Flutter Entertainment: why shares are up 72% to a six-week high

This bookie is racing ahead and there’s an elegant solution for the dividend, says our head of markets.

17th April 2020 09:47

by Richard Hunter from interactive investor

This bookie is racing ahead and there’s an elegant solution for the dividend, says our head of markets.

This update from Flutter Entertainment (LSE:FLTR), the owner of Paddy Power bookmakers, is something of a game of two halves, with trading performance up to mid-March and then since showing a stark contrast.

The coronavirus outbreak has had some sort of financial impact on the vast majority of companies, and Flutter is no exception.

The inevitable disruption to sporting events globally has had a material impact on the business over the last month, with group revenues having fallen by 32% and sports revenue by 46%, although there has been some mitigation on the latter given that horse racing in Australia and the US has continued.

Betting shops have been closed since mid-March, such that the PPB Retail division, which had been contributing 13% of overall revenues, is now providing nothing whatsoever.

- C-19 update: three companies beating the market

- The Ian Cowie interview: profile of a top financial journalist

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

From a broader perspective, although likely to be less of an issue in the short term given the current environment, the ongoing threat of intervention by either regulators or governments looms large.

Indeed, the gaming industry is a traditionally easy target for authorities needing to raise taxes and, on the other side of the epidemic, this could become a focus as governments look to repair their bruised financial positions following the major costs of the pandemic.

Furthermore, this is an intensely competitive industry, especially in the US where Flutter is building both a presence and a reputation.

Yet there are a number of positives for the business as a whole and, if the performance up until the middle of March can be resumed post-crisis, there is much to go for.

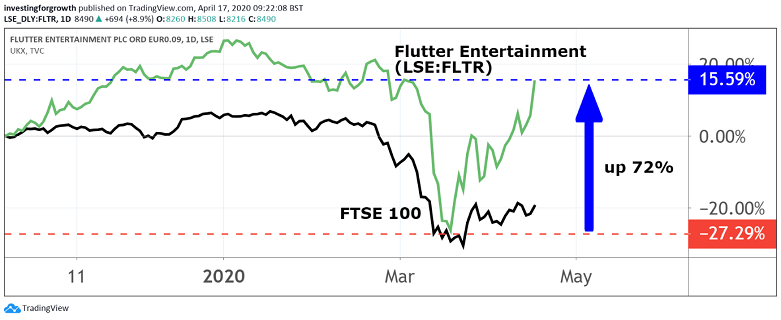

Source: TradingView Past performance is not a guide to future performance

Each of Flutter’s four divisions were making material contributions to the overall effort, with PPB online enjoying sports and gaming revenue increases of 43% and 17% respectively, Australian revenues up 32%, overall US revenues climbing 72% and PPB Retail up 13%.

The clear benefits of diversification, both globally and by product, were in clear evidence and are now to be bolstered by the significant acquisition of the Stars Group, which is expected fully to complete in the second quarter.

Even since the lockdown, the online gaming strands of the business have held up relatively well as consumers have shifted their habits, at least on a temporary basis.

In a sign of some prudence as well as confidence, the company’s decision to proceed with the dividend in the form of shares rather than cash is quite an elegant solution to the problem facing so many other companies, who have largely chosen to back away from making any distributions at all for the time being.

The share price performance has reflected both the difficulties currently facing Flutter as well as the achievements it had been making up until recently.

The 15% decline in the share price over the last three months is a clear indication of the current concerns.

However, even this dip does not detract from a strong performance over the last year, where a rise of 20% compares to a 25% decline for the wider FTSE 100 index.

In fact, since hitting a low of around £50 a month ago, the shares broke above £86 Friday for a gain of 72% in just one month.

Balancing past performance with today’s challenges tends to polarise investors. As such, the current market consensus of the shares on balance remains a “hold”, even though the initial reaction of the business to the current pandemic bodes well.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.