Four high yield oil plays

Oil prices have doubled since April’s low, but there are still big dividend yields on offer.

29th July 2020 10:03

by Rodney Hobson from interactive investor

Oil prices have doubled since April’s low, but there are still big dividend yields on offer.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Few sectors have been hit harder by the coronavirus crisis than oil. The price of crude fell to the point where explorers awash with the black stuff were reputedly paying users to take it off their hands. A glimmer of light is now showing, a factor that has not yet been reflected in oil share prices, where yields are particularly attractive.

Brent is one of the key markers for crude. Its chart shows massive fluctuations over the past few years as Opec has struggled to maintain discipline among its members, Russia has developed as a major international player, and the United States upset the apple cart with massive investment into fracking.

Brent’s recent peak was at $85 a barrel in October 2018 and the price seemed to be stabilising at around $70 in January this year when the world went into a tailspin.

Economic activity collapsed and Brent hit the bottom in April at $16, less than a quarter of its level at the start of the year. It has since recovered to around $43, raising hopes that the worst may be over despite forecasts that demand for oil this year will be 9% below that for 2019.

Source: TradingView Past performance is not a guide to future performance

The second quarter of 2020 has probably seen the worst of the economic setback, with crude production nearly 10 million barrels a day higher than consumption. Lockdowns in countries such as Britain, Spain and Italy have now eased despite some local flare-ups; China, the first country to be hit, is virtually back to normal; the United States remains problematic but most of the country continues to defy the pessimists. While countries such as Brazil and India are still caught up in a wave of infections, shutting up shop and waiting is not an option for less affluent workers.

On the supply side, Russia and Opec agreed to reduce output by a total of 9.7 million barrels a day, virtually wiping out the overproduction. Encouragingly, this agreement has now been amended to 7.7 million barrels, an indication of confidence that demand for oil is already picking up. Major oil producing nations believe that demand will continue to grow over the rest of the year and into 2021.

This scenario clearly depends on whether Covid-19 can be brought under control, and, even if the virus dies out or a vaccine is perfected, it does not necessarily follow that global economic growth will resume apace. It is highly unlikely that the dip will be fully eradicated for at least 12 months.

- Investing in oil: prices, dividends, shale firms, and stock tips

- Oil for beginners: why oil prices move up and down

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

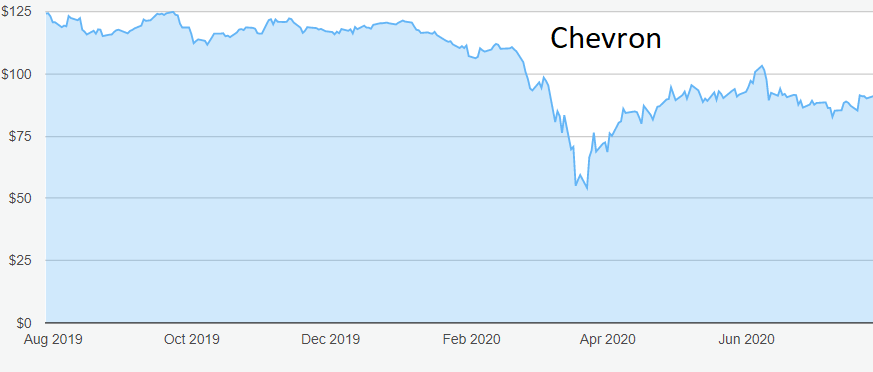

Chevron (NYSE:CVX) shares halved from $121 at the start of the year to $60 in mid-March but have since recovered to $89, recovering almost half the fall. They have eased back a little this month, presenting a possible buying opportunity. The yield is an attractive 5.45%.

Source: interactive investor. Past performance is not a guide to future performance.

I recommended the shares at $85 on 11 March, arguing that they had fallen unfairly compared with other oil producers. I did warn, without then realising what the full impact of Covid-19 would be, that the short term could be a test of nerves, but at least this one is back above my last update.

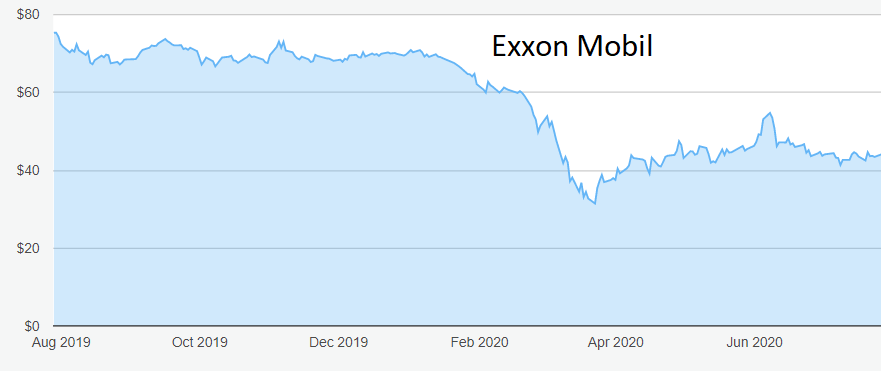

Exxon Mobil (NYSE:XOM) has been really disappointing. I thought it was worth a look at $75 in February last year and again at $68 last August. The stock is now $43.50, which puts the yield at a remarkably tempting 7.9%.

Source: interactive investor. Past performance is not a guide to future performance.

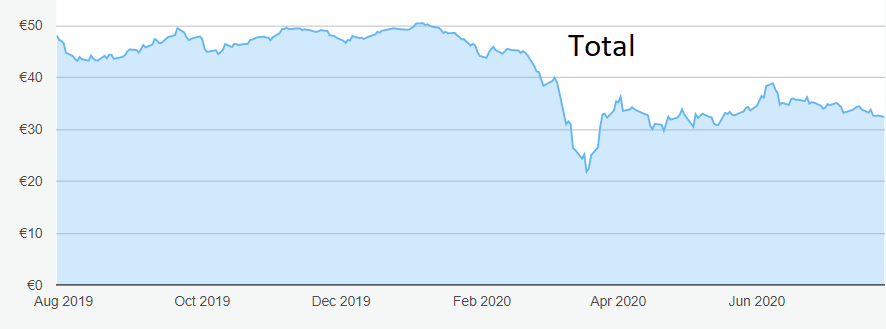

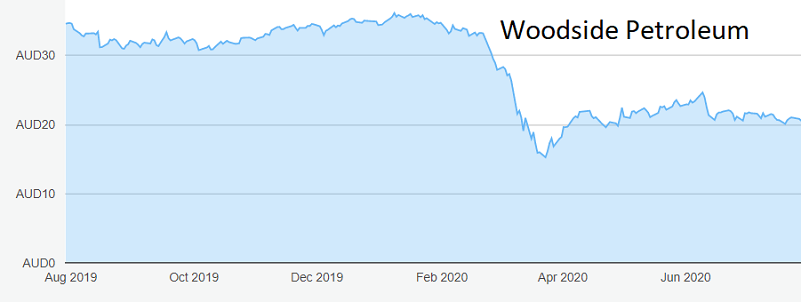

Total (EURONEXT:FP) shares have drifted over the past six weeks to €32.50, where the yield is 8.3%, and Woodside Petroleum (ASX:WPL) has run out of steam at just above AUS$20 despite offering a yield of 6.55%. These two surely deserve a higher rating. Woodside I fancied at AUS$36 back in January, before the storm broke.

Source: interactive investor. Past performance is not a guide to future performance.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s Choice: Buy Chevron up to $100, the level they reached in early June. Surely Exxon’s time has come while the stock is below $46. Buy Total up to €36 and Woodside up to AUS$24.50.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.