European stock market outlook for 2021: fortune favours the brave

Following a Brexit trade deal, our overseas investing expert explains how to pick companies this year.

4th January 2021 10:09

by Rodney Hobson from interactive investor

Following a Brexit trade deal, our overseas investing expert explains how to pick companies this year.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

When UK Prime Minister Theresa May took responsibility for bringing Britain out of the European Union, she famously remarked: “No deal is better than a bad deal.” She presumably didn’t believe her own words, for she negotiated a deal so bad that the House of Commons voted it out three times, in the process inflicting the worst parliamentary defeat a UK government has ever suffered.

Nor, apparently, did the European Union or investors believe it was a good idea for Brexit to go ahead without an agreement between Britain and the EU. Why else would the UK and the EU have gone to such great lengths to secure first a transition agreement and now a trade agreement and have been prepared to go right down to the deadline to do so?

- Invest with ii: Top UK Shares | Share Tips & Ideas | Buy International Shares

The Brexit deal is at least better than no deal for Europe, but it still leaves some weighty problems. The removal of Britain’s €9 billion annual contribution to the budget leaves a massive hole, since countries that are net recipients of EU cash are unwilling to agree on corresponding spending cuts. There will also probably be some disruption to trade with the UK, at least in the early days.

No sector will be more relieved at the deal than car manufacturing, which depends heavily on transporting parts from one country to another. Although sales of second-hand cars have risen 25% in the European Union, as less wealthy residents fearing catching Covid-19 sought an alternative to public transport, sales of new cars slumped 25% in the first 11 months of the year.

Sales of new cars were still down 12% year on year in November, the latest month for which figures are available, and the situation would have been worse had not Germany restricted its decline to just 3% that month. Sales in France were an alarming 27% adrift.

- Will the three big fund trends of 2020 continue in 2021?

- Europe’s stock market: an introduction to investing on the continent

- Want to buy and sell international shares? It’s easy to do. Here’s how

One issue only indirectly connected to Brexit is European labour laws that provide safeguards for the workforce but which arguably discourage entrepreneurs. This could leave European companies at a disadvantage in competing with counterparts in the United States, which has fewer legal protections for workers.

It could also result in the UK taking a competitive advantage, one of the reasons why the EU was so keen to impose its own rules on British exports to the Continent to keep a level playing field.

European companies seem to have managed pretty well with restrictions on hiring and firing staff and with worker representations in the boardroom. Indeed, it is possible to argue that these rules help to improve morale in the workforce. However, they could be a hindrance in a fast-moving world where flexibility is vital.

The other big obvious factor in European investing is Covid-19, which swept initially through Italy and Spain, but which has had an effect all the way from the Mediterranean to the Arctic Circle. In terms of cases as a percentage of the population, Belgium has taken the hardest hit, but the most worrying aspect from the point of view of the European economy is the impact there has been on Germany, still the Continent’s powerhouse.

Germany is facing lockdown to Easter after the death toll topped 1,000 in a single day and the total in the second wave topped that in the first one. The hospital system is facing overload as the infection rate has risen and demand for intensive care beds increased.

The European Central Bank (ECB) has launched stimulus measures costing €500 billion to stave off a double-dip recession in the Euro bloc, taking its anti-coronavirus measures to a total €1.85 trillion. It has also extended the scheme, under which it lends money to banks on the understanding that they will provide cheap funds to businesses, for nine months to March 2022.

While that is potentially good news for companies seeking to hold down the cost of extra borrowing, the reasons for the dramatic gesture are sobering. ECB President Christine Lagarde said the central bank’s data suggested that Covid-19 would have a more pronounced impact in the opening months of 2021 than previously expected. Many businesses have closed and unemployment is rising sharply, she admitted.

The ECB predicts Eurozone growth of 3.9% for 2021. While that sounds quite reasonable on the surface, it represents a disappointing bounceback from the disastrous 2020 performance that was hit heavily by lockdowns. It is also a downgrade from an earlier forecast of 5.5%.

- How the UK market and investors reacted to Brexit deal

- What Bill Ackman thinks will happen to stocks in 2021

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

As in the UK, much depends on how quickly vaccination can be rolled out. While the UK got a head start, the European Union has begun vaccinations in earnest since Christmas and, if the authorities can get on top of the pandemic, the economic outlook should start to improve soon.

