Five ways to boost a workplace pension

Employees, here are five tips to make sure your pension delivers.

10th February 2020 10:17

by Sam Barrett from interactive investor

Employees, here are five tips to make sure your pension delivers.

Pensions automatic enrolment has changed the face of retirement savings, with more than 10 million people now paying into their workplace scheme. But as the government sets the minimum contribution level, there’s a risk many will assume they’re on course for a decent level of income in retirement.

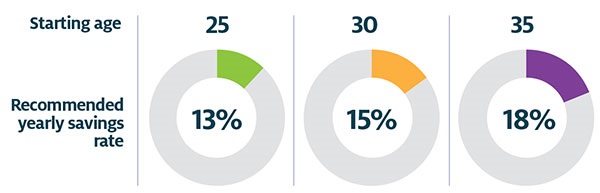

Contribution levels totalling 8% of your salary, as prescribed by the government, are a good starting point; but Maike Currie, director of Fidelity Workplace Investing, says it can leave you with a significant shortfall. “We suggest putting away at least 13% of your income between the ages of 25 and 68,” she explains.

“If you start later, or take a career break, you’ll need to save more.”

(See infographic below.)

To ensure you’re on track, whatever age you start, engaging with your pension is a must. Jonathan Watts-Lay, director of Wealth at Work, recommends using online calculators to see whether you’re saving enough.

“The Money and Pensions Service’s pension calculator (at moneyadviceservice.org.uk) can give you an indication of what your savings will be worth in retirement, and how changes such as increasing contributions or retiring later will affect them,” he says. “It can be a real eye-opener.”

Unless you’ve been very disciplined since you started work, it’s likely that you’ll need to save more into your pension. These tips can help you get the most out of your pension and, in some cases, take some of the pain out of paying in more.

The later you start, the more you need to save each year

Source: Fidelity International. Figures assume a salary of £40,000

1) Get more from your employer

Making a larger contribution is the obvious way to boost your pension pot, but it’s worth checking whether your employer will help. Although many offer the minimum 3% employer contribution, some are more generous.

“Ask your employer,” says Fiona Tait, technical director at Intelligent Pensions.

“Some will match your contributions or pay in a higher percentage if you’re happy to increase what you pay in. It’s free money, so don’t overlook it.”

Where an employer matches your contribution, even paying in an extra 1% of your income can make a significant difference to your pension pot. For example, take a 40-year-old earning £30,000.

Assuming they and their employer make contributions of 4%, the pension would be worth £109,000 at age 68 (average growth of 2.4%). Bump up the monthly contribution to 5% from each – equivalent to an extra £25 a month from the employee –and the final fund would increase to £136,000.

That’s a 25% boost.

2) Divert a bonus

As well as – or instead of – making a regular additional commitment, you might want to consider diverting some or all of a bonus to your pension. Watts-Lay says that psychologically, this can be much easier than increasing monthly contributions. “Unless you’ve already lined up how you’re going to spend it, a bonus is extra money,” he says. “Because of this, you’re much less likely to miss it.”

The tax relief makes a bonus worth more in your pension than in your bank account. As an example, if you received a £500 bonus, this would be £340 after basic rate tax and national insurance, but £425 if it was paid into your pension with tax relief (national insurance would still be payable).

This figure can be increased further if your employer offers so-called ‘bonus sacrifice’. “Bonus sacrifice is a great way to pay less tax and national insurance,”says Currie. “Plus, as your employer saves on national insurance, they may pass on these savings too.” ‘Sacrificing’ the £500 bonus would see the full £500 wind up in your pension. On top of this, if your employer passes on its national insurance saving, you could have a further £69 added to your pension.

If you are considering bonus sacrifice, make sure you let your employer know before they pay it to you, as it’s not an option once it has been paid.

3) Free up some spare cash

Changing your habits in other areas of your finances could also provide a healthy top-up for your pension. “People talk about giving up your daily latte and putting that money into your pension, but that’s too much of a personal sacrifice,” says Watts-Lay.

“Instead, look at your household expenditure and see whether you can make savings on things that you wouldn’t even notice, like utility bills or motor insurance.”

As an example, he says that shopping around for a new motor insurance deal could save you between £200 and £300. “Put this into your pension with tax relief and it could make a significant difference to your retirement lifestyle,” he says.

Another area where you may be able to release some spare cash is on your employee benefits. “If you’re a couple and both working, there could be duplication in your benefits packages,” he says.

“Private medical insurance is commonly provided for spouses, but it’s pointless having two lots of cover. This could free up as much as £1,500.”

4) Ditch the default

Evaluating your pension investments can also boost your pot, without needing higher contributions. “Many people are in their pension’s default fund, which is a relatively conservative balanced fund,” says David Gibb, chartered financial planner at Quilter Private Client Advisers.

“If you’ve got at least 10 years to go, you can afford to go for something more adventurous. It’ll be more volatile, but you’ll have time to ride out any falls in value.”

Although returns vary, Gibb says it’s possible to move from an average annual return of 4% on a default fund to a return of 8% on something more adventurous. This switch could potentially double the size of your pension pot over the long run.

As well as switching out of the default, it’s also worth checking the lifestyling option. This is designed to move your pension into lower-risk investments as retirement approaches. However, as a result of pension freedoms and the removal of the default retirement age, many of our plans around retirement have changed.

“Lifestyling used to be all about getting our pension ready to buy an annuity, but with this less likely now, it’s worth contacting your pension provider to let them know your plans,” adds Gibb.

5) Consider consolidation

As we clock up an average of 11 jobs in a working life, it can also mean we end up with a litter of pension pots. Pete Glancy, head of policy, pensions and investments at Scottish Widows, recommends a spot of decluttering. “Consolidating some of these pots will make it easier to manage them, but could also help to increase the size of your pension,” he explains.

For a start, charges may be lower. Modern pensions charge a percentage of your pot, which can be up to 0.75% but is often lower. Older pensions may come with a higher percentage charge or levy a fixed monthly amount, typically around £2.

Although the difference may sound small, the savings can be considerable. Over 20 years, a £50,000 pension pot would increase to £109,556, assuming 5% annual growth and a 1% annual management charge. With a 0.5% management charge, the value would be £120,587.

Moving your previous employers’ pots into your current workplace scheme may also give you better investment options, which again could improve the growth of your pot. But it’s worth checking the terms and conditions before consolidating. Glancy explains:

“Some older schemes, especially final salary pensions, will have benefits that you won’t want to give up. If you’re in any doubt, seek financial advice.”

Stop! Don't pay in too much

Paying as much as possible into a pension is a sensible strategy for many people, but it’s also important to be aware of the limits to contributions.

£40,000 Annual Allowance

If your income is lower than this, the most you can pay in yourself is capped at 100% of your earnings. If you have no earnings, it’s £3,600. Exceed this and you’ll need to pay back the tax relief on the excess.

£1,055,000 Lifetime Allowance (2019/20)

This covers all your pensions, excluding the state pension, and you’ll face a tax charge on the excess if you go over the allowance. This is paid when you take the pension, at the rate of 25% if you draw it as an income, or 55% if you take the excess as a lump sum.

£4,000 Money Purchase Annual Allowance

This replaces the £40,000 annual allowance if you’ve flexibly accessed one of your pensions and taken out more than the 25% tax-free cash.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.