FTSE for Friday: will there be a Christmas miracle?

24th December 2021 09:34

by Alistair Strang from Trends and Targets

Independent analyst Alistair Strang recalls a past trade on Christmas Eve, and explains why he doesn't trust the morning session.

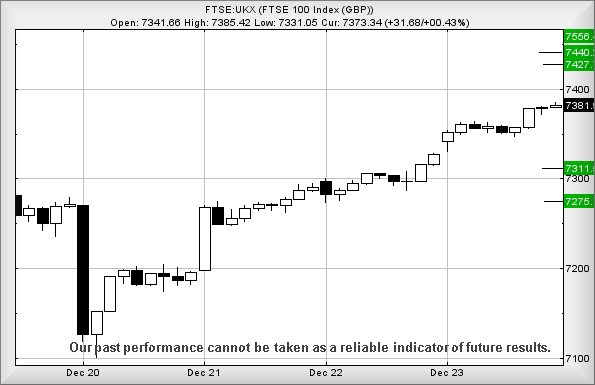

Despite few people likely taking the time out to read yesterday's article (something to do with the Christmas holidays), our whimsical report for Thursday proved rather concise. Our initial target of 7,378 points was successfully achieved, bettered by seven points, and giving a nice little useful 36-point trade. Of course, the big question relates to Friday morning's potentials.

A painful memory of many years ago relates to opening a long position on Christmas Eve, sometime around 10am. Of course, nothing actually happened for an age and eventually, at 12.15pm, with the market due to close at 12.30pm, the decision was made to close the position and go Christmas shopping. Quite literally, within minutes of the position being closed, the FTSE started to make solid movements and reached the target level, the final thing on screen as the system shut for the holiday break. Despite not trading anymore, this spiteful reminder of why the morning session on Christmas Eve remains, also providing the reason we don't trade.

- Watch our Christmas and New Year share tips here and subscribe to the ii YouTube channel for free

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

When involved in a trade, emotion enters the frame. Anxiety, fear, greed, impatience, or whatever the human brain can produce to foul logical thinking. Successful traders are those folk who can lock emotion away in a drawer. Idiotic traders, like we were, experienced panic - in this instance a fear of discovering the shops were closed - but more commonly, panic due to a worry about profit vanishing, often taking minimal profits rather than "risk" a trade running to its logical target. They say you can't go 'bust' making profits, but you can completely burn yourself out and lose all perspective. There was a famous day, when 27 days were completed averaging £1 profit per trade. This was pretty close to the end of our personal efforts to trade!

Source: Trends and Targets. Past performance is not a guide to future performance

A couple of friends asked earlier this year about long-term investments. We'd suggested Rolls-Royce (LSE:RR.) at 107p, then experienced a complete roller coaster of emotions in the months since, only to be utterly horrified when the chum emailed to ask how Rolls-Royce were doing. As per our initial scenario, she'd bailed at 139p and banked profits, opting to leave the value of her initial investment running for the longer term. While on a daily basis, we'd been worriedly monitoring the share price, she hadn't even bothered looking at it. She was blissfully unaware of the fairly wild ride the share price has been on.

This again encapsulates the reason we don't/can't trade: we take the transactions far too personally.

As for the FTSE for Friday, the index remains looking positive. Despite FTSE futures currently being marginally down from Thursday's close, things risk becoming quite enticing should the FTSE manage above 7,388 points. Such a Christmas miracle comes with the potential of movement to 7,427 points next. If bettered, our secondary calculates at 7,440 points. Alas, this is Christmas Eve and, as mentioned earlier, a session we distrust.

If triggered, the index needs to fall below 7,324 points to spoil the party, threatening reversal to 7,311 points with secondary, if broken, down at 7,275 points.

Have a good Christmas break. We'll be back on Wednesday next week, hopefully sober, well fed, and calm.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.