The week ahead: AB Foods, Morrisons, Galliford Try

7th September 2018 14:16

by Lee Wild from interactive investor

With summer holidays over and the kids back to school, there are plenty of results out next week that need watching closely, writes Lee Wild.

Monday 10 September

It seems little can stop the steady decline in value at Associated British Foods. The share price is down 20% since June and by a third since last autumn's peak. We've already been warned that falling EU sugar prices will cut profit at the higher margin sugar division, but key here will be by how much. Retail chain Primark is expected to make more than last time, which will reignite calls for the two very different businesses to go their separate ways.

Source: interactive investor Past performance is not a guide to future performance

Trading Statements

Brady, Gulf Keystone Petroleum, MD Medical Group Investments, Associated British Foods

AGM/EGM

Live Company Group, Totally

Tuesday 11 September

Trading Statements

Acacia Mining, Harworth Group, PureTech Health, Surgical Innovations, Vectura Group, TP Group, Team17 Group, Silence Therapeutics, JD Sports Fashion, Cairn Energy, Ashtead, Eu Supply, DP Eurasia, Murgitroyd, Alumasc

AGM/EGM

Ashtead, Bilby

Wednesday 12 September

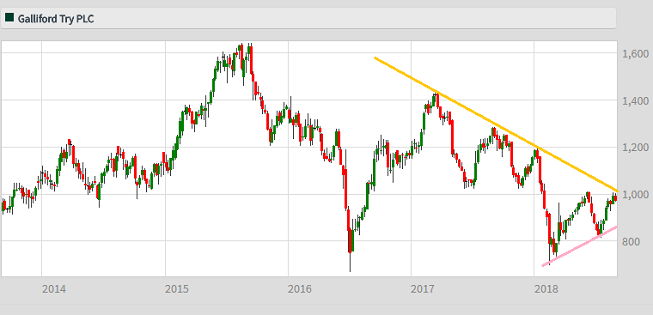

Galliford Try has had an eventful 2018 so far. After getting a rights issue away in April to pay for cost overruns on its Aberdeen bypass contract, a confident update in July revived fortunes.

The share price has risen almost 20% since then, putting it among the sector's best performers, but it gave away quite a lot in July, and it's unclear whether these full-year results will be enough of a catalyst to shove them back above the magic £10 mark.

Source: interactive investor Past performance is not a guide to future performance

Trading Statements

Advanced Medical Solutions, Anexo Group, Forbidden Technologies, Concurrent Technologies, Medica Group, Ten Entertainment, 1pm, Galliford Try, Dunelm, Stenprop

AGM/EGM

Orient Telecoms, Stenprop

Thursday 13 September

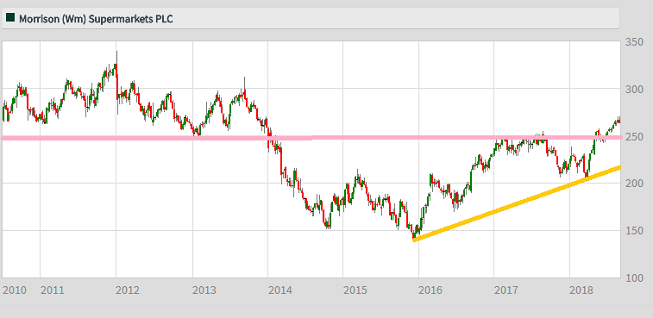

Morrison (Wm) Supermarkets has rewarded loyal investors over the past three years and the shares continue to regularly make their best levels since late 2013. Chief executive David Potts takes a lot of the credit, and there's reason to believe that a bullish assessment of prospects at the last update is justified.

Like-for-like sales grew by 3.6% during the first quarter and there's evidence that the discounters are becoming less of a threat. That plays into the hands of Morrisons which is already growing faster than the other Big Four grocers and we should begin to see profit margins improve in the first half.

The shares don't scream value, but they are among the cheapest of the UK supermarkets and the dividend yield is respectable.

Source: interactive investor Past performance is not a guide to future performance

Trading statements

GVC Holdings, Xeros Technology, SafeCharge International, Ophir Energy, Morrison (Wm) Supermarkets, Oxford BioMedica, Gresham House, Faron Pharmaceuticals, Ricardo

AGM/EGM

XPS Pensions Group, Picton Property Income, FlyBe, Better Capital, Entertainment One, Bahamas Petroleum Company, City of London Group

Friday 14 September

Trading statements

PV Crystalox Solar, Triple Point Social Housing Reit, Wetherspoon (JD)

AGM/EGM

Atlantis Japan Growth Fund, Severstal, Investec

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.