C-19 update: three companies beating the market

Barratt Developments shares have plunged, but there are well-known stocks doing rather better.

16th April 2020 13:05

by Graeme Evans from interactive investor

Barratt Developments shares have plunged, but there are well-known stocks doing rather better.

An air of calm over London markets was aided by Barratt Developments (LSE:BDEV), Dunelm (LSE:DNLM) and Rentokil Initial (LSE:RTO) today after the trio provided reassuring updates on life during the Covid-19 lockdown.

While their shares all rose, there was no bounce for PZ Cussons (LSE:PZC) on the back of “exceptionally high demand” for its Carex hand wash and sanitiser gels. Challenges in sourcing packaging and raw materials mean the company hasn't been able to fully capitalise on the crisis, with uncertainty elsewhere meaning profits will be at the low end of consensus.

Providing forward guidance in this way is not an option for most companies, with today's latest wave of updates on Covid-19 still focused on liquidity and balance sheet strength.

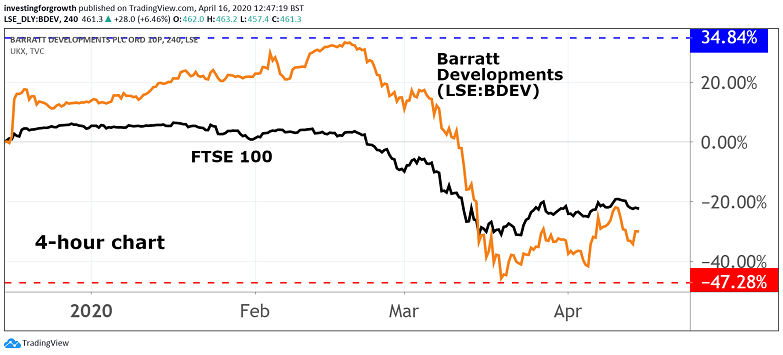

Barratt Developments, for example, pointed out it had £450 million in cash, which is actually £70 million higher than the last time it reported in mid-March. This follows a further 1,349 housing completions since then, although with sales centres and construction sites now closed opportunities for further reservations and completions are limited.

Barratt still has access to £700 million of untapped credit facilities, while it is saving £100 million with the previously announced cancellation of its 9.8p a share interim dividend due to be paid on May 11.

Today's update helped its shares rise another 2% to 443p, having been as low as 364.7p last month. Analysts at UBS think a return to 625p is achievable, even if this is still a long way short of the multi-year high of more than 800p seen before the crisis.

Source: TradingView Past performance is not a guide to future performance

They added:

“We think there is value and that balance sheet risk looks relatively low. The key catalyst will be the re-opening of construction sites.”

Barratt was joined on the FTSE 100 risers board by Rentokil Initial after the pest control and hygiene services business talked about building for the recovery phase, and the strategic opportunities that may follow Covid-19. In the meantime, however, it needs to get through the crisis phase, with Q2 trading set to be worse than the final two weeks of March.

Revenues in Italy were down 15.3% in March after several weeks of lockdown, but North America revenues rose 8.5% in the month due to the country being about two weeks behind Europe in the crisis. Ongoing revenues across the group still rose by 7.2% in the first quarter to March 31.

CEO Andy Ransom pointed out that the company's operations in China were now returning to normal, with all employees able to return to work.

He added:

“As we are seeing already in China, Hong Kong and South Korea, the crisis will subside over time and when it does, it is my strong conviction that we will have the best people, skills, innovations and technologies to help our customers get quickly and safely back to business.”

The company has re-trained an additional 7,000 staff to perform disinfection and deep clean services, while it now has a Covid-19 targeted website presence. And as part of £100 million of cost savings measures, Ransom has cut his Q2 salary by 35% with the remaining 65% donated to a new employee support fund.

Shares lifted by 6% to 417.4p, continuing the recovery from 339p seen in mid-March.

- Ian Cowie: three trusts built to survive war and recession

- Commodities outlook: why oil price won’t rise after OPEC+ deal

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Dunelm also reassured investors after expressing confidence that it will have access to sufficient liquidity to survive a prolonged period of store closures. Its online business is back up and running, with recent order levels significantly higher than the period before Covid-19.

Shares, which peaked at an all-time high of 1,400p in February before falling back to 700p a month later, were up 4% to 855p today.

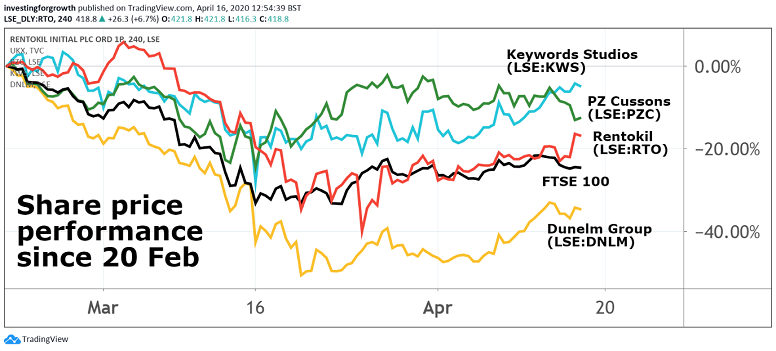

Rentokil, PZ Cussons and Keywords Studios beat the FTSE

Source: TradingView Past performance is not a guide to future performance

Keywords Studios (LSE:KWS) looks to be well placed to weather the Covid-19 storm, given the boost to popularity for video gaming during the lockdown.

The company, which provides services to 23 of the top 25 most prominent games companies, has experienced some operational disruption due to the pandemic, but is confident it is well placed to deliver on the pent-up demand across its client base when the operating environment normalises.

It reported an 8% rise in annual profits today, with trading so far in 2020 in line with market expectations. Shares rose 2% to 1,548p.

Augmentum Fintech (LSE:AUGM), meanwhile, rose 3% to 86.4p after the UK’s only publicly listed specialist fintech fund reported two successful fundraisings by portfolio businesses Onfido and Previse.

The company, whose diversified collection of 18 fintech investments includes interactive investor and peer-to-peer lending platform Zopa, said Onfido has raised US$100 million to deliver a new identity standard that helps people worldwide to securely access digital services.

Previse, which specialises in artificial intelligence and data science fintech that enables instant payments for suppliers, has also raised $11 million to support further growth.

Augmentum has seen shares rally sharply since an update in mid-March highlighted robust performances by companies in the portfolio.

CEO Tim Levene added today: “In our announcement of 24 March we explained that the company has a strong and diversified portfolio across fintech sectors many of whom are category leaders.

“We expect several of them to perform counter-cyclically and a number are already experiencing heightened demand for their products and services. Onfido and Previse are just two such companies.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.