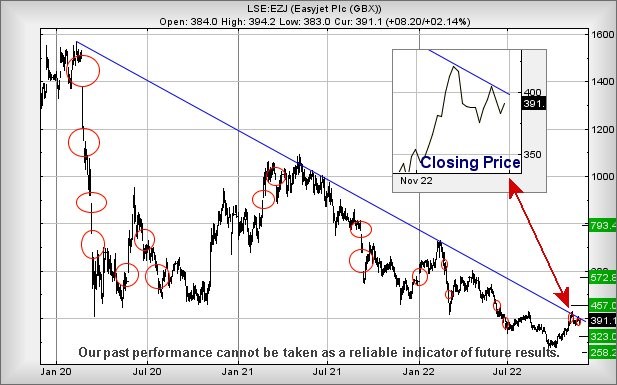

We quite cruelly refer to market price gaps at the open of trade as "manipulation". Our reasoning is quite basic, if no-one was able to trade, how else can the market justify the price movement? But if manipulation is your thing, few shares prove quite as fascinating as easyJet (LSE:EZJ), a share where we've been painting little red circles since 2020 on inexplicable price movements.

There are a lot, an awful lot, roughly 10 per year.

- Find out about: Transferring a Stocks & Shares ISA | Share prices today | Top UK shares

From our perspective it's a nuisance, as software likes data which makes sense. When gaps in the trading value of shares appear, they provoke a degree of confusion and led us to introduce a little piggy bank of gap values against shares. These accumulating values essentially allow for plus or minus parameters in any major price movement.

To be fair, we've as little confidence in this logic proving correct or having any hope the reader will understand the point being made.

With easyJet, the confusion is strong. We reviewed the share a couple of months ago, promising we'd revisit if the price closed above our 355p target level.

Trading around 390p at time of writing, the share price needs to exceed just 415p to give considerable hope for an ascent to an initial 457p with secondary, if bettered, at a longer term 572p. So far, so good, unless we throw a spanner in the works and take account of manipulation gaps.

- easyJet shares: what the City thinks

- easyJet: beginning to emerge from the clouds

- The future for easyJet, plus a stock market theory

Above our secondary hovers a third level calculation at 793p, a number which visually even looks sane! Our confidence always increases when target values match historic highs or lows. In the case of the 800p level, the share price has tended to pivot above and below for quite a while.

Past performance is not a guide to future performance

Unfortunately, this is easyJet and we're a little worried at the effort employed to stop the share price from closing above Blue, the downtrend since pre-pandemic 2020.

If this avoidance of the trend proves correct, below 370p risks promoting reversal to an initial 323p with secondary, if broken, down at 258p.

We think easyJet shall offer a surprise and head to 572p next.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.