Galliford Try repair job has investors flocking

12th September 2018 14:37

by Graeme Evans from interactive investor

It had a dreadful start to the year in the wake of Carillion's collapse, but Galliford has bounced back strongly and its dividend remains attractive, writes Graeme Evans.

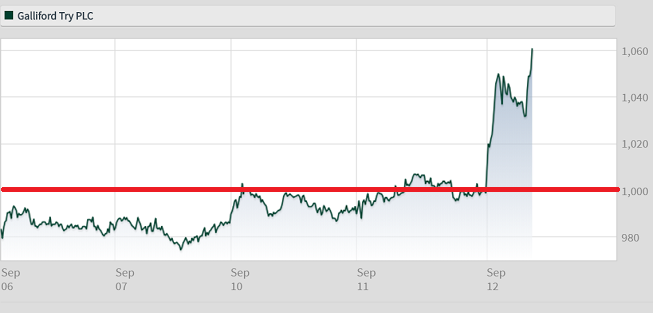

Another landmark in the turnaround of Galliford Try was reached today as forecast-beating results gave its shares an 8% boost and foothold above the £10 barrier (see chart).

It's been an arduous couple of years for Galliford, whose fortunes have been knocked by construction overruns and the saga of the Aberdeen road bypass scheme, which contributed to the need for a £150 million rights issue in April.

Shares endured a dreadful start to the year and dipped as low as 823p in July, only to spark into life following a better-than-expected update that month.

Galliford maintained the momentum today, largely thanks to a strong performance from Linden Homes, whose improved margins helped drive an 8% increase in the division's operating profit to £184.4 million.

Source: interactive investor Past performance is not a guide to future performance

The construction business has also shown signs of stability, with new projects being booked at improved margins. The division still booked an exceptional charge of £45 million from the Aberdeen joint venture, but shareholders will be relieved large sections of the road are now open to traffic.

Significantly, Galliford remains on track to achieve its 2021 strategic targets, including 60% growth in profits based on 2016 results. The cautious economic outlook means it has tempered its growth ambitions for Linden volumes, but this is offset by stronger margins and improved optimism for the Partnerships & Regeneration division, which continues to pursue “vigorous growth”.

As indicated, Galliford cut its annual dividend by 10% to 77p today as part of a move to increase earnings cover to 2x. This process was accelerated by the rights issue, meaning the pay-out should progress in line with profits from now on. It is aiming for five-year compound growth in dividends of at least 5% by 2021, with the stock currently trading with a dividend yield in excess of 7%.

The forward price/earnings (PE) multiple is a modest 6.7 times, but this blend of low PE and high dividend yield is not uncommon among housebuilding and construction stocks.

Peel Hunt analysts have a "buy" recommendation and target price of 1,165p, having made no change to their forecasts despite today's upbeat results.

• Stockwatch: 20% potential upside and 7% yield

• 10 shares to generate £10,000 income in 2018

• The week ahead: AB Foods, Morrisons, Galliford Try

They said: "Investors will take comfort from the improving signs in Linden margins and the growth in Partnerships.

"But the settlement of the Aberdeen road remains an important swing

factor for cash flow and sentiment towards the construction business."

Group underlying earnings per share of 158p were ahead of Peel Hunt's estimate of 147p, while the dividend was higher than the 71p predicted by the broker.

Our companies analyst Edmond Jackson highlighted the recovery potential of Galliford back in May, when he forecast a 20% upside in the price to 1,150p.

Buoyed by operational momentum, he said a case could be built for the stock as both a 'medium-term trading buy' - able to grind higher as the market grows used to shock-free news - and one with the ability to lock in the yield.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.