Find out whether you will outlive your pension pot

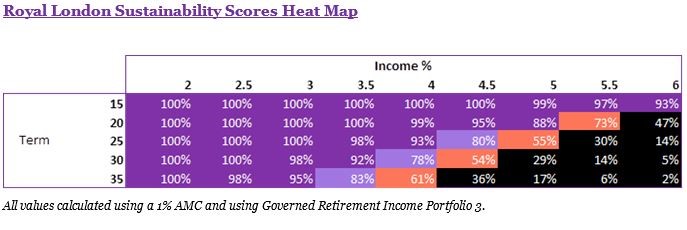

This heatmap sheds light on the sustainability of different withdrawal rates over various time periods.

16th November 2018 15:17

by Tom Bailey from interactive investor

This heatmap sheds light on the sustainability of different withdrawal rates over various time periods.

Too many people may be taking too high levels of income out of their pension pots and risk making their retirement plans potentially unsustainable, new research has found.

Research by Royal London found that a slight majority of those taking pensions drawdown are taking an income that leaves their pot unlikely to support them for the rest of their lives. It found that just 47% of its drawdown customers have a more than 85% chance of their income lasting them for life. That means 53% risk running out of income in their lifetime.

The sustainability of a drawdown level depends upon the "term" of the pension pot (the timeframe for which the pensioner is expected to be relying upon their pot).

Below is a heat map, developed by Royal London, which shows the sustainability of different withdrawal rates over different time periods.

According to the Office for National Statistics in 2013–2015 a man in the UK aged 65 had an average further 18.5 years of life remaining, whereas a woman typically lived for a further 20.9 years.

Thus, as the heat map above shows, an income of 3.5% or less would need to be taken over a 20-year period to ensure the pension pot does not run dry. Those who take an income of 4% have a 99% chance of outliving their pension pot, whereas for those who take 4.5% the figure drops to 95%. Those who take 6%, though, only have a 47% chance.

However, notes Royal London, the number deemed to be opting for unsustainable withdrawal levels doesn’t fully account for those with multiple pension pots who can afford to opt for higher drawdowns.

In many cases a drawdown customer may have intentionally chosen a more aggressive drawdown from one of their pension pots, knowing that others will become available at a later date. Royal London gives an example: "For instance, someone may be 60 years old and choosing to draw down one pot to give them income before others become available at age 65."

Lorna Blyth, head of investment solutions at Royal London Intermediary Pensions, notes: "For some income drawdown customers, income sustainability is not so important as they have high capacity for loss. For others, it is extremely important that they understand the risk around potentially running out of money."

Separate research carried out previously by Morningstar found the 'safe withdrawal rate' for UK pension savers is 2.5%. This is based on historical returns, on a portfolio split equally between shares and bonds.

The premise is that over any 30-year period the income payments will always be met, increasing in line with inflation. The overall capital may fall or remain intact, depending on market conditions. But the capital value will last the 30 years.

Morningstar's study is notably more conservative than other academic research that has been carried on the same subject.

William Bengen, a former financial planner, carried out the same calculations two decades ago, but instead used a portfolio of 50% in American shares and 50% in American government bonds. Bengen's research found the safe withdrawal rate was 4%.

For investment strategies outlining how savers can construct portfolios to provide a sustainable income level, in our October issue we asked three financial advisers to construct hypothetical portfolios for investors with different requirements.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.