FCA urged to introduce consistent terminology for ESG

7th January 2022 11:03

by Jemma Jackson from interactive investor

It’s time to get clear on ESG for DIY investors.

- Flash poll of almost 2,000 interactive investor website visitors this week illustrates a preference for ‘Green’ and ‘Sustainable’ labels, but the jury is still out and results were mixed

In response to the FCA’s discussion paper: Sustainability Disclosure Requirements (SDR) and investment labels, interactive investor, the UK’s second-largest DIY investment platform, highlights the urgency of this initiative and how much more needs to be done to ensure retail investors feel empowered when choosing responsible investment products.

This is an important piece of work and change can’t come soon enough.

Moira O’Neill, Head of Personal Finance, says: “We welcome this paper and are delighted to feed back, but we can’t help but despair to see yet another dreary and highly technical acronym creep into the ethical investing world. SDR, standing for Sustainability Disclosure Requirements, might not be intended for retail investors, but there’s always that danger that regulatory language filters down.

“It’s over two years since we launched our own ii ethical ACE investment styles, which stand for Avoids, Considers, Embraces – words carefully chosen to explain what an investment is doing. Yes, another acronym, but one investors have been able to use! In an industry littered with a lot of off-putting ethical acronyms, we decided to create one that is fun and means something.

“We don’t have all the answers, and we hope the FCA can find a better, industry-wide solution. But in a sector which still isn’t very easily understood or navigated, in the absence of any IA ethical sectors, our ACE investment styles have been helping investors navigate the sector for over two years. A lot of great industry and regulatory consultations on ethical investing have been and gone during that time, and this at least is helpful in the here and now.”

Becky O’Connor, Head of Pensions and Savings, interactive investor, says: “ESG, which stands for Environmental, Social and Governance, continues to be a dominant theme in the investment industry, and rightly so. We’ve seen huge growth in investment products focused on this area in the last few years, and the UK’s presidency of the COP26 climate conference in Glasgow last year placed greater responsibility on the shoulders of the UK finance industry to deliver more.

“However, the variety of these products and their differing strategies can be confusing and overwhelming. It can even be totally off-putting, if someone feels let down by an investment that claims to be responsible or sustainable, but on further inspection, does not seem to live up to the label. Finding information about a fund or trust’s true sustainability credentials shouldn’t be an onerous task for any investor.

“As things stand, the risk of greenwash is high, so it is a priority that we have greater clarity and consistency of language when describing ESG products to investors, who should be able to feel confident that they are choosing products that live up to their expectations.”

Interactive investor research

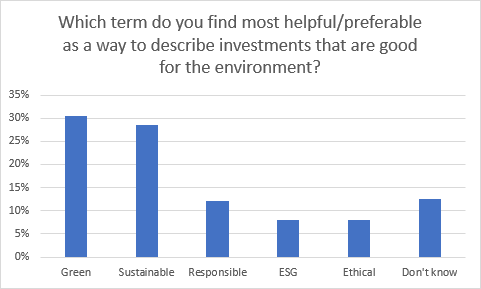

A flash poll of 1,908 interactive investor website visitors between 5-6 January 2022 suggests that ‘green’ and ‘sustainable’ were considered more helpful/preferable terms when choosing environmental-focussed investment products.

Some 31% of respondents preferred ‘green’, and 29% ‘sustainable’. However, the results are mixed. The third highest result was ‘don’t know’ with 13% of votes, closely followed by ‘responsible’ which had 12%. This was followed by the terms ‘ESG’ and ‘ethical’ – which both got 8% of the vote.

Even though this poll was focused on the ‘E’ of ‘ESG’ – it demonstrates a lack of consensus about what language investors should be looking for to find investment products that are good for the environment. We expect this confusion is amplified when trying to choose products with ‘S’ and ‘G’ credentials, as well.

interactive investor has emphasised the need for extensive market research to identify which terminology investors find most useful and how this should be used to shape criteria for ESG investment products. The tone and style of sustainability information is vital: it must be simple, factual and engaging.

interactive investor is also asking that the regulatory regime establishes a single standard. So far, initiatives created by bodies such as the IA, CFA, TISA, and the BSI, intended to tackle the issue of inconsistency, may themselves be adding to the problem, by creating a range of standards. These differing standards, while they have served a useful purpose in the evolution of sustainability standards, should arguably be discontinued once replaced by a single statutory set of guidelines, to avoid further confusion.

Becky O’Connor added: “Every investment has an impact of some kind, and because of this, no product should be considered out of scope and should still be subject to the labelling element of the regime.

“As well as the labelling itself, we must also ensure investors can find this information quickly and effectively. A product’s ESG credentials should be presented on the main product information page, as well as the Key Investor Information Document, so that even before consumers begin downloading documentation, they are already assured that the product meets their preferences.”

Notes to editors

To read interactive investors’ full response, see here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.