eyeQ: could summer of sport boost this FTSE 100 share?

interactive investor has teamed up with the experts at eyeQ who use artificial intelligence and their own smart machine to analyse macro conditions and generate actionable trading signals. Here’s the view on a recovery play.

23rd April 2024 11:00

by Huw Roberts from eyeQ

"Our signals are crafted through macro-valuation, trend analysis, and meticulous back-testing. This combination ensures a comprehensive evaluation of an asset's value, market conditions, and historical performance." eyeQ

- Discover: eyeQ analysis explained | eyeQ: our smart machine in action | Glossary

JD Sports Fashion

Trading signal: long-term strategic model

Model value: 107.4p

Fair Value Gap: +9.33% premium to model value

Model relevance: 27%

Data correct as at 23 April 2024. Please click glossary for explanation of terms.

It’s been a horrible start to 2024 for JD Sports Fashion (LSE:JD.). A profit warning saw the stock plummet almost 40% between mid-December and mid-January. Even when the company announced more upbeat guidance in a trading update at the end of March, that rally quickly petered out.

Today they’ve announced plans to buy Hibbett Inc (NASDAQ:HIBB), a sporting goods chain in the US. Stock analysts will do their homework, assessing whether the purchase will help JD succeed in America. Given this summer’s Paris Olympics and Euro 2024 football tournament in Germany, you’d like to think it’s a decent time for sales of sporting merchandise to enjoy a boost.

But consumers will only splash out on new kit if they have spare cash. It’s a good example of how macro forces are always at work, even if they sit in the background. Only when the economy is strong, labour markets are healthy, consumers feel secure in their jobs will you tend to see robust discretionary spending.

So, what is the big picture from eyeQ’s smart machine?

