eyeQ: our smart machine in action

interactive investor has teamed up with the experts at eyeQ who use artificial intelligence and their own smart machine to generate actionable trading signals. Here, we demonstrate AI in action.

1st February 2024 10:47

by Huw Roberts from eyeQ

- Discover: eyeQ analysis explained | Glossary

Hays helps navigate the UK labour market

Investors seeking insights into the UK labour market and the health of the broader economy can use recruitment companies as a valuable barometer.

Take Hays (LSE:HAS), for instance, a prime example of how eyeQ can transform complex market dynamics into actionable insights.

A few months back, UK unemployment data was suspended because of quality concerns, undermining its ability to gauge the pulse of the labour market. However, by focusing on recruitment companies like Hays, eyeQ can shine a light on the larger economic picture.

Examining Hays through eyeQ's lens reveals three vital aspects:

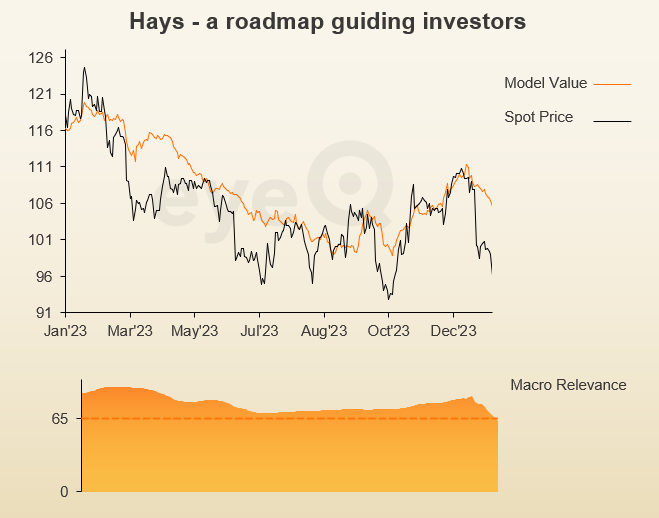

- Spot price: where the share price is actually trading.

- Model value: eyeQ’s guidance for the asset’s fair value.

- Macro relevance: highlights the influence of macro conditions versus company news and how confident we are in the model value.

Let’s look at the chart, then explain what it all means.

Key takeaways:

For most of the last year, investing in Hays required an understanding of macro conditions - you can see on the chart that macro relevance has been consistently high. Above 65% means the macro environment is critical, so any valuation signals carry strong weight.

The Hays stock price has moved around model value. You can see on the chart that it was oversold last March (spot price below model value) and bounced; same again in July, August and October. Macro conditions are the “anchor” around which the market fluctuates in the short term.

Then, two things happened at the very end of 2023.

- eyeQ model value for the recruiter turned lower, warning us that the Q4 bounce was becoming stretched and vulnerable to a correction. In other words, the macro backdrop stopped supporting a higher Hays stock price and said the macro environment was deteriorating. This would not be obvious to the average investor simply watching newsflow and economic data.

- Macro relevance also turned lower to below the key 65% level. That means eyeQ’s smart machine issued a signal that investors should watch company news not macro events. The former was becoming more important than the latter. Then, on 9 January, Hays issued a profit warning and the stock fell 18%. One key benefit here is that eyeQ saves you time – highlighting what investors really need to be watching.

In the complex world of investments, where noise can drown signals, let eyeQ be your concise yet powerful guide, simplifying the intricacies of modern financial markets for confident decision-making.

These third-party research articles are provided by eyeQ (Quant Insight). interactive investor does not make any representation as to the completeness, accuracy or timeliness of the information provided, nor do we accept any liability for any losses, costs, liabilities or expenses that may arise directly or indirectly from your use of, or reliance on, the information (except where we have acted negligently, fraudulently or in wilful default in relation to the production or distribution of the information).

The value of your investments may go down as well as up. You may not get back all the money that you invest.

Equity research is provided for information purposes only. Neither eyeQ (Quant Insight) nor interactive investor have considered your personal circumstances, and the information provided should not be considered a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised financial adviser.