Fund spotlight: Man GLG Continental European Growth

25th October 2021 13:04

by Tracy Zhao from interactive investor

Tracy Zhao, a senior fund analyst at interactive investor, examines one of the funds in our Super 60 list.

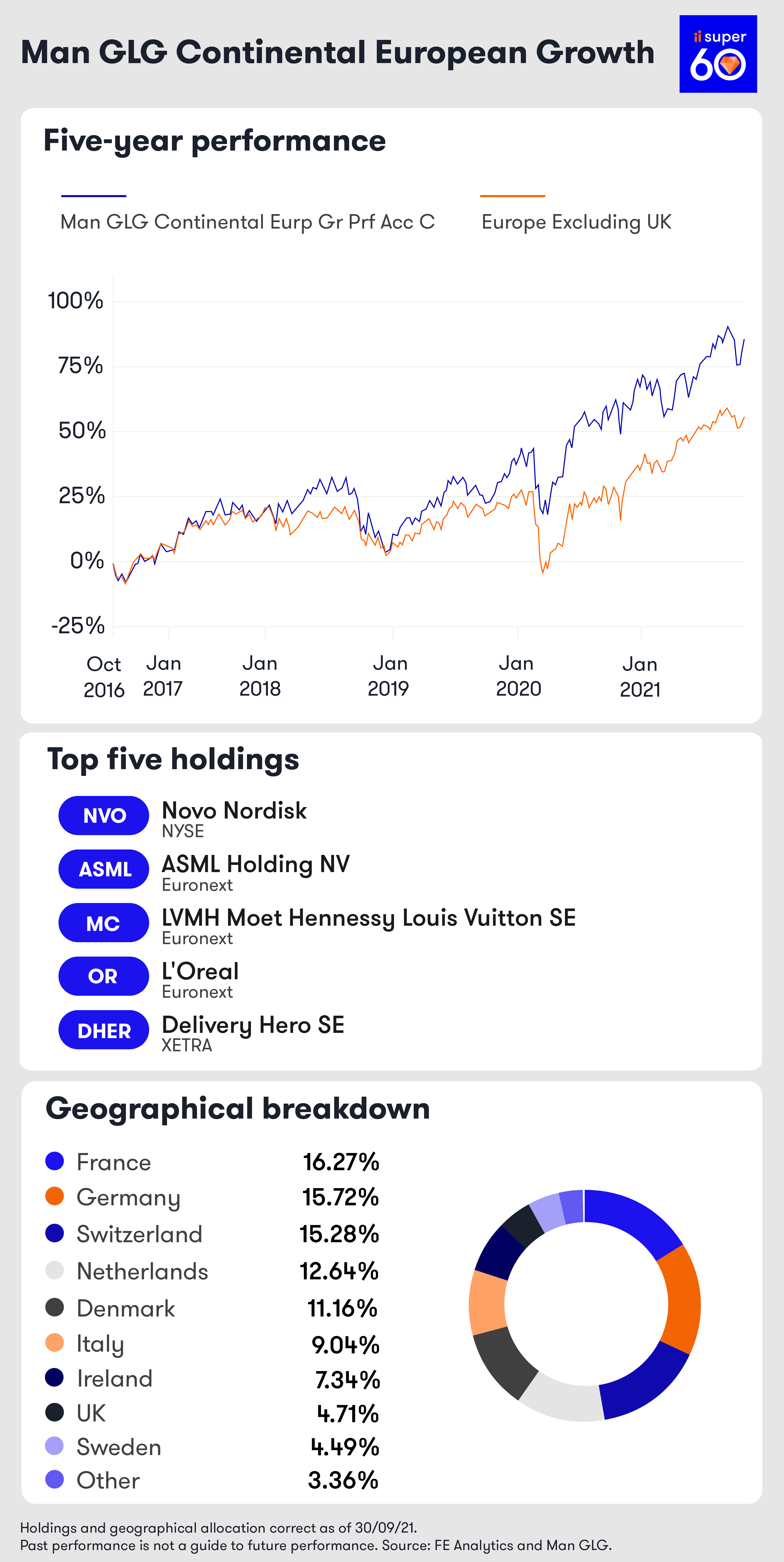

Man GLG Continental European Growth is actively managed, aiming to outperform the FTSE World Europe ex UK Index over five-year rolling periods. Since inception in 1998, the size of the portfolio has grown to more than £1.4 billion.

Seasoned investor Rory Powe has managed the fund for seven years. In 2018, Virginia Nordback was promoted to co-manager. The management takes a long-term ownership approach, focusing on stock-picking as opposed to making decisions based on the wider macroeconomic backdrop.

Over the past three and five years, the fund has achieved first quartile performance compared to its peers.

- Fund managers dash for cash amid inflation and China concerns

- How our model portfolios fared as volatility returned to markets

- Funds and trusts four professionals are buying and selling: Q4 2021

What does it invest in?

The manager aims to identify and invest in Europe’s strongest companies that must display several characteristics that are sustainable over the long term. They can be of any size and from any country or industry in continental Europe. Currently, more than 90% of holdings are large companies.

Companies selected fall into the category of ‘established leaders’ and ‘emerging winners’.

Established leaders are leaders in their industry in terms of market share and pricing power. They must have a clear five-year expansion path in terms of growing their earnings and generating free cashflow. The leaders are expected to have an upside potential of 10% a year on average under normal market conditions.

Emerging winners are companies that have high growth in a new or existing market, and they can demonstrate clear competitive advantages. The emerging winners are expected to have an upside potential of 15% a year on average under normal market conditions.

From more than 2,000 companies, 30 holdings have been selected, two-thirds are established leaders and one-third are emerging winners.

This strategy clearly favours quality growth stocks.

Sector weightings and examples of holdings

The portfolio holds more than the index in consumer discretionary, information technology and consumer staples. These three sectors account for 60% of the fund.

The fund holds less than the index in financials and communication service firms.

In terms of countries, just under 50% of the portfolio is invested in France, German and Switzerland.

Moving on to the top 10 holdings, which comprise just over half of the portfolio, some examples are: LVMH (EURONEXT:MC), L'Oreal (EURONEXT:OR), Ferrari (MTA:RACE), Nestle (SIX:NESN) and Puma (XETRA:PUM), which are all familiar household names.

How has it performed?

| 01/10/2020 - 30/09/2021 | 01/10/2019 - 30/09/2020 | 01/10/2018 - 30/09/2019 | 01/10/2017 - 30/09/2018 | 01/10/2016 - 30/09/2017 | |

| Man GLG Continental European Growth Fund | 12.57 | 25.75 | -1.03 | 6.79 | 22.11 |

| IA Europe Excluding UK Sector | 22.40 | 3.21 | 2.23 | 1.91 | 21.95 |

| FTSE World Europe Ex UK Index | 22.05 | 0.37 | 6.35 | 2.01 | 22.70 |

Source: Morningstar, Total Returs, GBP.

How does the fund stand out from the crowd?

The fund sits in the Super 60 European Equity category. It has a proven track record; over three and five years the fund outperformed the average European fund. In addition, it has achieved this with below-average risk.

The European region is a rich hunting ground for stock-pickers in search of companies that have a long track record of successfully navigating a variety of economic conditions.

In regard to performance of the European equity market, it has lagged the US and UK since the start of the year and in the third quarter. Therefore, there’s scope for investor sentiment to improve going forwards given the European economy is yet to reach its pre-pandemic highs.

As the fund is highly concentrated, we would expect short-term volatility from time to time. Due to this, it is prudent for investors to adopt a long-term investment horizon and diversify with other fund regions and styles as a part of their overall portfolio.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.