Stock market indices in Europe have performed less well than counterparts in the US and have not all recovered levels enjoyed before the coronavirus scare gripped markets, which suggests that a poor start to 2021 is factored into share prices. A post-Christmas boost from the Brexit deal announced on Christmas Eve has had only a limited effect and, as so often happens in the case of stock market panic buying or selling, soon gave way to a correction.

The CAC40, the benchmark index for France, was bobbing around just above 6,000 points before a plunge to 3,750 in mid-March and is now around 5,600.

Source: TradingView as at 4 January 2021. Past performance is not a guide to future performance

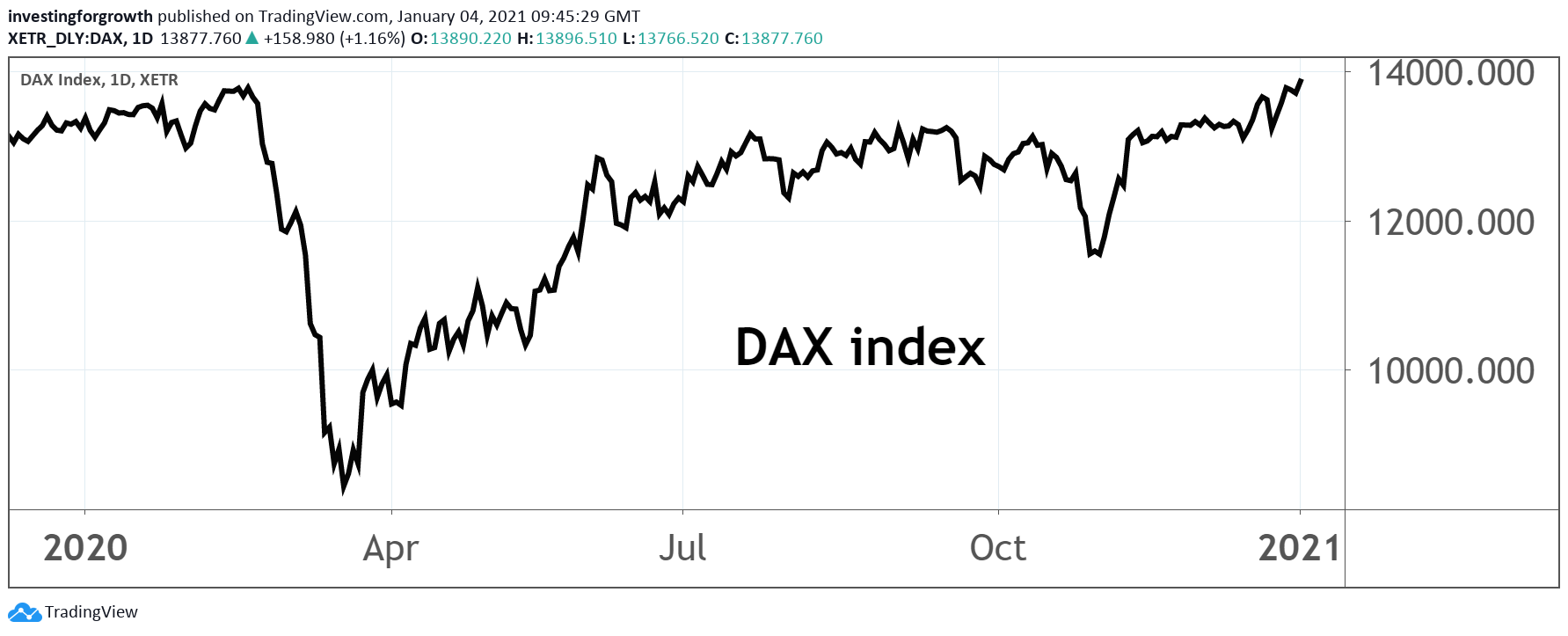

The DAX in Germany has performed better, recovering to the 13,800 level seen in mid-February.

Source: TradingView as at 4 January 2021. Past performance is not a guide to future performance

It will be tough identifying investment opportunities in Europe in 2021, particularly in the early months before vaccinations bring Covid-19 under control. However, fortune may well favour the brave who invest before markets start to take off again.

Look for solid, boring companies that can stand the shutdowns. They will at least be in a position to grow as weaker rivals wilt.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.