Financial markets: Time to buy, or keep selling?

16th October 2018 11:41

by Tom Bailey from interactive investor

After last week's sell-off, there are still good reasons to be bullish, but there are three convincing arguments to dump stock. Tom Bailey talks us through each one.

Last week was a painful one for many investors. Asian equities saw heavy selling, while in the US some of the market's top performers this year, such as Netflix and Amazon, posted heavy losses. Meanwhile, the FTSE 100 entered correction territory, having fallen 10% from peak to trough since May.

Since then, markets have started to see a slight recovery, with most major indices closing up at the end of last week.

However, the sharp sell-offs now have everyone wondering: have global markets finally turned a corner?

Here are three reasons to be bullish and three to be bearish.

Bullish

Growth remains strong

Global growth is still looking relatively strong. While the International Monetary Fund has revised downward its projections in its latest report, it still expects the world economy to continue growing at above 3% both this year and next, with the exact amount dependent upon US and China trade relations.

As Anthony Gillham, head of investments at Quilter Investors notes:

"The macro economic environment remains stable, with reasonable global growth, despite some pockets of weakness."

In particular, US economic growth remains robust. The third quarter of 2018 is set to see strong growth. According to Pantheon Macroeconomics, 4.5% in the third quarter is possible, before a drop to somewhere below 3% in the last three months of 2018.

Behind the sell-off was the optimistic view of economic growth from the Federal Reserve. Investors took Fed chair Jerome Powell's claim of being positive about the US economy as a signal that interest rates would continue to rise. Paras Anand, head of asset management, Asia Pacific at Fidelity International, says:

"The medium term outlook for the global economy remains robust and the gradual withdrawal of monetary stimulus is a sign of a return to more normal conditions."

Corporate earnings are still on the up

Driving the bull market, it is often argued, is the steady rise of US corporate earnings growth. Companies have seen their earnings edge up and investors have reacted by buying equities.

The good news is that corporate earnings are expected to see further growth this earnings season. Danske Bank's chief strategist, Tine Choi notes: "Consensus currently puts expected earnings growth at 19.2% and revenue growth at 7.3% for S&P 500 companies."

That's lower than expectations for earnings in the second quarter of this year, but still strong. Choi adds:

"If expectations are met, this would be the third highest earnings growth rate since the first quarter of 2011. Hence, in our view, there is still good reason to overweight in equities and underweight in bonds."

Europe could soon be at a turning point

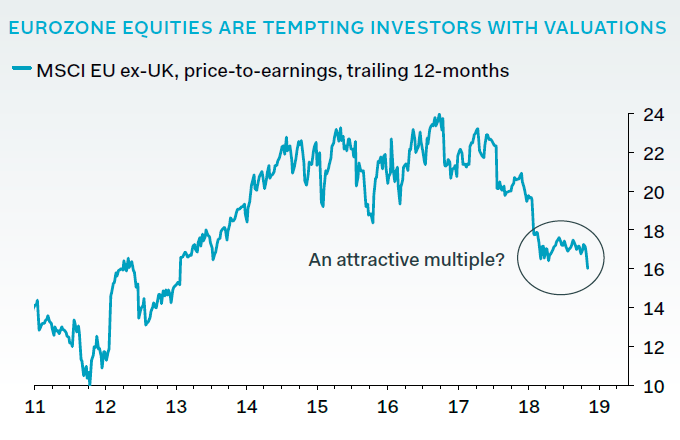

One area of the world that investors may soon find themselves bullish about is Europe.

European equities have seen abysmal performance over the past year. Year to date the Euro Stoxx 50 index is down around 8.5%, while the Euro Stoxx 600 is down 7.5%.

Despite this, European companies have seen decent earnings growth. As a result, price-to-earnings ratio for Eurozone stocks are at four-year low of about 16, based upon the MSCI EU ex-UK index, says Pantheon Macroeconomics.

Past performance is not a guide to future performance

The firm adds:

"Unless the economy is about to stumble into recession-which is unlikely-it leaves room for a rebound if sentiment improves, even slightly."

"Depressed sectors such as telecoms and financials should do particularly well, if they can continue to deliver earnings growth."

Of course, there's always the risk that the current spat between Brussels and the Italian government could spook markets, pushing equity markets lower.

Bearish

Don't expect the Federal Reserve to slow rate rises

Partly behind last week's sell-off was the expectation that the US Federal Reserve will keep upping interest rates and in response bond yields would continue to rise. This makes equities less attractive, hence leading some investors to start trimming their equity holdings.

Investors shouldn't expect the Fed to now change course, despite president Donald Trump calling the Fed's tightening 'crazy' and blaming it for the market sell-off.

If anything, Trump's comments make the prospect of the Fed changing tack and easing monetary policy less likely. Holding off on a rate hike in December would make it appear as if the Fed is responding to political pressure from the president. That would damage the Fed's reputation of being independent.

Save any major nasty surprises in the US economy, we can expect rates to continue to climb upwards, further reducing the attractiveness of equities compared to bonds.

The US/China trade war won't end anytime soon

The US and China trade war also helped convince investors to sell-off stocks last week.

At the end of November, Chinese president Xi Jinping and US president Donald Trump are scheduled to meet at the G20 summit in Buenos Aires, Argentina. This has given some hope that the US and China may try and find some agreement, allowing the current US and China trade war to end. Investors, though, shouldn’t hold their breath.

While the US and China may exchange some niceties and even agree to repeal certain tariffs, US and China relations are now in a new, hostile era. The US now openly talks about being in a period of 'interstate competition,' viewing China's technological and economic ascendency as a national security challenge. China, meanwhile, is convinced that its economic reliance on US technology, investment and consumers is a vulnerability to be addressed.

This new era of US/China competition may cause further pain to large US and multinational companies, particularly in the tech sector. These firms have built sprawling global supply chains, extending from Chinese coastal cities to the US. If the Chinese and Americans are both serious about 'disentangling' their economies, such supply chains remain under threat.

Risk of No Deal

Brexit negotiations are still mired in uncertainty. The latest episode has seen negotiations temporarily put on hold, with the UK insisting that a draft treat proposed by the EU was a 'non-starter' and politically unfeasible.

The UK is due to attend a meeting with EU heads of government on October 17. However, with no further scheduled talks between now and then, the hope of some sort of agreement on the UK's terms of departure being agreed looks less likely, increasing the chances of the UK crashing out with 'no deal' in March 2019.

Terminating forty years of legal and technical regulations with no immediate replacement is likely to be both costly and disruptive to British businesses, particularly those reliant upon fragile supply chains extending across national borders.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.