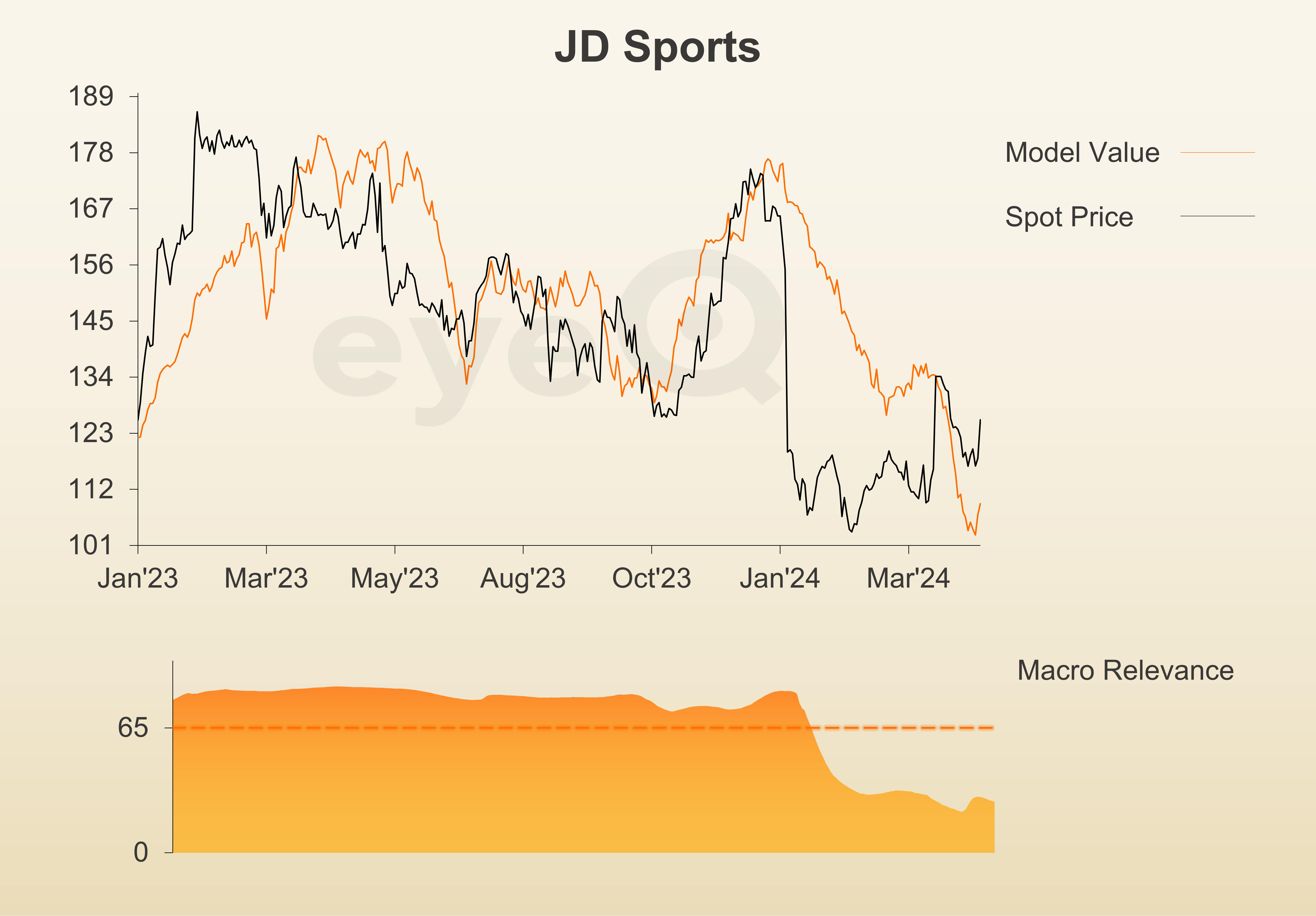

JD was a macro play for pretty much all of 2023. But our macro relevance score - how confident we are in our model value - fell hard in January as company news (the profit warning) dominated. It’s subsequently stabilised but, at 27%, it’s still low (below 65%, we deem that something other than macro is driving the price). Company stories are currently more important than big-picture stuff like when the Bank of England cut rates or how the pound trades.

But what is interesting is how eyeQ’s model value appears to be trying to carve out a base. Low model confidence means there’s a health warning, but it is notable that, at the margin, macro conditions may have stopped deteriorating.

To be fair, it showed signs of doing the same in March, but that attempt failed. And right now, the share price screens as rich, which means it’s slightly above model. There is no signal.

But what’s more important in the near term is watching model value itself. Ideally, we’d see definitive signs of rising model confidence and rising model value, i.e. JD is becoming driven by macro once again and those macro conditions are improving.

Add in a successful Olympics for Team GB and a 1996 Euros-style “feel-good” factor as the Three Lions progress in Germany, and JD Sports could be one to watch…

Source: eyeQ. Past performance is not a guide to future performance.

Useful terminology:

Model value

Where our smart machine calculates that any stock market index, single stock or exchange-traded fund (ETF) should be priced (the fair value) given the overall macroeconomic environment.

Model (macro) relevance

How confident we are in the model value. The higher the number the better! Above 65% means the macro environment is critical, so any valuation signals carry strong weight. Below 65%, we deem that something other than macro is driving the price.

Fair Value Gap (FVG)

The difference between our model value (fair value) and where the price currently is. A positive Fair Value Gap means the security is above the model value, which we refer to as “rich”. A negative FVG means that it's cheap. The bigger the FVG, the bigger the dislocation and therefore a better entry level for trades.

Long-Term model

This model looks at share prices over the last 12 months, captures the company’s relationship with growth, inflation, currency shifts, central bank policy etc and calculates our key results - model value, model relevance, Fair Value Gap.

These third-party research articles are provided by eyeQ (Quant Insight). interactive investor does not make any representation as to the completeness, accuracy or timeliness of the information provided, nor do we accept any liability for any losses, costs, liabilities or expenses that may arise directly or indirectly from your use of, or reliance on, the information (except where we have acted negligently, fraudulently or in wilful default in relation to the production or distribution of the information).

The value of your investments may go down as well as up. You may not get back all the money that you invest.

Equity research is provided for information purposes only. Neither eyeQ (Quant Insight) nor interactive investor have considered your personal circumstances, and the information provided should not be considered a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised financial adviser.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.